Take control of your money with the

Vitality Money Financial Analyser

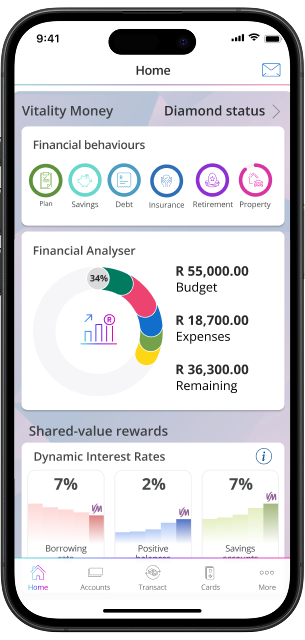

Get a clear view of your finances

The Vitality Money Financial Analyser uses advanced analytics and data processing to give you a complete picture of your finances, including your income, savings, and spending habits.

Make informed decisions about your money

Set spend alerts to stay on top of your spending.

Identify areas where you can save more.

Track your progress towards your financial goals.

Get rewarded for taking steps to manage your money well.

Access the Vitality Money Financial Analyser in the banking app

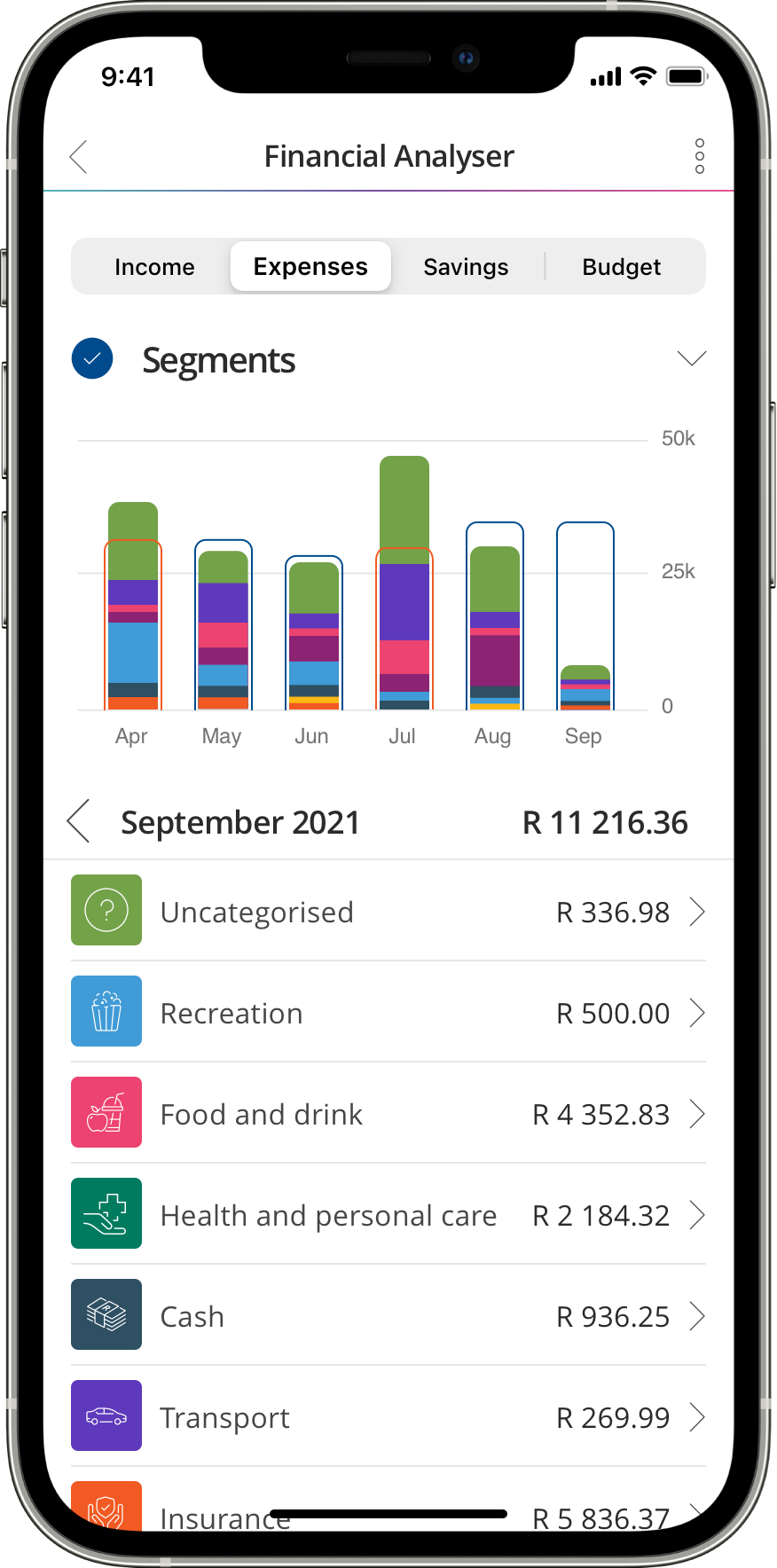

Let us help you understand your financial behaviour

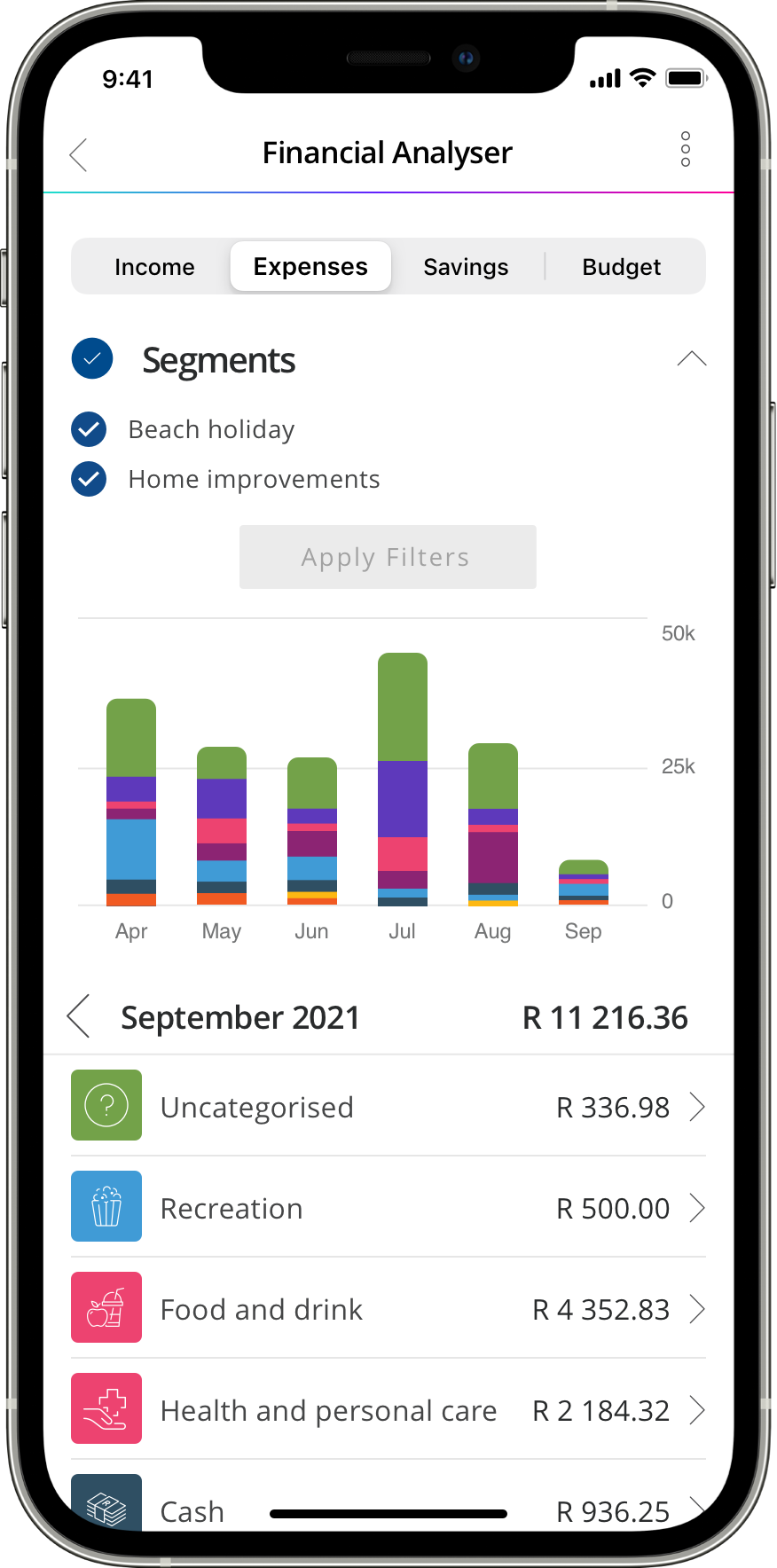

Get a simple, real-time view of your finances.

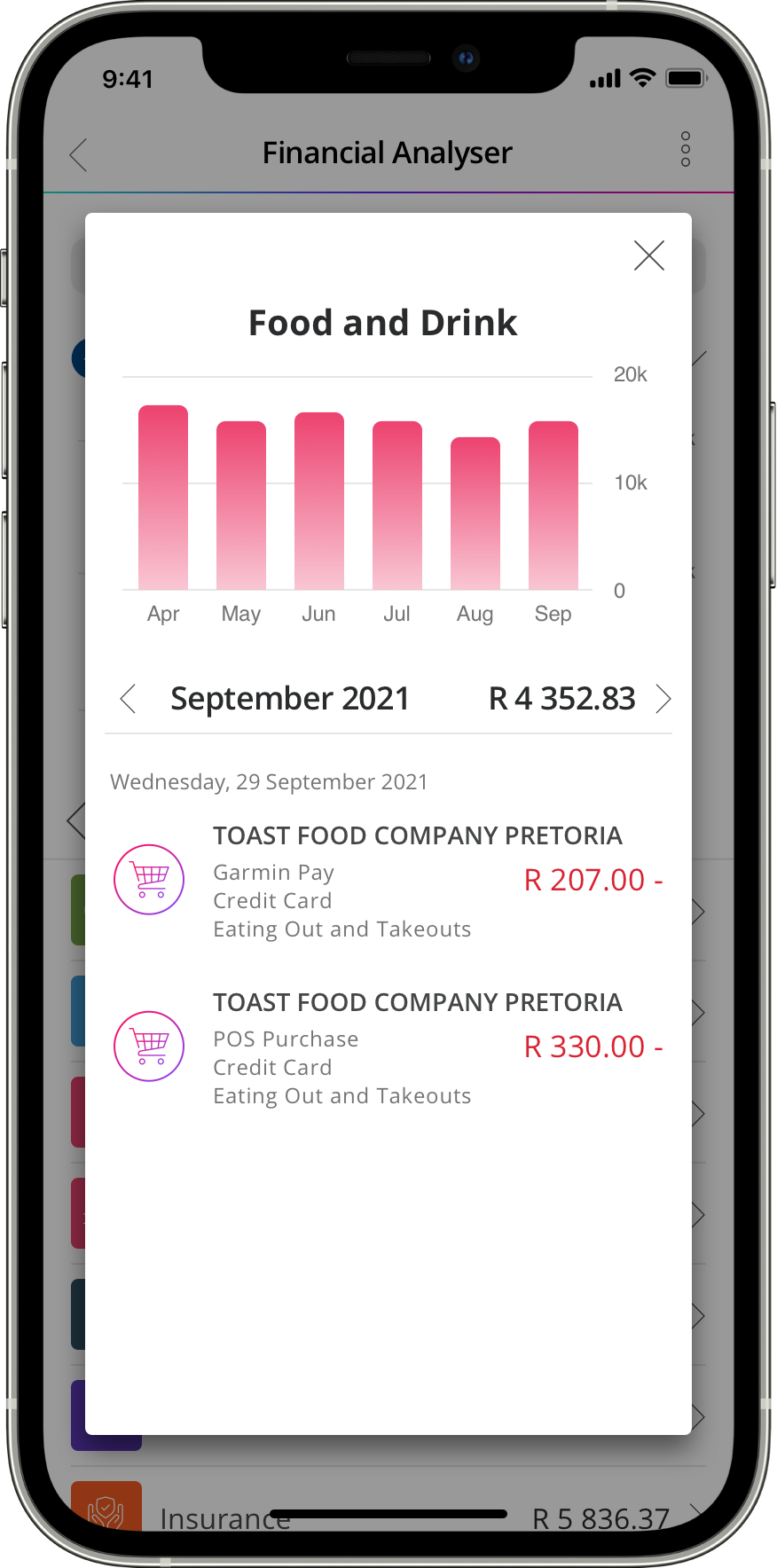

Get automatic categorisation of your expenses into more than 160 categories.

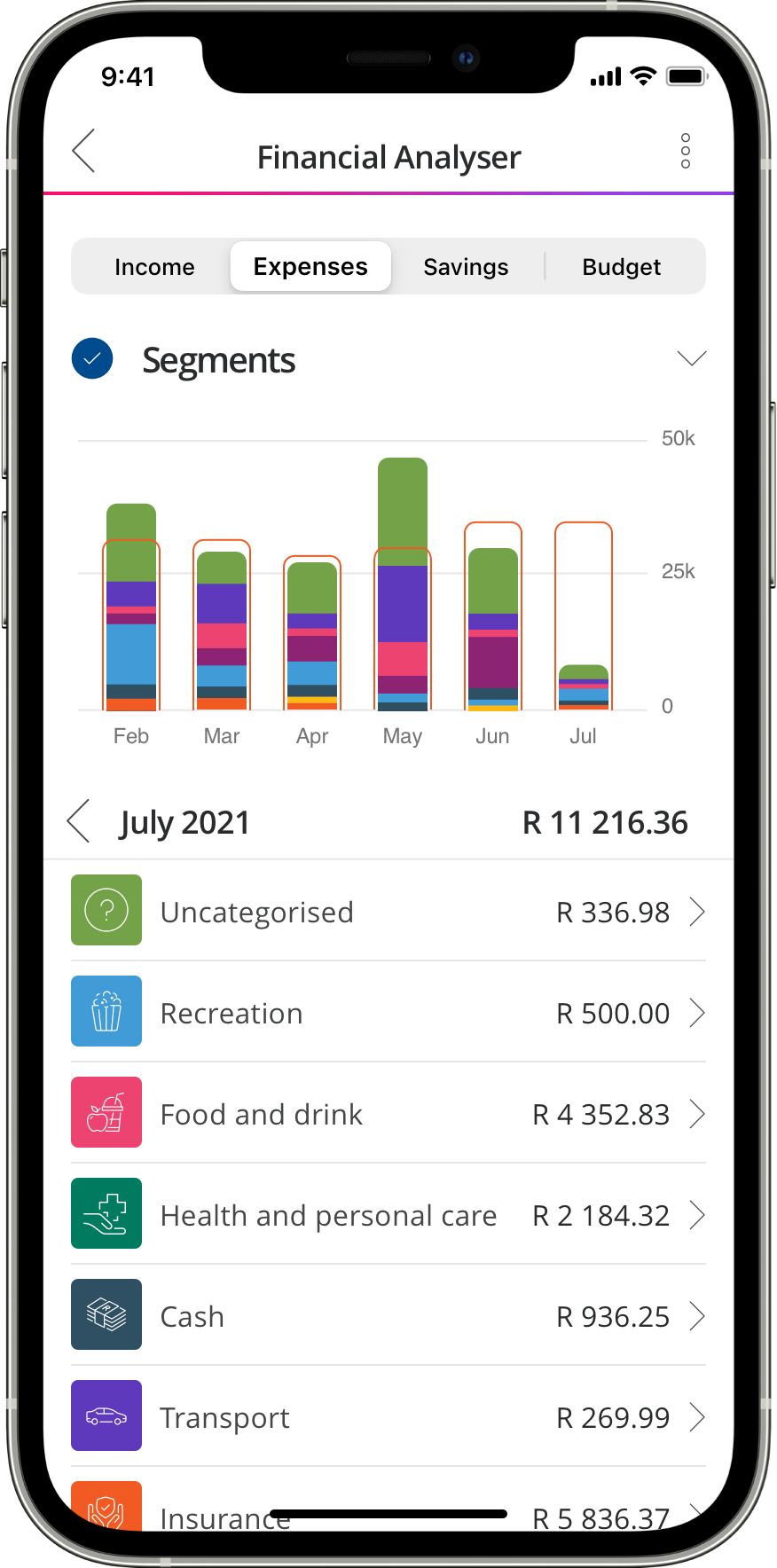

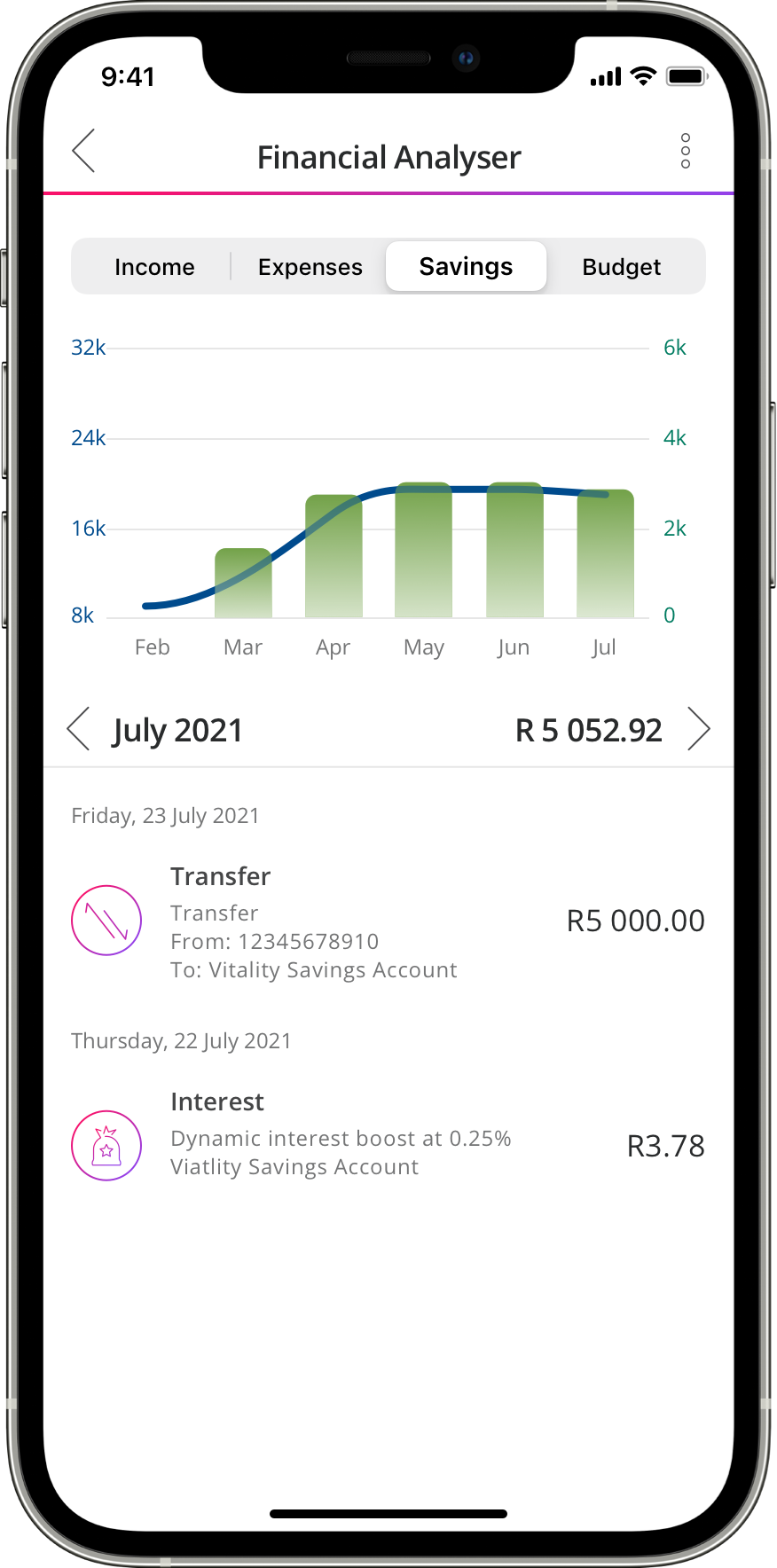

Understand your spending trends by category over time.

Create personal segments for holidays, home improvements, or anything you want.

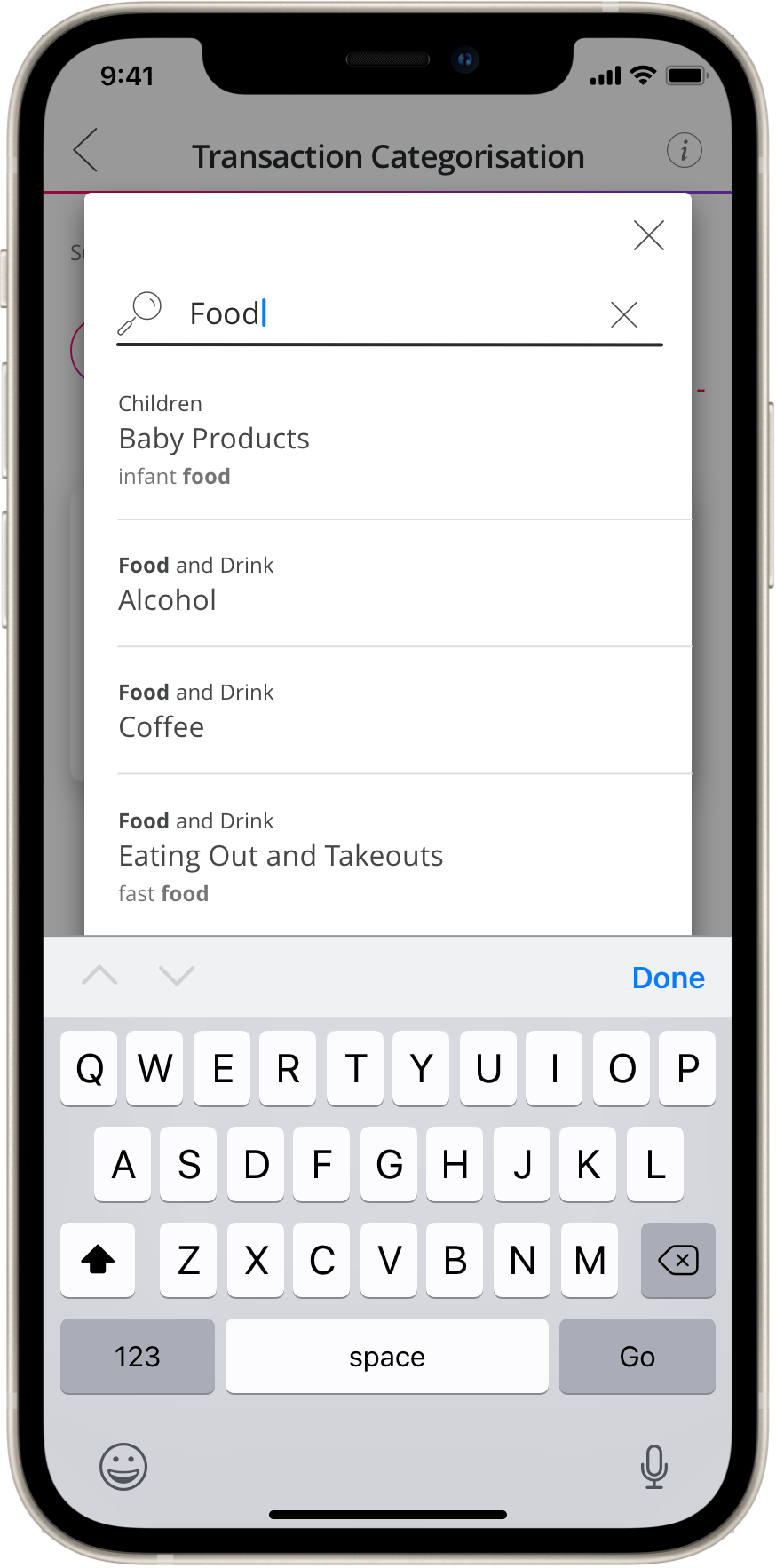

Easily recategorise transactions using predictive text to quickly find them again.

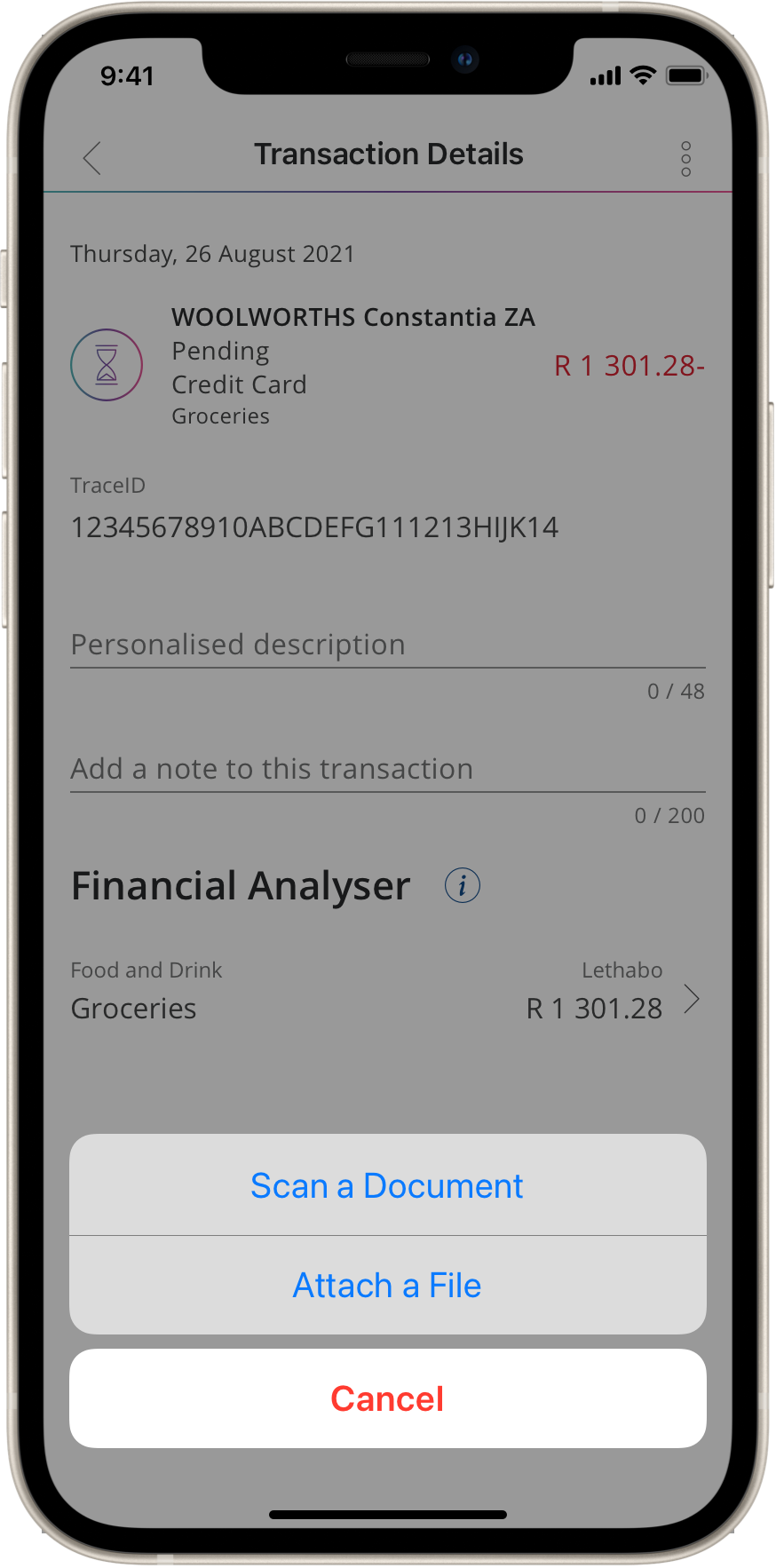

You can also conveniently upload and store important receipts or documents and link them to specific transactions using Smart Vault.

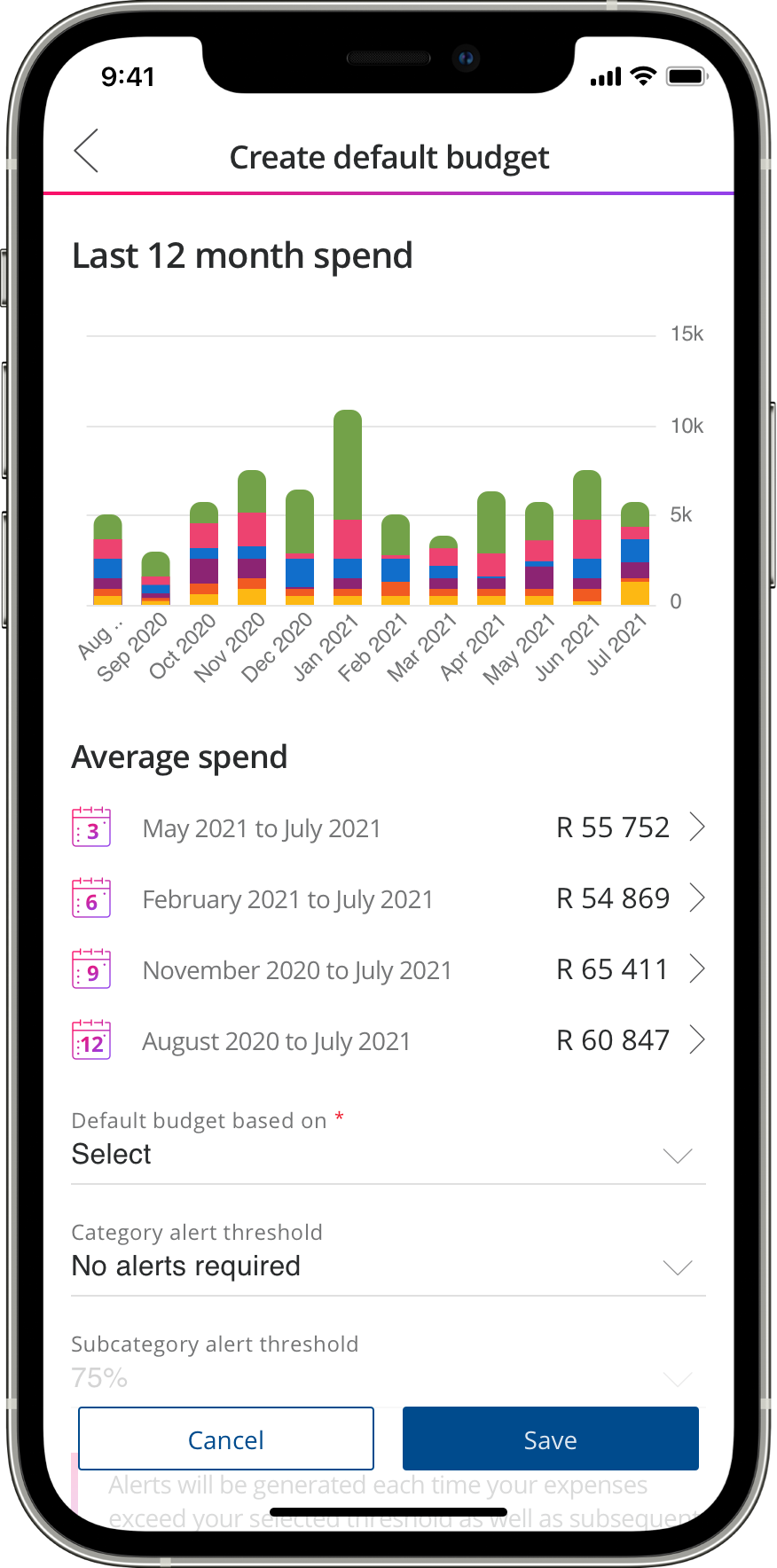

We automatically create budgets for you based on your spend trends or you can create your own.

We guide you to meeting your goals with intelligent insights and personalised alerts on how you're doing.

See exactly how much you're saving each month, and watch your savings grow.

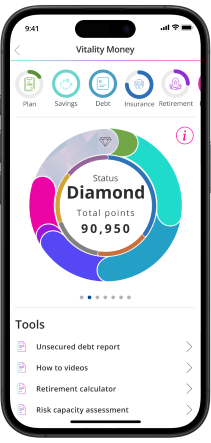

Get rewarded

Boost your Vitality Money status. Get up to 10 000 Vitality Money points by setting up your budget and sticking to it.

Read more on how we reward you for managing your money well

Start using the Vitality Money Financial Analyser today and see how it can help you secure your financial future.

Why we created the Vitality Money Financial Analyser

Our research shows that 65% of people don't know what they spent during the previous month1. More than half of people who think they know what they spent either over or underestimate this amount2.

1Intuit Mint Life Survey, 2020.

2Exception Is the Rule: Underestimating and Overspending on Exceptional Expenses. Journal of Consumer Research, 2012.