Clients can receive 10% additional income for three years

Valid from 6 November to 31 March 2018. Terms and conditions apply. An authorised FSP.

We continue to drive positive savings behavior by rewarding clients for saving more, getting healthier, and remaining invested for longer. In celebration of our 10-year anniversary, we have designed an investment opportunity that provides clients with a higher income in retirement.

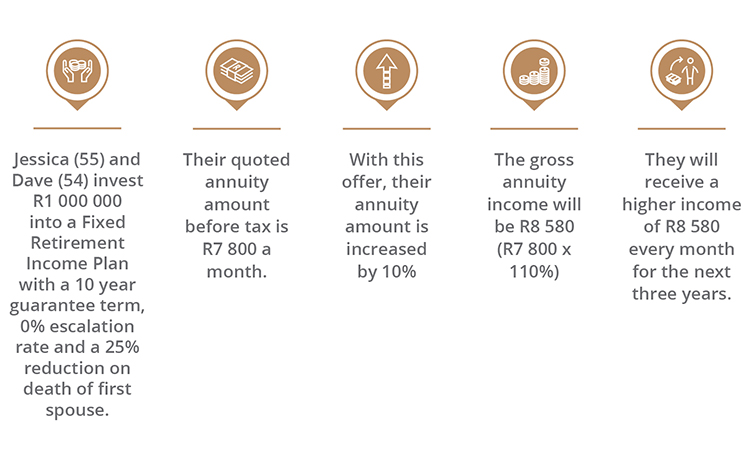

We are providing clients with an opportunity to receive a 10% additional income for three years on Fixed Retirement Income Plans. This income is an addition to their quoted annuity income amount before tax and applies for the first three years of their policy.

This offer in action:

How this offer works

- Clients receive 10% additional income on each income payment date for three years. The additional income is an addition to the annuity income amount, after allowing for annual escalations and before deducting tax.

- After three years, the client’s annuity income will return to the quoted annuity income amount before deducting tax.

- The additional income applies to either single – and joint-life policies, on any escalation rate and on any guarantee term chosen. The additional income cannot be renewed, interrupted or transferred to a later date.

- For single-life annuities, the 10% additional income will stop upon the clients death, if that occurs before the end of three years.

- For joint-life annuities, the 10% additional income will only be applied to the current amount in payment and will stop when both annuitants have died.

- Quotes will include the following wording: “Please note that the gross annuity amount shown on this quote (annuity income before tax) will be increased by an additional 10% (calculated on the gross annuity income) for the first three years of the annuity. Thereafter, it will revert to the gross annuity amount without the additional 10% income.” The terms and conditions required to qualify for this offer will also be included on quotes, but no offer values will be shown. Clients will also be able to see the details of the offer in their fund statements from the second quarter of 2018.

- Clients' policy schedules will initially not contain the details of the offer. These details, as well as the terms and conditions of this offer, will be communicated to clients in letters of confirmation that we will send to the clients within 60 days of them activating their policies. The letter of confirmation will serve as an addendum to a client’s policy schedule.

Qualifying criteria

- The income is only available for new investments written in the investment opportunity period.

- New applications have until 30 June 2018 for the investment amount to be paid and received by us. All documentation must be correctly completed and received by 31 March 2018.

- Existing investments will not qualify for the investment opportunity. Any in-progress applications submitted will qualify for this offer, as long as the investment amount is received by us by 15 December 2017.

The contents above should not be seen as financial advice; for any advice-related matters please contact your financial adviser. The Discovery Invest Retirement Plans and Retirement Income Plans are administered by Discovery Life Investment Services (Pty) Limited trading as Discovery Invest, a subsidiary of Discovery Limited. Product rules, terms and conditions apply.