Discovery is a proudly South African-founded financial services organisation that operates in the healthcare, life insurance, short-term insurance, long-term savings, banking and wellness markets.

Since inception in 1992, Discovery has been guided by a clear core purpose - to make people healthier and to enhance and protect their lives. We have been able to do this by pioneering the Shared-value Insurance model, which delivers better health and value for clients, superior actuarial dynamics for the insurer, and a healthier society. The success of the model in the markets where we operate has been testament to its importance to society.

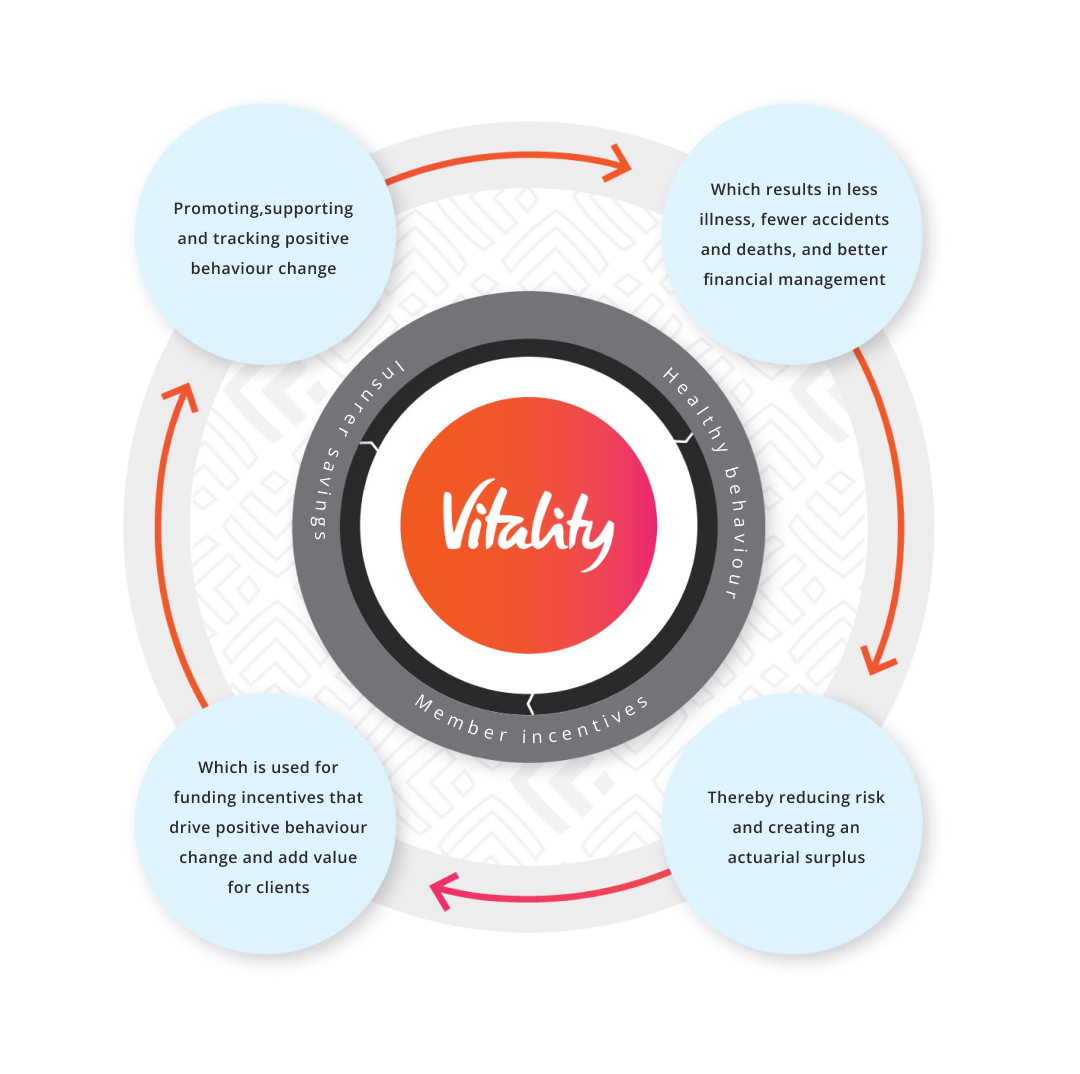

Our Shared-value Insurance model

To make people healthier and enhance and protect their lives, we must look at what compromises their health, wealth and safety, and the context we operate in. Our Shared-value Insurance model delivers better health and value for clients, superior actuarial dynamics for the insurer, and a healthier society. Key to delivering on our model, is a deep understanding of the reasons for the shift in the nature of risk.

The nature of risk is behavioural

4

lifestyle behaviours

4

chronic conditions

Responsible for

60%

of all deaths worldwide

5

driving behaviours

3

driving conditions

Responsible for

60%

of fatal accidents

3

financial behaviours

3

outcomes

Responsible for

90%

of South Africans having inadequate retirement funding

5

financial behaviours

3

outcomes

Responsible for

80%

of credit defaults and retirement shortfalls

4

lifestyle behaviours

Responsible for

85%

of personal and household CO2 emissions

Improving risk through our Shared-value Insurance model

The model provides clients with access to a range of pathways and incentives to lessen their personal risk and improve their behaviour through three programmes - Vitality Health, Vitality Drive and Vitality Money.

Independent research validated our model for its positive impact on reducing healthcare costs, resulting in improved profitability - a portion of which is channelled back into funding and incentives that drive positive behaviour change, thereby creating ongoing value that is shared between our clients, the business and society. In this way, Insurance and financial risks are no longer a function of a person's circumstances when taking up the product, but rather how they manage their behaviour across health, driving and financial management.

Where we operate

Shared-value Insurance is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets, including Asia-Pacific, Europe, North America and South America. In 2021, Vitality Health International introduced shared-value health insurance to employer groups and Travel for Treatment service to the rest of Africa.

Geographical presence

Operational in

41 Markets

Over

40 Million lives

Over

13 700 employees

Market capitalisation of

R100 Billion

as at September 2023

What we do

We seek disruption as we lead a global transformation in financial services. Our market-leading businesses are built to create a compelling value proposition for clients through products that are innovative and can deal with complex issues. We build businesses from the ground up that grow organically and our shared-value approach - which is scalable, repeatable and globally relevant - is central to each business. We apply our Vitality behavioural platform to any institutional capability - banking, savings, health, life or other insurance - in a Discovery-owned business or through our strategic partnerships.

South Africa

We are a leading South African company with an influential presence in the life insurance, medical scheme administration, short-term insurance, long-term savings, and banking industries. The South African operations are made up of the following businesses:

Discovery Health is South Africa's largest medical scheme administrator and managed care provider, managing over 39% of the total membership of South African medical schemes. Non-medical scheme-related products such as gap cover, Flexicare and Healthy Company are also offered.

Discovery Insure offers innovative and comprehensive car, home, and business insurance and has been entrusted with over 285 000 cars on South African roads.

Discovery Invest offers a comprehensive and flexible range of local and offshore investment plans to both retail and corporate clients and has over R120 billion in assets under administration.

Discovery Bank is a full-service digital retail bank offering a range of products. It has attracted over 1 million accounts within three years of the launch date.

United Kingdom

Our success and learnings in South Africa allowed us to launch in the UK market with great success, with Vitality UK comprising the following businesses:

VitalityHealth specialises in Private Medical Insurance, providing unique and comprehensive health and wellbeing solutions to individuals, corporates, and small and medium businesses.

VitalityLife provides long-term life, serious illness, and income protection cover to individuals.

Vitality Global

Vitality Global is responsible for expanding Discovery's Shared-value Insurance model outside South Africa and the United Kingdom. Vitality Global has two distinct business units:

Vitality Network operates by licensing the Vitality programme and related expertise, data and technology to insurance partners across the globe.

Vitality Health International leverages both Discovery Health and Discovery Vitality's IP to create strategic partnerships, primarily through equity arrangements, with health insurance players in markets. In other countries in Africa, the business launched Vitality Health International and the two key partnerships in Vitality Health International are Ping An Health and Amplify, in which Discovery owns 25% and the balance owned by Ping An Group and AIA, respectively.

Our history

-

1992

Discovery Limited is started up and initially established as a small specialist risk insurance company with the support of Rand Merchant Bank.

-

1993

Discovery launches Discovery Health

-

1997

Discovery launches Vitality

-

1999

Discovery lists on the JSE

-

2000

Discovery launches Discovery Life

-

2004

Discovery launches Discovery Card

Discovery and Prudential plc announce joint venture and launch PruHealth in the UK

-

2007

Discovery launches Discovery Invest

Discovery expands its UK presence through the launch of PruProtect in partnership with Prudential plc

-

2009

Discovery expands into China by acquiring 25% of Ping An Health, a wholly owned subsidiary of Ping an Group

-

2010

Discovery expands PruHealth book by acquiring Standard Life Healthcare

-

2011

Discovery launches Discovery Insure

-

2012

Discovery launches Vitality to Ping An Health clients in China

-

2013

Discovery announces joint venture with AIA group to form AIA Vitality

-

2014

Discovery takes full ownership of PruHealth and PruProtect in the UK and rebrands to VitalityHealth and VitalityLife

Discovery expands into Australia in partnership with AIA

-

2015

AIA Vitality is launched in the Philippines, Hong Kong and Macau

Discovery expands into the United States in partnership with John Hancock

AIA Vitality is launched in Singapore and Australia

-

2016

AIA Vitality is launched in Thailand and Malaysia

Generali Vitality is launched Germany

Discovery expands into Canada in partnership with Manulife

-

2017

Generali Vitality is launched in France

AIA Vitality is launched in Sri Lanka

AIA Vitality is launched in Vietnam

Generali Vitality is launched in Austria

-

2018

Discovery expands into Japan in partnership with Sumitomo Life Insurance co and SoftBank corporation

AIA Vitality launched in South Korea

Discovery launches Umbrella Funds

Discovery launches VitalityInvest in the UK

Discovery launches Discovery Business Insurance

-

2019

Discovery expands into Pakistan in partnership with IGI Life

AIA Vitality launched in New Zealand

Discovery expands into Ecuador in partnership with Equivida and Saludsa

Discovery expands into the Netherlands in partnership with a.s.r

Discovery launches Discovery Bank

-

2020

Discovery expands into Argentina in partnership with Prudential

Discovery expands into Saudi Arabia in partnership with Tawuniya

Discovery expands into Portugal in partnership with Multicare and Fidelidade

-

2021

Discovery introduces Vitality Health International

AIA Vitality launches in Indonesia

Discovery expands into Mexico in partnership with BBVA Bancomer

Discovery expands into Spain in partnership with Generali

Discovery launches into Brazil in partnership with Prudential

Discovery expands into Italy in partnership with Generali

-

2022

Discovery launches Amplify in partnership with AIA

Discovery expands into Mozambiqué

Discovery expands into Nigeria

Discovery expands into Kenya

Discovery expands into Ghana

Discovery expands into Zambia

Discovery expands into DRC

Discovery expands into Czech Republic in partnership with Generali.

Discovery expands into Poland in partnership with Generali

Discovery expands into India

-

2023

Discovery expands into Tanzania