Where did all your money go? Find out with SpendTrend22 insights

Discovery Bank was built from the ground up to help clients enhance their financial behaviours. We actively support and reward behaviours that improve our clients' financial wellbeing. This encourages people to save more money, lowers the bank's risk, and enhances society's total wealth.

"We believe the first step towards improving your financial position is having an accurate understanding of what it is, so we decided to run some fun analyses on our Discovery Bank client base to get a better idea of their spending and saving habits in 2021. Part of managing money well is knowing exactly what you're spending money on, where you are possibly overspending, and following a set budget," Hylton Kaller, CEO of Discovery Bank says.

Introducing SpendTrend22

We're all about giving our clients innovative tools to learn more about their financial behaviours. After looking at our clients' top money trends in 2021, we realised that these insights are not only useful for helping them manage their finances but are super interesting and entertaining.

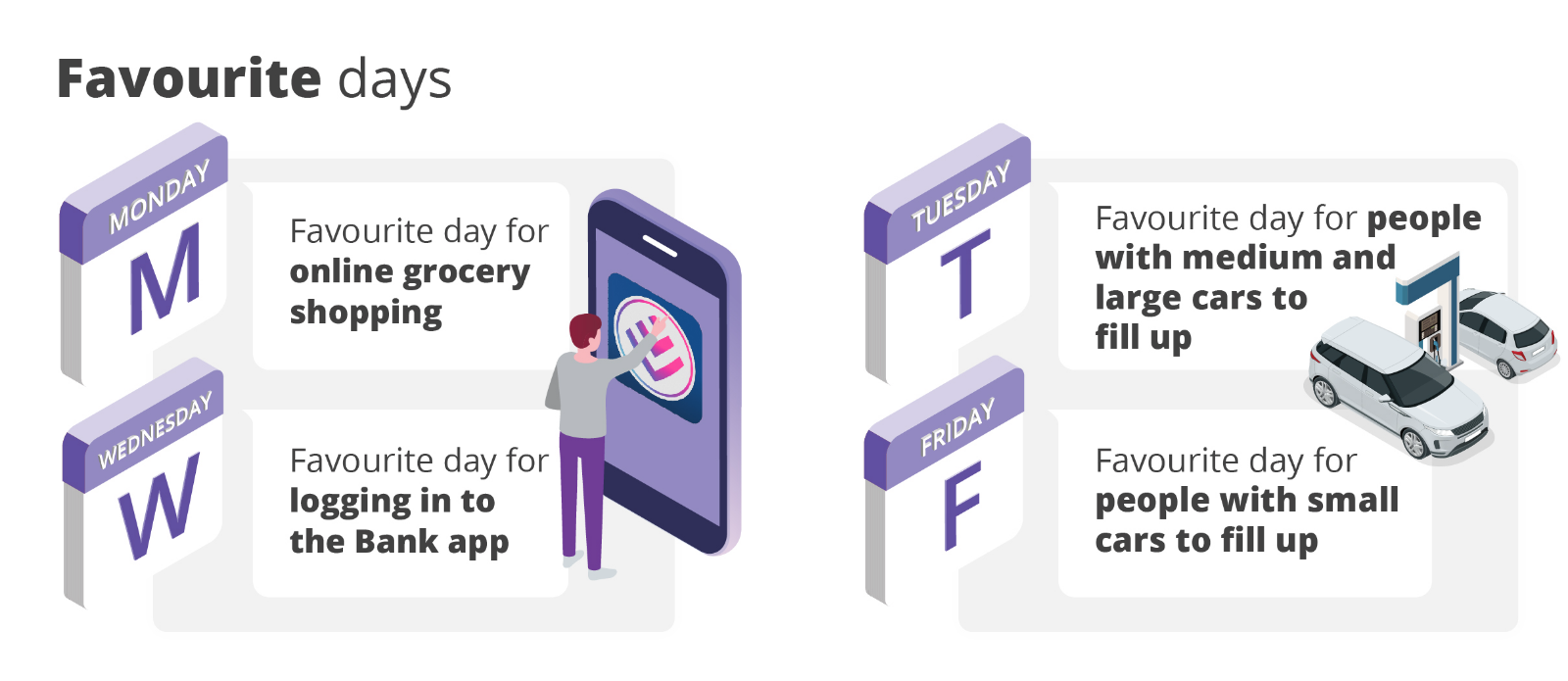

For example, did you know that most Discovery Bank clients do their online shopping on a Monday (work-avoidance much?), and the day most clients treat themselves with ice cream is a Sunday (or should we say Sundae?)?

Here are other interesting things we discovered about our client

Discovery Bank clients can get their own personalised SpendTrends22 report

A personalised SpendTrend22 report gives clients insights into their personal spending habits in 2021. The personalised report is available on the banking app to all Discovery Bank clients who have had a transaction account, credit card account or full banking suite since at least June 2021.

In it, we've packaged everything our clients ever wanted to know about their spending habits last year. They can find out more about what their money got up to, including:

- Their digital banking trends (their preferred ways to pay).

- Their favourite places to spend - be it on groceries, transport, treats, personal care or eating out.

- How many Discovery Miles they earned and spent.

- How much they saved in interest through Vitality Money and smart money management.

Kallner says "While our custom SpendTrend22 reports give clients a fun, shareable snapshot of their spending habits over the last year - financial awareness and education are critical in enabling better financial decision making. Understanding finances is often difficult and confusing - which is why Discovery Bank is trying to simplify it."

How to access your SpendTrend22 report

Qualifying clients can access their personal SpendTrend22 report in just a few taps using our banking app. Simply:

- Log in to your Discovery Bank app

- Tap More

- Tap on Notifications

- Tap on News and updates

- Tap on the SpendTrend22 notification to see more.

Share SpendTrend22 insights with friends

Clients can share sections of their SpendTrend22 report with friends and family using social media or WhatsApp. They can simply look for the share icon to share. Or use the share icon at the top of your app screen to share the whole page.

As the Future of Banking, we want to give you the tools, knowledge, and insights to not only make your life easier but also to get you to improve the way you manage your money - while having some fun with the insights along the way.

Want to win –5,000? Share any of your favourite personalised insights on social media. Remember to tag us on Instagram, Facebook or Twitter and use the hashtags #SpendTrend22 and #DiscoveryBank. Terms and conditions apply.