Fund update | Fund philosophies for volatile times

Conservative assets like cash and bonds have performed better than equities recently, but in the long run they cannot deliver the level of growth needed to beat inflation.

The last few years have been difficult for most investors. The South African economy has struggled to make headway and almost all asset classes have delivered mediocre returns.

At these times, it is very tempting for investors to retreat to the time-honoured “safe havens” like bonds and cash. True, returns from cash and bonds have outstripped equity in recent years. Yet market volatility is to be expected over shorter terms. On average, over the long term, growth assets outperform conservative income-generating assets.

Volatility and politics might seem like the biggest risks to retirement savings. Not so: The biggest threat is inflation. It is only by maintaining exposure to growth assets like carefully selected equities that investors can protect the long-term value of their savings from being eroded by inflation.

Although there are no quick fixes for the SA economy, the positioning of the Discovery Target Retirement Date Funds and Discovery Balanced Fund reflect our view that SA has passed the point of maximum pessimism and that from now on there will be a gradual improvement in the country’s growth prospects.

Discovery Target Retirement Date Funds offer investors a single fund for all their retirement savings needs

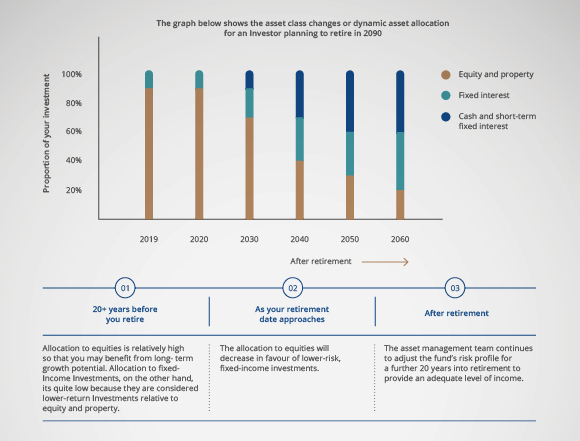

The Target Retirement Date Funds invest in a diversified portfolio of assets that balance risk and potential reward with a particular retirement date in mind. They are currently fairly evenly balanced between growth assets (such as equities, listed property and commodities) and more conservative income-generating assets (typically bonds and cash). Within those categories, the focus is on specific asset classes and market sectors.

In the Target Retirement Date Funds, the saver remains in the same fund throughout the entire pre- and post-investment cycle. They are never forced to switch between funds as the fund itself changes its asset allocation to match the changing needs of investors as they approach retirement. Therefore, the risk of switching at the most inappropriate time is completely removed.

The long-term strategic allocation of these funds is based largely on long-term return expectations. We optimise the exposure to maximise returns while minimising volatility. Since the longer-dated funds have higher real return targets, these will have a larger exposure to growth. Over the short to medium term we consider asset fundamentals and market price behaviour to adjust the fund’s exposure and exploit any inefficiencies across the different asset classes.

The graph below shows the asset class changes over time for an investor expecting to retire in 2040. It shows that the weighting towards cash and income-generating assets should be lower for younger investors and higher for retirees.

Why invest in the Target Retirement Date Funds?

Rüdiger Naumann, portfolio manager for the Target Retirement Date Funds speaks about the importance of saving for retirement and how the Target Retirement Date Funds have performed.

The Discovery Balanced Fund range caters to all risk attitudes

Discovery’s Balanced Fund range aims to maximise returns, while catering to investor’s different attitudes to risk: Cautious, Moderate and Aggressive. The funds take a multi-asset approach, allowing investors to take advantage of the benefits of diversification, while remaining within their individual risk requirements.

Similar to the Target Retirement Date Funds, The Balanced Fund also has a mix of growth and income assets.

In the Discovery Balanced Range – as well as in the Discovery Target Retirement Date Funds – the asset allocation decision is based on taking a global perspective as economic cycles unfold. While markets are constantly impacted by political and economic events, the investment philosophy of these funds favours asset classes that are attractively valued, underpinned by good fundamentals.

Over the long term, this process and philosophy has ensured consistency in returns. Below are more details of the current positioning of the fund which is based on the fund manager’s view of the economy, and factors such as stocks. The positioning is followed by both the Target Retirement Date Funds and the Balanced Fund.

Offshore growth asset exposure is significant for these funds

The funds currently have significant exposure to growth assets, but are not fully invested given prevailing risks. The preferred asset class is global equities in selected regions, particularly Europe and Asia. The policy backdrop for European companies is increasingly favourable, while Japanese companies are taking steps to improve governance, so earnings from these companies are expected to outperform their peers elsewhere in the world.

The outlook for South African equities is more subdued. The slightest improvement in market perceptions about either cyclical or structural growth could drive share prices up meaningfully. In a difficult operating environment for locally focused businesses, earnings prospects are modest, but some companies offer better prospects because of operationally driven improvements or self-help measures.

These funds also have local equity exposure

The current local equity exposure is to large companies and prospects of rising earnings, such as Anglo American, BHP Group, Naspers, Anheuser-Busch InBev and British American Tobacco. The funds also hold selected ‘SA Inc’ plays with decent relative earnings prospects that trade at reasonable valuations, including Absa Group, Sanlam and Standard Bank Group.

The funds hold very little exposure to local listed property at present. Local listed property looks attractive based on overall valuations (price/net asset value) and because it offers higher yields than can currently be earned from South African bonds and equities, but distribution growth expectations have been scaled back due to subdued domestic conditions and rising vacancies. Commodities look more appealing, especially palladium where favourable supply and demand continue to support prices.

For income assets, these funds prefer local exposure

Within income assets the current view is that domestic instruments are more attractive than offshore. The outlook for global bonds is negative. Yields are dropping as the market prices in looser global monetary policy.

Among domestic assets, bonds are preferred to cash because they offer higher yields. Inflation looks set to remain within the South African Reserve Bank’s 3 to 6% target range, giving monetary authorities room to adjust interest rates against the backdrop of sluggish economic growth. The plight of state-owned entities (SOEs), particularly Eskom, remains a serious concern, but investors are being compensated for these risks as domestic bond yields continue to offer a premium over their emerging market peers.

Recent comments from Moody’s Investors Service, one of the three important credit rating agencies, seems to suggest that it is not ready to downgrade the country’s sovereign debt rating. Moody’s expects that gradual policy reforms will put SA on a more positive path in the medium term, but if these fail, the sentiment from Moody’s could change.

Summary of these funds’ asset mix

The following diagram summarises our views. As far as growth assets are concerned, we are overweight in relation to our benchmark on foreign equities and the commodities sector, in line with the benchmark on local equities and underweight on the property sector. On income assets, we are overweight in relation to the benchmark in local bonds and foreign cash holdings, in line with benchmark on local cash and local inflation-linked bonds, and underweight in foreign bonds.

This article is meant only as information and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06. An authorised financial service provider and registered credit provider, NCA Reg No. NCRCP3555. Product rules, terms and conditions apply. The views expressed in this article are those of the author and may not necessarily represent those of Discovery Invest.