How to keep track of your savings goal on the Discovery Bank app

How far are you from achieving your Vitality Money savings goal? No need to guess. Keep reading and watch a video to find out how you can easily keep track of your savings points on the Discovery Bank app.

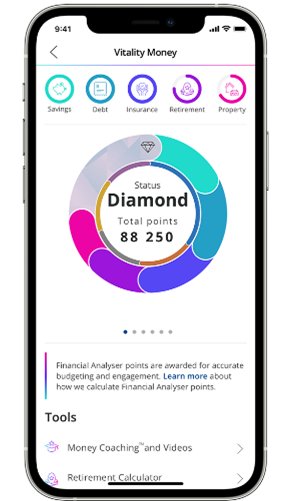

Last month we showed you how to add a new savings account in just a few taps on your banking app. Now, let's take a closer look at how you can find and use your Vitality Money savings ring to your advantage.

Get to know your Vitality Money ring

Vitality Money is Discovery Bank's behavioural change programme that measures how well you manage your finances across five behaviours that you can control:

1.

Having enough savings

2.

Managing short-term debt

3.

Having the right type of insurance

4.

Being on track for retirement

5.

Managing property investments

On your Discovery Bank app, your dynamic and interactive Vitality Money ring shows your Vitality Money status and total points. You earn points for how well you manage each behaviour, and your total points determine your Vitality Money status. By improving your financial health, you can improve your Vitality Money status and unlock:

- Better savings and borrowing rates

- Dynamic lifestyle rewards

- Rewards for getting active

- Vitality Travel rewards

- Discovery Miles, our rewards currency that's more valuable than cash

- And much, much more.

Find out more about measuring your financial health with Vitality Money .

Spotlight on savings - why it's important

Having enough savings is one of the most important behaviours that determine your financial health. Studies show that more than 50% of South Africans would have to take out a personal loan, rely on credit facilities or borrow money to cover an unexpected expense of R10,000, while 30% are not certain how they would handle it.

Savings keep you safe from life's unexpected expenses. As a general rule, you need to have at least three months' gross salary in savings to soften a financial setback, like losing your job or fixing your house after heavy rains.

How we calculate your savings points

You can earn up to 30,000 savings points a year if you have a Discovery Bank Gold card or earn less than R349,999; and 25,000 points if you earn over R350,000 or have a Platinum, Black or Purple card.

You can earn savings points if you have:

- Emergency savings that you can access easily

- A wide range of non-retirement savings such as unit trusts, stocks, forex and endowments.

What about your retirement savings or home loans? For those you earn retirement and property points.

To earn the maximum savings points, you need to reach your personalised savings target amount, which is three times your gross monthly income. For example, if you earn R50,000 before tax, you need R150,000 in savings to earn the maximum savings points. Plus, you'll be more prepared for an unforeseen event.

How to earn more savings points

Every rand you save can add to your savings points and help you improve your Vitality Money status. You automatically earn points for amounts in your Discovery Bank savings accounts and certain investments with Discovery Invest.

Plus, you can earn more savings points when you:

- Upload documents showing proof of savings and investments with other non-bank financial institutions on your banking app.

- Transfer savings from other banks to Discovery Bank savings accounts.

- Increase the amount you contribute towards a savings account each month.

- Have savings in a trust, but you may only claim the value of your share. Upload proof using the Discovery Bank app.

View your savings points on the banking app

You can see all your savings points and personalised targets in the Vitality Money section of your banking app. Simply click on Vitality Money and tap the savings ring to see how well you're doing, upload documents, and find out what you need to do to reach your financial goals and improve your Vitality Money status.

Watch the video for step-by-step guidance:

It's the Future of Banking. Now.

This article is meant only as information and should not be taken as financial advice. For tailored advice, please contact your financial adviser.

Get between 10% and 75% off flights when you book your local or international flights with Vitality Travel. Then, get up to 25% off accommodation from our partners across South Africa including hotels, B&Bs, luxury resorts, thrilling game lodges and more, for all Vitality Health members and qualifying Discovery Bank clients. Enjoy 15% off your next trip when you book exclusive holiday packages. Plus, save up to 25% on car hire.

Related articles

Five reasons why Vitality Travel is the only way to travel

Discovery Bank clients can now go everywhere with Vitality Travel, the first integrated travel booking platform in South Africa. Here are five reasons why it's about to become your go-to site for all your travel needs.

Secure your travel costs by saving in a foreign currency

In the Future of Banking, anyone can afford a foreign currency account. Plus, it adds ease and convenience when you travel internationally. Here are a few good reasons to open the only Real-Time Forex Accounts today.

Forex vs credit card - which is best for international travel?

Gone are the days of traveller's cheques (remember those?) or converting large amounts of cash at the airport. Travelling abroad is much simpler these days, especially if you have a forex or credit card. But which one is best?