Simple truths

Through his simple sketches, Carl Richards (The Sketch Guy) does what many others struggle to do - he makes complex ideas easy to understand.

In this second article in our ongoing series, we look at five more of his bite-sized depictions of core financial planning concepts. The way in which Richards simplifies financial concepts visually can help you explain them to your clients.

Effective financial planning

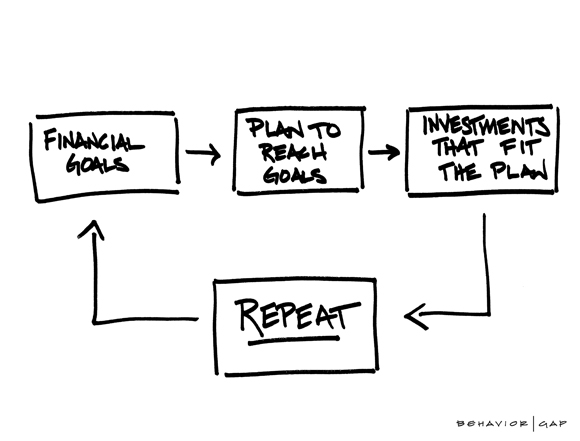

This sketch is a good way to explain the process for creating an effective financial plan. Decide on financial goals, devise a plan, and structure investments accordingly. The sketch shows that investors should be as specific as possible when setting goals, and that they don't need to start with the end goal. Setting smaller, achievable milestone goals will help them see the progress they're making.

Possibly the most important step in this process is "repeat". The sketch gives you a simple way to show your clients that a good plan requires regular revisiting, monitoring, measurement and consideration. Personal circumstances change, the environment changes, goals shift. With your help, your clients should review their investment goals and plans regularly to ensure their investments are aligned with what they want to achieve.

Avoiding a herd mentality

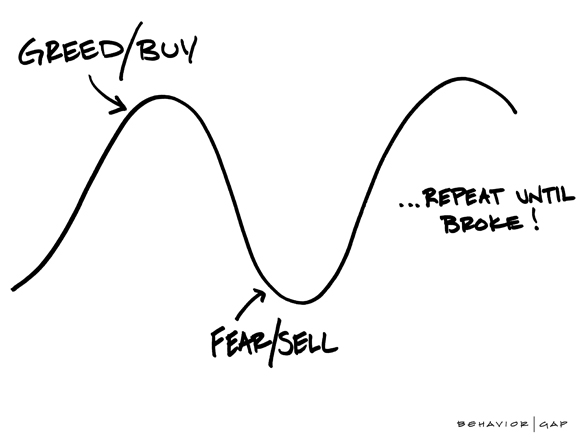

An alarming number of investors buy high and sell low, which is the exact opposite of the primary goal of investing. Part of ensuring that your clients invest successfully is helping them to keep their emotions in check - specifically the powerful emotions of greed and fear.

This sketch helps explain that when bad news abounds, it's human nature to want to follow the pack and sell. But times of financial crisis demand a cool head and in fact represent incredible buying opportunities. Similarly, when financial headlines are abundant with good news, it may mean that stocks are at their most expensive.

The long-term view

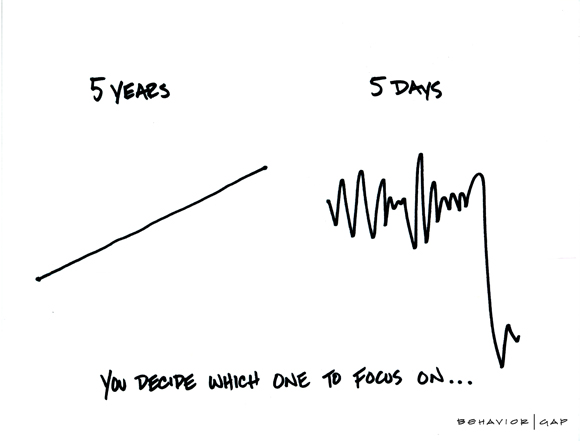

When an investor focuses on the short term, periods of market volatility seem extreme. Trying to monitor performance on a daily basis means living through the ups and downs of daily unpredictability. The stress and uncertainty are damaging and unnecessary.

The key here is what to focus on as an investor. This sketch can help investors see that over the long term, market volatility smooths out and investment growth trends in the right direction - upwards.

A focus on the entire financial plan

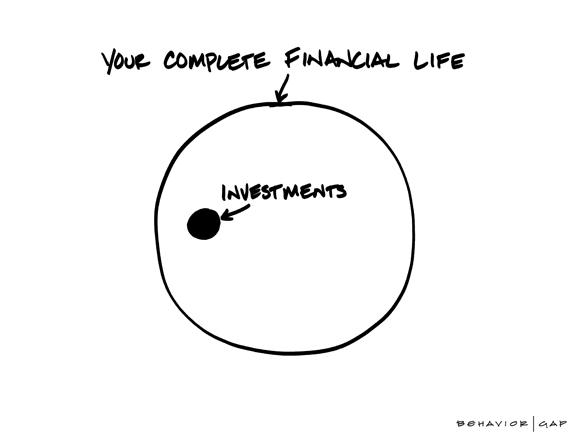

Often, the process of investing and the performance of investments are what come to mind first when considering financial goals. The above sketch reminds us to look at the big picture and the importance of holistic financial planning with investments as a key component.

Personal finance is complex and multi-layered, and clients should be striving for success in all areas of their financial life, as every aspect is instrumental in creating wealth and financial security. One way that Discovery helps your clients achieve this is by monetising positive behaviour into extra investment returns. Clients can earn up to 2% extra returns every year for living well and can also earn up to 50% extra retirement income for life. You can read more about how it works here.

Talking openly about money

This sketch demonstrates another simple truth: that money is an emotional matter. Many people shy away from discussing personal money matters, despite having no qualms about talking about money, investing or the economy in general. We were never taught to speak about money - in fact, it is often regarded as rude. This sketch can help clients open up about their feelings regarding their financial situation, their dreams and goals - and their fears. As a financial adviser, you have to create a safe space, where your clients can talk freely about their emotions around money.

Trending news

This article is meant only as information and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06. An authorised financial service provider and registered credit provider, NCA Reg No. NCRCP3555. Product rules, terms and conditions apply. The views expressed in this article are those of the author and may not necessarily represent those of Discovery Invest.