How much of my savings can I use once I retire for it to last?

No one wants to run out of savings too quickly, so it's best to work out in advance how much you can sustainably withdraw as a retirement income each month. It's also helpful to calculate how long you'll then have until your retirement income starts to reduce.

Do you wonder how much you can sustainably withdraw from your retirement savings fund once you retire to ensure it lasts your lifetime? Many in the retirement industry use the 4% rule of thumb to get an idea of this figure.

Don't rule out this rule of thumb!

The 4% 'rule' was first proposed in 1994 by a financial planner called William Benger. Basically, it states that your retirement money should reliably last for at least 30 years, as long as you only withdraw 4% of the investment annually. Note that you also need at least 30% of your portfolio invested in riskier assets like equities and property during this time to earn enough returns to sustain your post-retirement income.

In theory, the 4% 'rule' can offer a sense of security, but financial planners since have found some shortcomings in using it as a key part of your savings plan. However, it's still useful as an approximate guideline.

Example: How to calculate your income post-retirement using the 4% rule

Let's assume you've saved R10 million at retirement

- 4% of 10 million = R400 000. This is the maximum annual salary you should withdraw once you retire, according to the 4% investing rule of thumb.

- R400 000 divided by 12 months = around R33 333. This is the maximum amount you should withdraw each month to ensure your savings last at least 30 more years.

Remember, the less you withdraw the better your chances of outliving your savings, and the more left over for your loved ones once you pass away. And of course the converse applies too - the more you withdraw, especially after 4%, the higher the chances you outlive your savings and the less left over for your loved ones.

How long do I have before my retirement income starts to reduce?

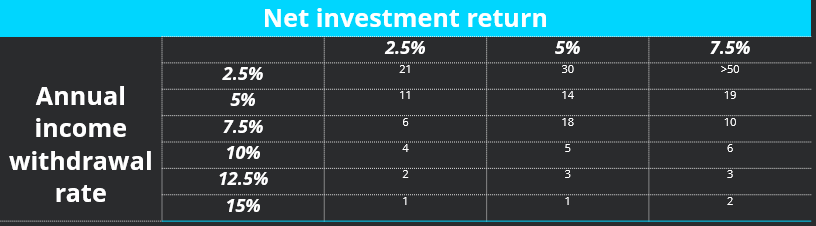

The Association for Savings and Investment South Africa (ASISA) and many retirement fund providers use the table below to work out how long your retirement income will last you.

How the ASISA table figures play out in reality

Need examples? According to the table above:

- If you have a 5% return on your investment and you withdraw 5% of that investment to use as your annual income, your funds will start to run out in around 14 years.

- If you have a 10% return on your investment and you withdraw 15% to use as annual income, your money will start to run out in about two years.

Confused? Don't delay - get professional advice!

Remember, all these numbers and formulas are just guidelines. Everyone's case is different and depends on your assets, debts, family and personal circumstances and on how the markets play out while you're in retirement. If these calculations cause you more confusion than clarity, don't panic or procrastinate. Rather book a consultation with a financial adviser or planner today and discuss what steps to take so you can retire well, for as long as you need to.

If you're close to retiring or already retired and are looking for more ways to boost your income, here are some ideas and tips.

This article is not financial advice. Please consult with a financial adviser for financial advice or click here to leave your details.

Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06, a licensed life Insurer, an authorised financial service provider and registered credit provider, NCR Reg No. NCRCP3555. All boosts are offered through the insurer, Discovery Life Limited. The insurer reserves the right to review and change the qualifying requirements for boosts at any time. Product Rules, Terms and Conditions Apply. Discovery shall not be liable for any actions taken by any person based on the correctness of this information. For full details on the products, benefits and any conditions, please refer to the relevant fact file. For tailored financial advice, please contact your financial adviser.

We can help you play retirement catch up with our boosts

If you invest in our Retirement Annuity, you can get a boost of up to 20% to your lump sum investments and, if you live well by being healthy, driving safely and being responsible with your money, you can get rewarded with boosts of up to 15% to your monthly contributions.

Get rewarded for making healthy financial and lifestyle decisions

We make it easy for you to get rewarded for taking proactive steps to secure your financial future. With our customised online boost calculator, you can see the boosts and fee discounts you can get for making healthy lifestyle and investment decisions.