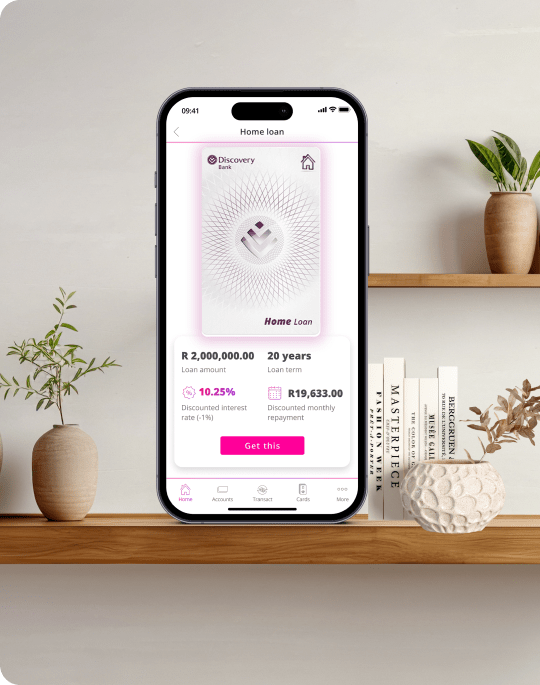

Introducing the first and only shared-value home loan from Discovery Bank. Whether you're a first-time buyer or looking to upgrade, you'll enjoy a full ecosystem of benefits and tailor-made service that starts in minutes in your banking app. Plus, pay up to 1% less on your Discovery Bank Home Loan interest rate, when you manage your money well.

Ready to go home sweet home?

Unlock the Future of Home Loans. Now.

Apply, Switch, Refinance - all in the app

-

Get a preliminary offer in 5 minutes.

-

Enjoy up to 100% financing for your home.

-

Select repayments terms up to 30 years.

-

Apply with up to 3 co-applicants.

-

All in the Discovery Bank app.

A personalised application process

-

Get a dedicated consultant to manage your application and guide you through the process.

-

Save up to 60% on bond attorney fees.

Pay even less on your home loan

-

Pay up to 1% less when you manage your money well and include your other Discovery products.

-

Take comfort with home loan protection and protect your home with building and contents insurance, seamlessly activated as part of your home loan application.

Financial flexibility in a few taps

-

Get flexible access to your prepaid home loan funds with a built-in access facility.

-

Enjoy access to additional credit of R20,000 to R1,000,000 with a Revolving Credit Facility. Enjoy affordable repayments from as little as 2.5% of the outstanding balance, with flexible terms and only pay fees when you use it - directly in your banking app.

Read more about Discovery Bank Home Loans

Discover more

Welcome Home with SA's first and only shared-value home loan

Whether you're a first-time buyer or looking to upgrade, enjoy a full home loan ecosystem of benefits and tailored services. Start in minutes in your Discovery Bank app, get a personalised interest rate, plus a further discount of up to 1%.

A guide to finding your dream home

Buying property is a big step. By defining your requirements, researching well, and carefully evaluating each option, you'll set yourself up for a satisfying investment. Here are tips from Discovery Bank on how to approach a property purchase.

What to look out for: the costs of buying a home in South Africa

Becoming a homeowner is fulfilling, but it requires diligent financial planning. This can help ensure that the property you buy is an investment that increases in value rather than a financial burden. Get pointers from Discovery Bank here.

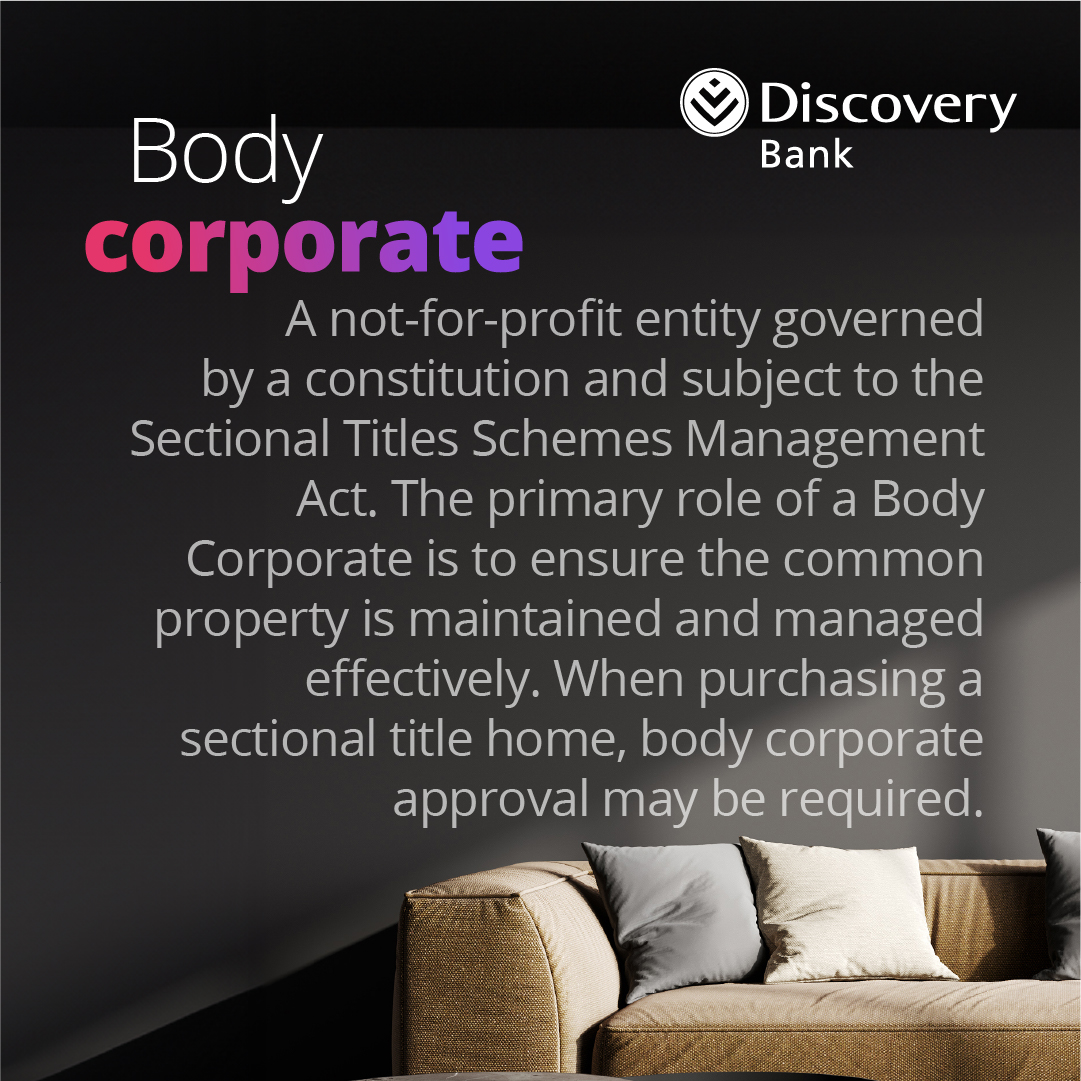

Understanding property types and choosing the right fit for you

Do you know the difference between freehold, sectional title, and share-block properties? Each property type may impact decisions like whether you can have a pet, plant a garden, or run a business from home. Get the lowdown from Discovery Bank here.

Fees guide

| Account fees | |

|---|---|

| Once-off initiation fee | R6,037.50 |

| Monthly servicing fee | R69.00 |

| Transfer fees (New loan) |

|---|

| Payable to the transferring attorney (chosen by seller) for registering the property in client's name, calculated on a sliding scale related to the purchase price. |

| Transfer duties (New loan) |

| Paid to SARS, based on the property value. Properties under R1 million in value and properties purchased from a developer are exempt. |

| Bond registration fees (New loan, switch, refinance) |

| This is payable to the bond attorney who is responsible for registering the bond with the Deeds Office. |

| VAT for developers (New loan) |

| VAT is payable instead of transfer duty if purchasing from a developer. |

| Bond cancellation fees (Switch) |

| Payable to the bond cancellation attorney for cancelling an existing bond at the Deeds Office and arranging for client's title deeds to be delivered. |

| Additional attorney costs (New loan, switch, refinance) |

| Smaller variable costs including FICA fees, electronic instruction fees, and postage. |

| Initiation fees (New loan, switch, refinance) |

| Fee charged by a credit provider for processing a bond application. |

| Monthly fees (New loan, switch, refinance) |

| Credit providers charge a monthly fee for managing and administering the credit facility. Fees are defined in the NCA. |

Purchase. Protect. Power.

An ecosystem built to go beyond home loans.

Get a personalised interest rate, plus a further discount of up to 1% on your home loan

Join Discovery Bank with a transaction account, credit card or full banking suite, then simply apply for a home loan in the banking app.