Doomed to pay interest? Here’s how to collect it instead

There are plenty of things you can do with your hard-earned money. So why invest it?

The simple answer is to protect and grow your wealth. Understanding the inevitability of inflation – and the power of compounding – makes investing a no-brainer. Here’s how.

All wealth creation starts with a commitment to save – and investing your money wisely will help you meet your financial obligations; provide for your loved ones; and fund the things you care about – so you can live the life you aspire to.

Doing nothing will cost you – how inflation erodes wealth

We’ve all heard from our parents and grandparents how a loaf of bread cost just a few rands or cents ‘back in the day.’ That’s because over time, the prices of goods tend to rise – this is called inflation.

By continually eroding the purchasing power of your money, inflation that is left unchecked is the silent killer of your wealth. So putting your money into an interest-bearing account or investing it in some other way is much smarter than stuffing your money under your mattress or letting it sit around in your bank account.

To achieve ‘real returns’ – a paper return minus the level of inflation – you need an investment strategy that counters the effects of inflation.

Counter inflation by investing – how compounding creates wealth

There is one golden mathematical principle at the heart of wealth creation through saving, and it is known as compounding. Compounding works when the returns you earn from an investment are continuously reinvested. By not cashing out returns, you can earn further returns on these reinvested returns.

As this process is left to continue, your wealth grows exponentially, rather than linearly – which makes all the difference in the long run.

The exponential power of compound interest

Scenario 1: Withdraw your earnings instead of investing

Say you saved R10 000 at a return of 6% and withdrew the interest of R600 every year, at the end of 10 years, you’d have the original R10 000 plus R6000 from your returns.

Scenario 2: Invest your earnings and let compound interest work for you

But, if you reinvested those returns each year – adding the R600 earned each time to the total – you’d generate returns on R10 600 by year two; then build that to R11 236 in year three, and so on. This way, you’d earn more interest each year because the total amount increases without you having to make any new investments. At the end of 10 years, you’d have the pretty sum of R17 908 – 12% more than Scenario 1, simply by letting compound interest do its magic!

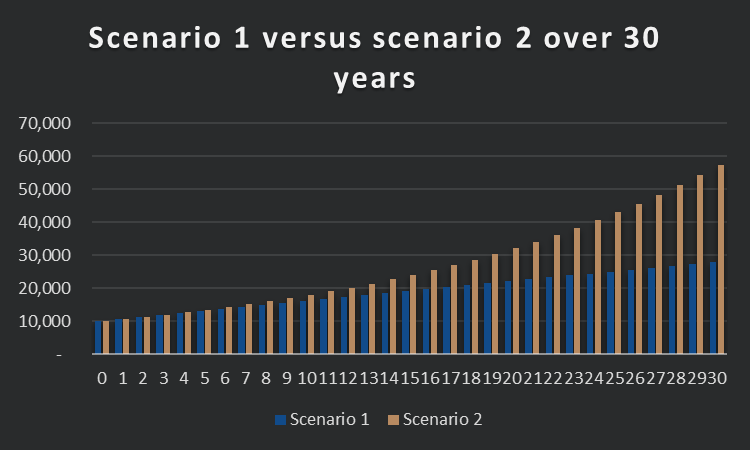

Over 30 years, the person in scenario 2 would have more than double that of the person in scenario 1:

The power-couple of investing: Compounding and ‘time in the market’

Compound interest coupled with the time it needs to really take off is the match all investors dream of, because you can get away with less capital if time is on your side.

Have a look at the graph below. The first investor (represented by the blue bar) invested R1 million and remained in the market for a 20-year period. The second investor (represented by the gold bar) put in R2 million – but only started investing 10 years later.

Even though the late investor invested double that of the early investor, due to compound interest, the early investor earned a 32% greater return.

You can see that even though the second investor put in double the amount of the first investor, the first investor still got a 30% better end result. So even with less initial capital, you can benefit from compound interest simply with consistency and time in the market.

Turn ‘doom’ into destiny – start investing today!

Albert Einstein is claimed to have once described compound interest as ‘the eighth wonder of the world', and by imagining year 20, 30 and 40 in the chart above, it’s easy to understand why!

Another quote (so often repeated that the author is disputed) presents this a sobering but powerful truth: “Those who understand compound interest are destined to collect it. Those who don't are doomed to pay it.” So don’t wait – invest sooner, invest more, just start investing today!

This article is not financial advice. Please consult with a financial adviser for financial advice.

Invest with people who invest in you

In 2007, Discovery Invest revolutionised the local investment space through this profound insight: By changing the way people behave, we can change the South African landscape for the better. Discovery Invest is the fastest-growing unit trust company in the country, offering a full range of investment solutions to help you earn compound interest to grow your wealth.

Recently, we’ve expanded our successful local offering to create the first international shared-value offering. Through our global investment offering, we give clients unique benefits and associations with some of the largest and strongest asset managers in the world, along with efficient structuring and a seamless digital investing experience. Navigate the world of global investing with ease – ask your financial adviser about us today!

Discovery Life International, the Guernsey branch of Discovery Life Limited (South Africa), licensed by the Guernsey Financial Services Commission under the Insurance Business (Bailiwick of Guernsey) Law 2002, to carry on long-term insurance business. Discovery Life Limited is a registered long term insurer and authorised financial services provider. Registration number 1966/003901/06. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, is an authorised financial services provider. The views and opinions expressed in this article are for information purposes only and should not be seen as advice as defined in the Financial Advisory and Intermediary Services Act. Discovery shall not be liable for any actions taken by any person based on the correctness of this information. For full details on the products, benefits and any conditions, please refer to the relevant fact file. For tailored financial advice, please contact your financial adviser.

Related articles

Shop safely with Discovery Bank’s contactless payment options

Retailers, shopping malls and most services are open for business. With COVID-19 around, we all have to be more mindful. And, at least for some time ahead, it will change the way we interact and shop. Fortunately, Discovery Bank makes contactless banking and payments easy for our clients.

Don’t let lockdown leave you vulnerable to cybercriminals

While self-isolation will keep you safe from the dreaded COVID-19 virus, it is up to you to keep yourself, your family and your company safe from digital scammers and hackers who will be looking for any opportunity to take advantage of you during this time.

Now is a great time to boost your financial knowledge and save big!

Discovery Bank and financial education partner, Worth, bring you an exciting learning channel to improve your financial knowledge. Why not use this time to get practical tips for better financial control every day?