Technology is a key enabler for us to broaden access and provide more cost-effective and affordable healthcare. During the year, we further enhanced the Discovery mobile app by adding the ‘find a healthcare provider’ function. This allows Discovery members to find general practitioners, medical specialists, hospitals or pharmacies, along with tips, details on cover through Discovery, and address and contact details.

As a key stakeholder in improving health outcomes and efficiency, Discovery is a founding member of the Health Information Exchange initiative, called CareConnect. A memorandum of understanding in collaborative governance, decision-making and resource sharing has been completed and planning for a pilot is currently underway. The initiative aims to securely provide health information sharing services to enhance healthcare consumer engagement and experience, as well as lower healthcare costs for all South Africans.

As reported last year, DrConnect is a digital platform available through the Discovery app or website, where participating medical scheme members can search a growing library of over five billion doctor-created answers to common medical questions or conduct a virtual consultation with a doctor in the network using voice, text or video.

Discovery HealthID, our patient health record platform, shares important information with healthcare professionals selected by patients to give a more complete view of their health history and test results. This improves patient care and reduces the likelihood of serious medical errors, and duplicate or unnecessary pathology tests. In addition, HealthID also reduces the administrative burden for doctors by making it quick and easy to for them to complete Chronic Illness Benefit applications, and provides them with the relevant scheme formulary list. We continue to see consistent engagement on the platform and track the number of members who have given consent for their health records to be accessed.

Our continued focus on innovation and technology is important in driving internal efficiencies and productivity, but in the world of our members, it provides more seamless interaction with key healthcare touchpoints and information sources for a more empowered healthcare consumer.

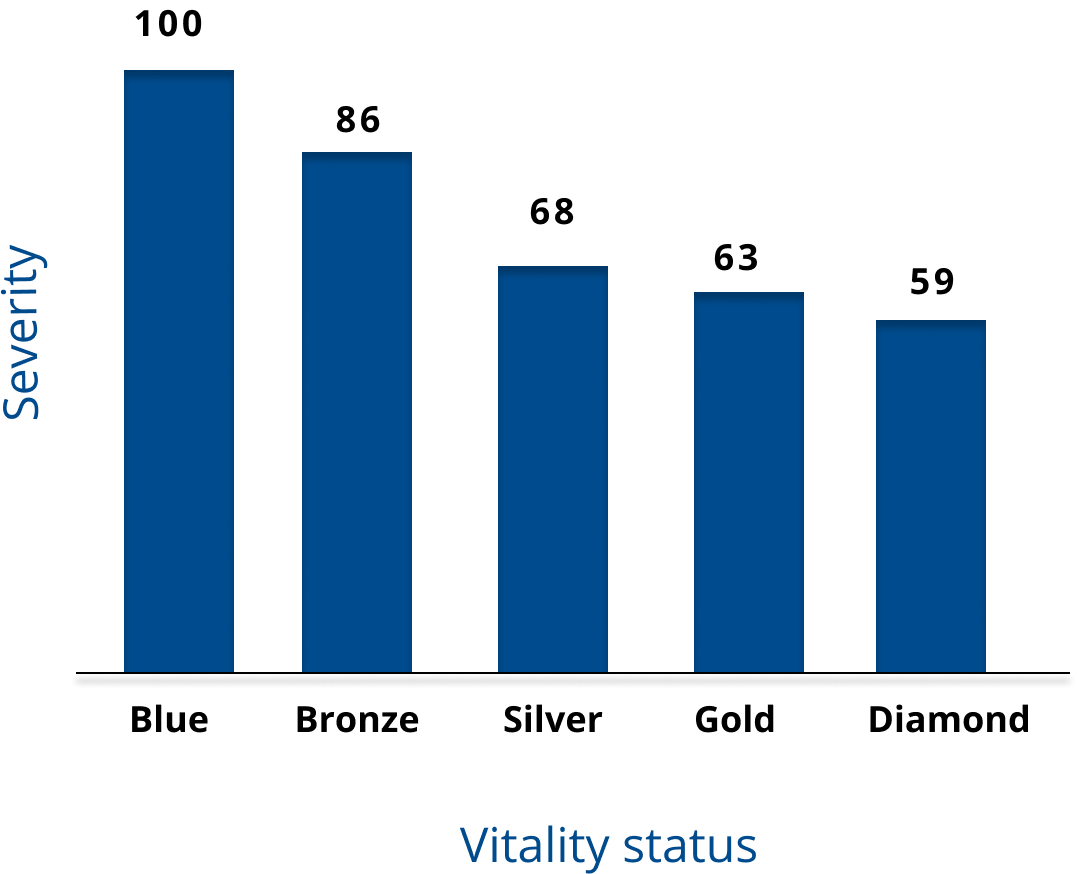

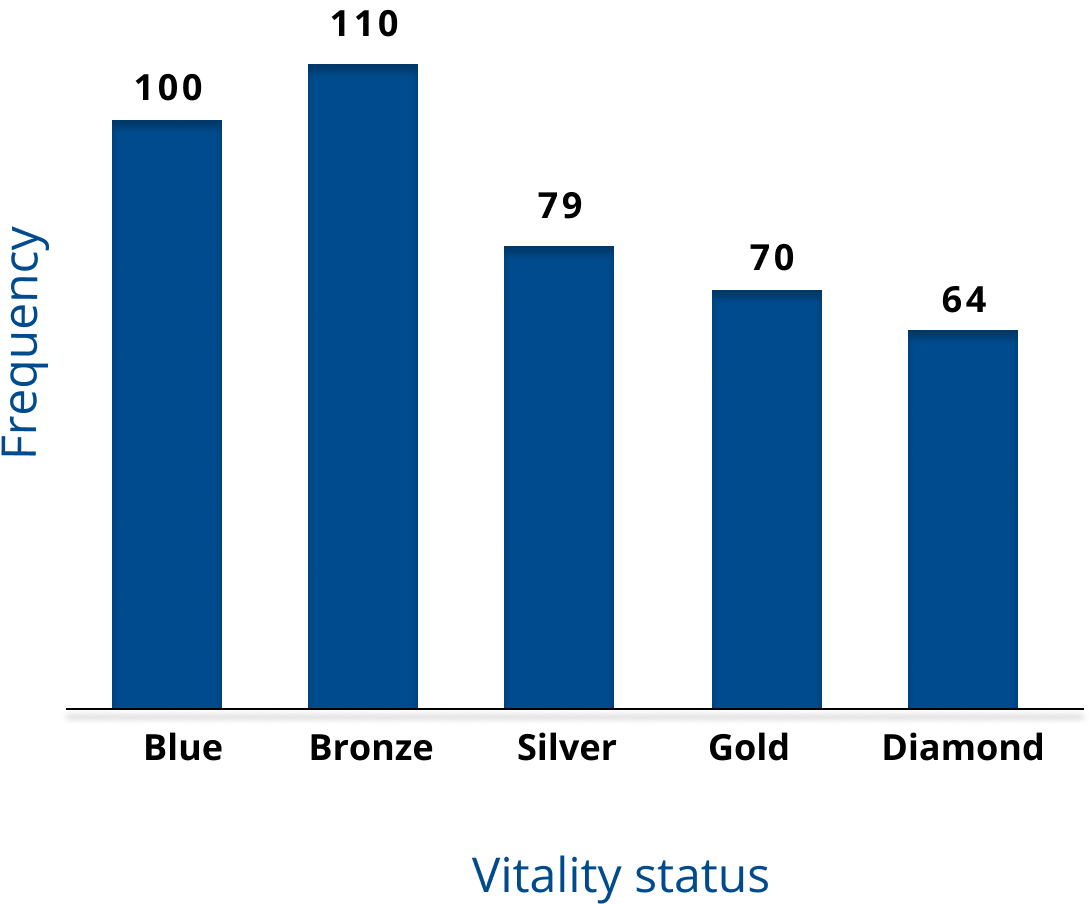

Also, improvements in technology allow for increased verifiability of member activity levels, supporting the sustainability of the Shared-Value business model that incentivises members for healthy behaviours. Vitality has introduced in-app health management for at-risk members with personalised nutrition, preventative screening, weight management and the medicine tracker.