Experience the only Real-Time Forex Accounts, available 24/7 on your banking app.

Open. Convert. Save. Pay.

In seconds.

Expand your banking portfolio today with our Discovery Bank Forex Accounts - designed for smart, seamless foreign currency transactions.

See how easy it is to save and transact in foreign currencies

More features of our forex accounts

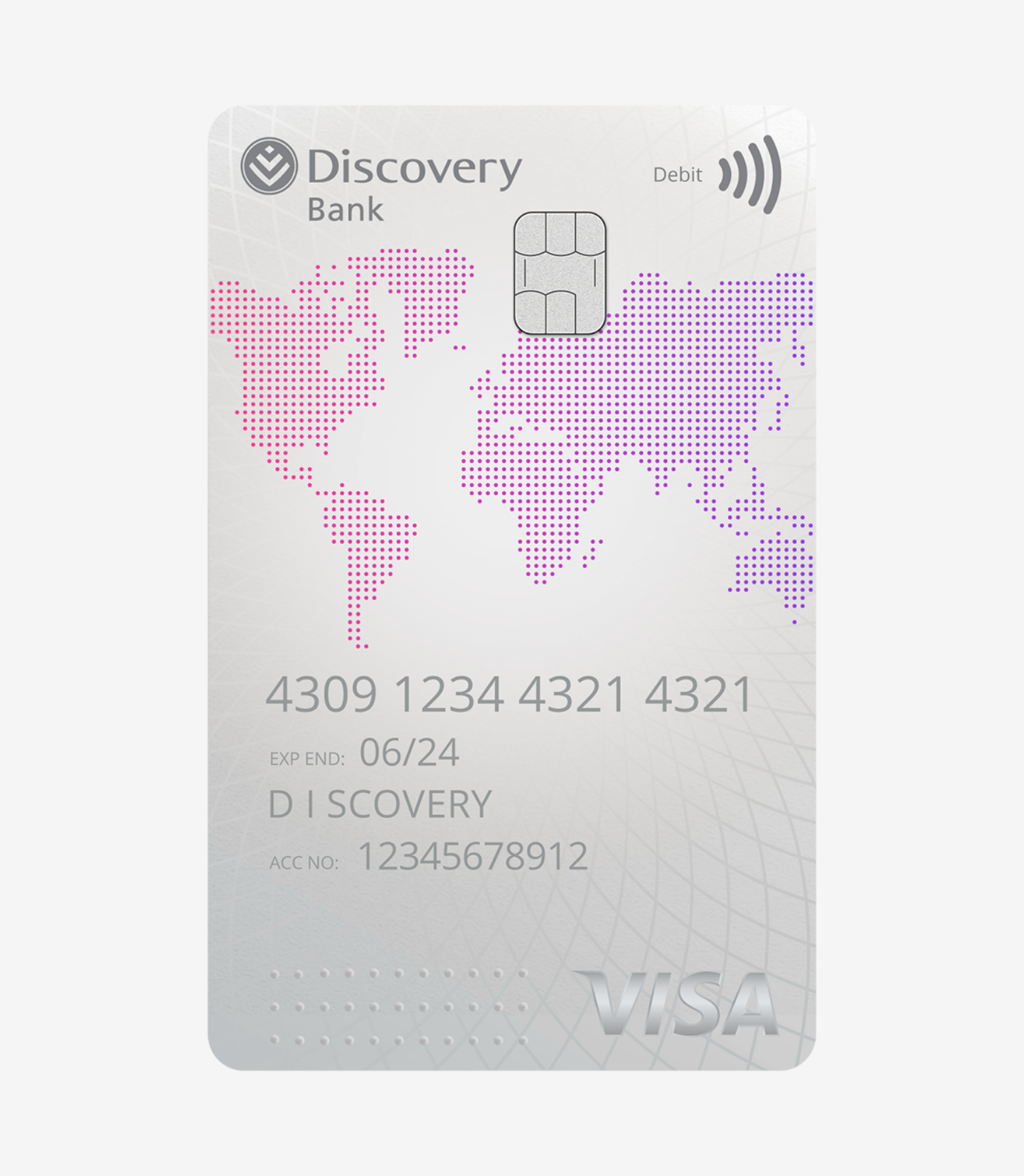

- Our smart virtual and physical debit cards automatically select which account to use based on the purchase currency.

- There's no minimum balance.

- We'll help you manage your foreign currency allowances and track the foreign transactions you make using our platform.

- Choose to split the transaction fees, take them on yourself or pass all transaction fees over to the beneficiary when making or receiving foreign currency payments.

- Discovery Bank instantly processes your payments into the international banking system. Once your payment is received by an intermediary bank, it is subject to their processes and timelines.

- Automatic CODI deposit cover of up to R100,000 per depositor in case of a bank failure and its liquidation.

Monthly account fees

| MONTHLY ACCOUNT FEES | |

|---|---|

| Discovery Bank Purple Suite | FREE |

| Discovery Bank Black Suite | FREE |

| Discovery Bank Gold or Platinum Suite, Discovery Bank Credit Card Account, or Discovery Bank Transaction Account with bundled fees | R22.50 for each forex account |

| Discovery Bank Transaction Account with pay-as-you-transact fees | R37.50 for each forex account |

| Card fees | |

| Virtual cards | FREE |

| Once-off physical debit card issuing fee (optional) | R200 |

Who can open a forex account

You need to be an existing accountholder of a Discovery Bank Transaction Account, Card Account or Suite and 18 years or older to add any of our forex accounts to your banking portfolio.

Not a Discovery Bank client yet?

Choose from a transaction account for your everyday banking needs, a state-of-the-art standalone credit card or get the full banking experience with a Discovery Bank Suite - it's the account that gives you the best rewards.

Download the Discovery Bank app to get started or

Join nowDid you know?

South Africans invest 75% of their assets in South Africa, yet South African investments make up just 0.3% of total investments globally1.

The ability to lower your risk and save and transact in foreign currency used to be a luxury that was only available to the wealthy. Now, Discovery Bank makes it affordable and easy for you to save and transact in the foreign currency of your choice.

1 World Investment Report, 2020.

Read our frequently asked questions

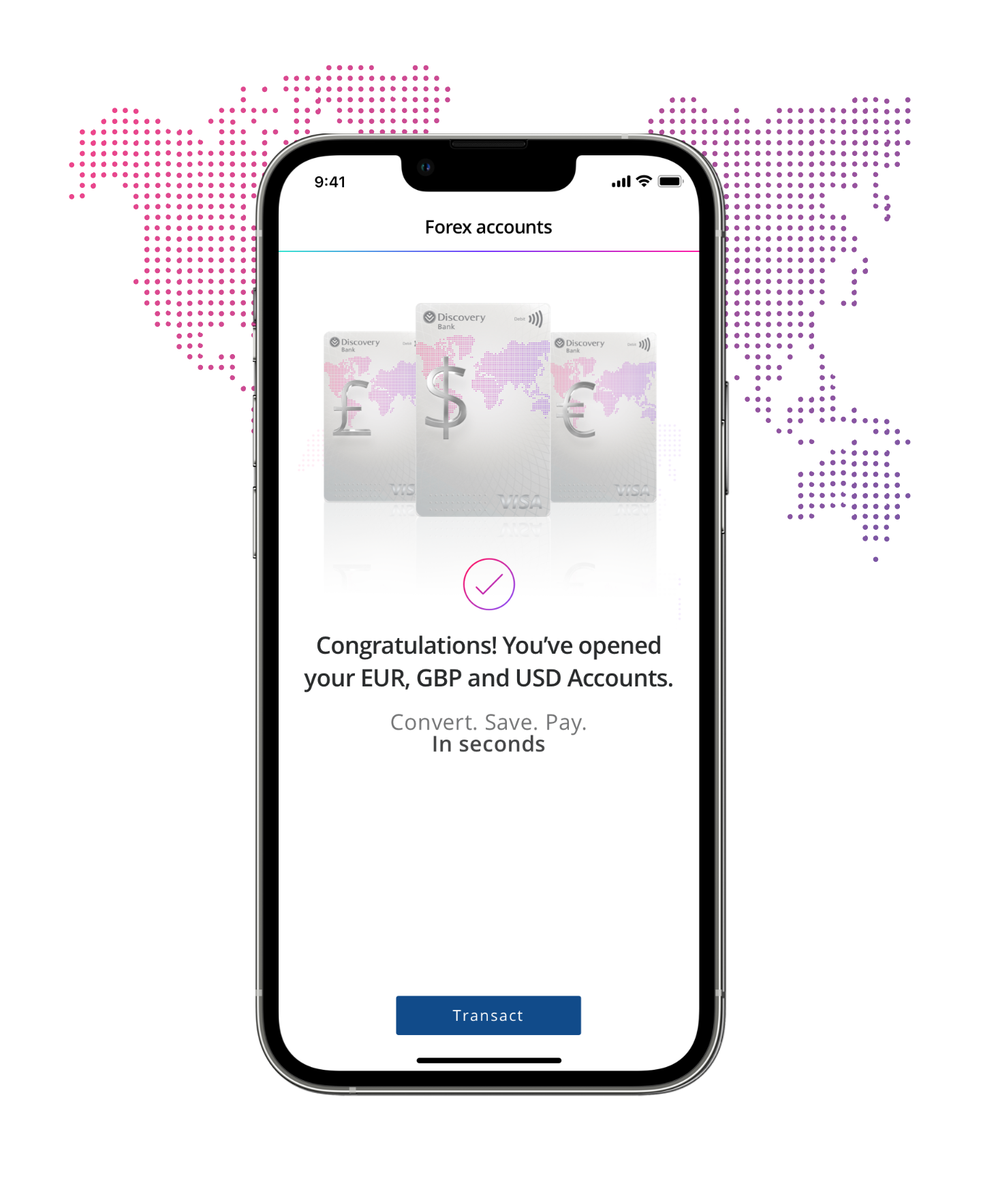

You can quickly and easily open one of our Discovery Bank Forex Accounts (British Pounds, Euro or US Dollar Account), or all three, in the Discovery Bank app.

To add these accounts, simply:

- Log in to the Discovery Bank app.

- Scroll to the end of your portfolio of accounts.

- Tap Add Account.

- Tap Foreign Currency.

- Enter your tax number (if it isn't there already).

- You'll be able to open a British Pound, Euro or US Dollar Account.

You can open only one British Pound, one Euro and one US Dollar Account.

You can see the fees on our website at www.discovery.co.za/bank/forex-account-fees or see the What do Discovery Bank products cost? section on Info and tips.

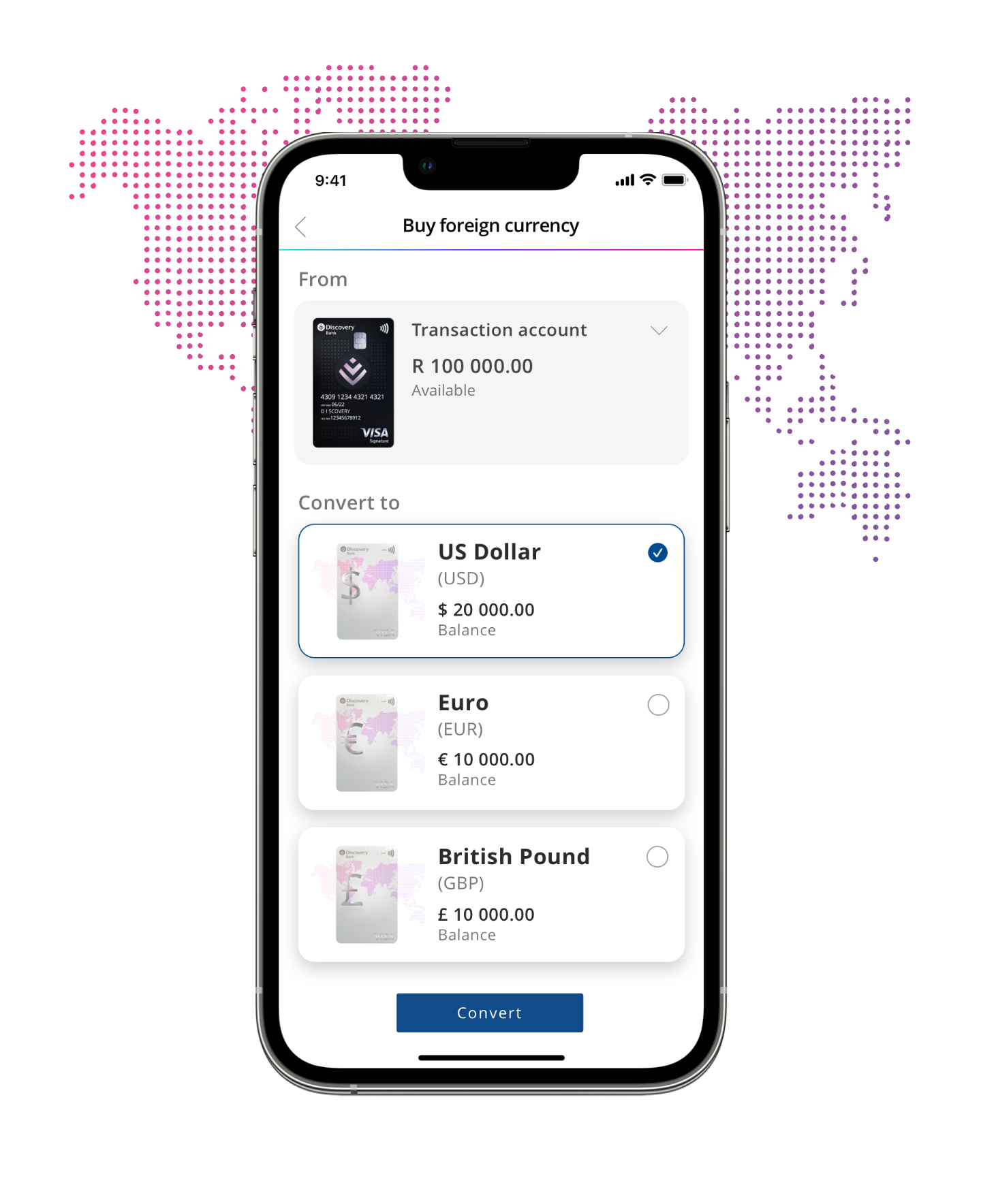

It works like a transaction account. You can receive money, make cross-border payments and do inter-account transfers between this and your other Rand accounts.

All transactions are in the currency of the account, which is GBP (British Pounds), EUR (Euros) or USD (US Dollars).

You can also choose to pay an external beneficiary in more than 60 other currencies.

We use the exchange rate at the time when you complete a transaction.

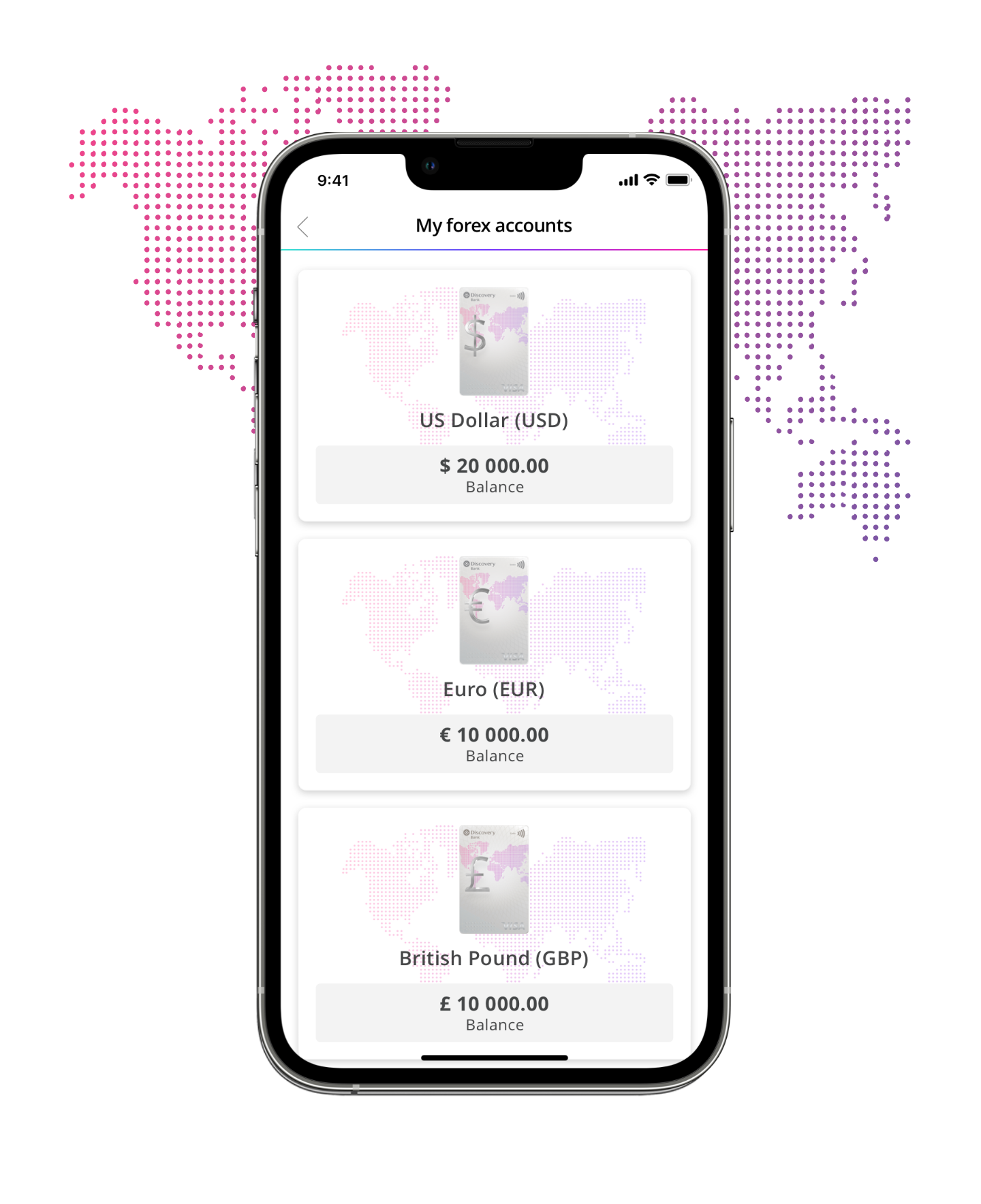

Yes, you can get payments in any of the following currencies:

- EUR (Euro)

- GBP (British Pound)

- USD (US Dollar)

- ZAR (South African Rand).

However, you can only get payments in the currency that matches the native currency of your receiving account. The reason for this is that we don't offer conversion rates when you receive money into your accounts.

For example:

You can only receive South African Rands sent from overseas into your Rand account. You can't receive US Dollars sent to you into your Rand account, meaning you can't receive US Dollars that we have to convert to Rands into your credit card or transaction account.

You can only receive US Dollars sent to you from overseas into your US Dollar Account. You can't receive British Pounds sent to you into your US Dollar Account, meaning you can't receive British Pounds that we have to convert to US Dollars.

Once you have received the money into your foreign currency account, you can always use the rate conversion function in the Banking app to convert your foreign currencies to Rands at any time and at an exchange rate that is favourable to you.

If you get a payment in a currency that doesn't match the native currency of your account, it will unfortunately be rejected.

You can do this in the Discovery Bank app.

- Log in to the app.

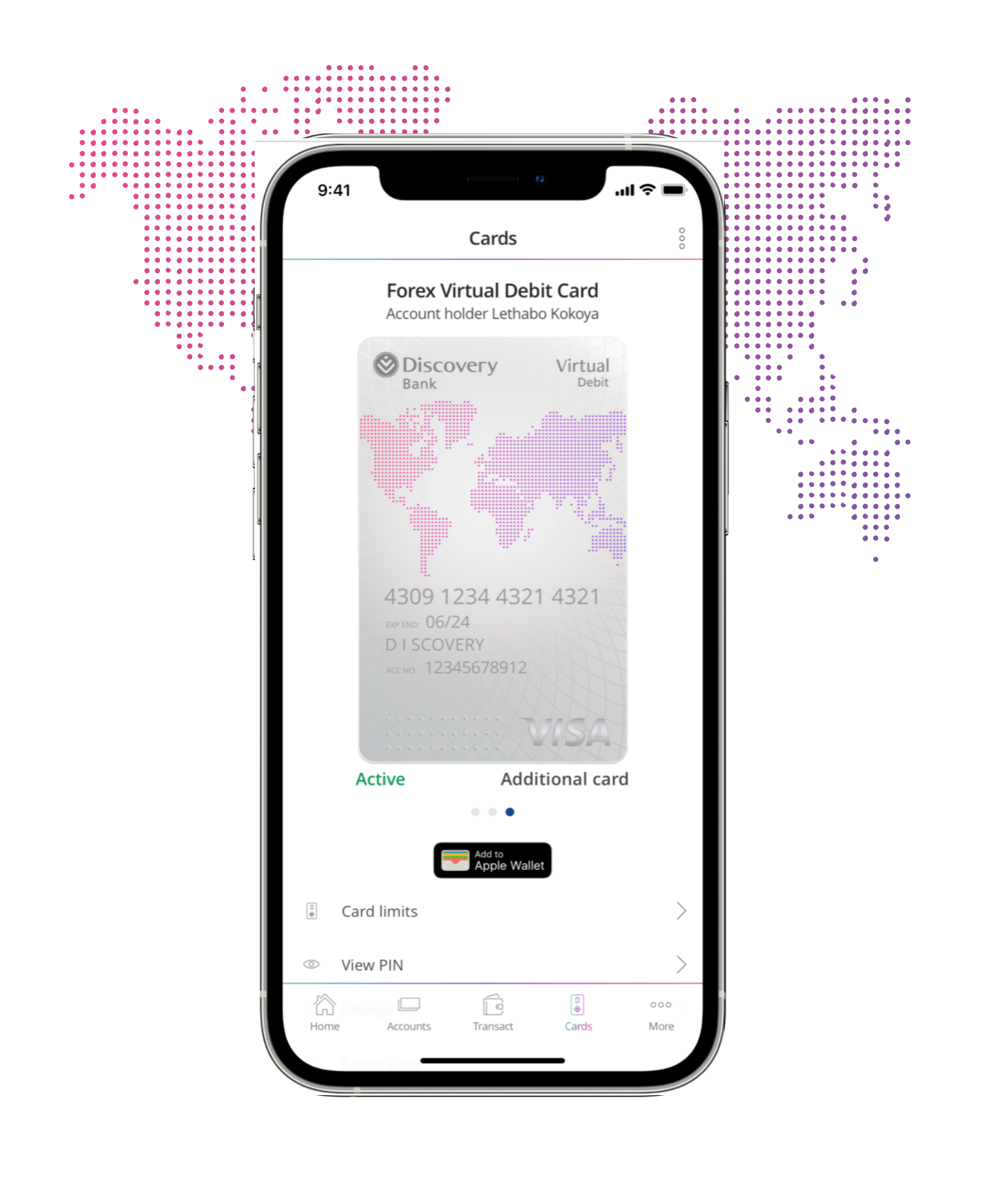

- Tap Cards.

- Choose between a physical or virtual card.

- Choose the account for which you would like to add the card (British Pound, Euro or US Dollar).

You can choose any of the three forex accounts to add the multicurrency card to. The card will automatically link to other forex accounts if you have them, and will also be linked to your nominated Rand account for fees and transactions in currencies other than USD / GBP / EUR. For physical cards, you'll also need to enter your delivery information.

Enter relevant information and select Next. Enter and confirm your PIN.

If you choose to add the card for a secondary cardholder, then you need to enter the cardholder's details. Remember that any payments made with this secondary card will use your own SDA allowance, and not the SDA allowance of the cardholder. We're working on allocating payments to the SDA allowance of the secondary cardholder as the person transacting.

You can do this in the Discovery Bank app.

- Log in to the app.

- Tap Cards.

- Choose between a physical or virtual card.

- Choose the account for which you would like to add the card (British Pound, Euro or US Dollar).

You can choose any of the three forex accounts to add the multicurrency card to. The card will automatically link to other forex accounts if you have them, and will also be linked to your nominated Rand account for fees and transactions in currencies other than USD / GBP / EUR.

Enter relevant information and select Next. Enter and confirm your PIN. Your card is ready to use.

You can also add it on your favourite smart device to use at tap-and-go payments using Apple Pay, Fitbit Pay, Garmin Pay, Google Pay, Samsung Pay and SwatchPAY!

If you choose to add the card for a secondary cardholder, then you need to enter the cardholder's details. Remember that any payments made with this secondary card will use your own SDA allowance, and not the SDA allowance of the cardholder. We're working on allocating payments to the SDA allowance of the secondary cardholder as the person transacting.

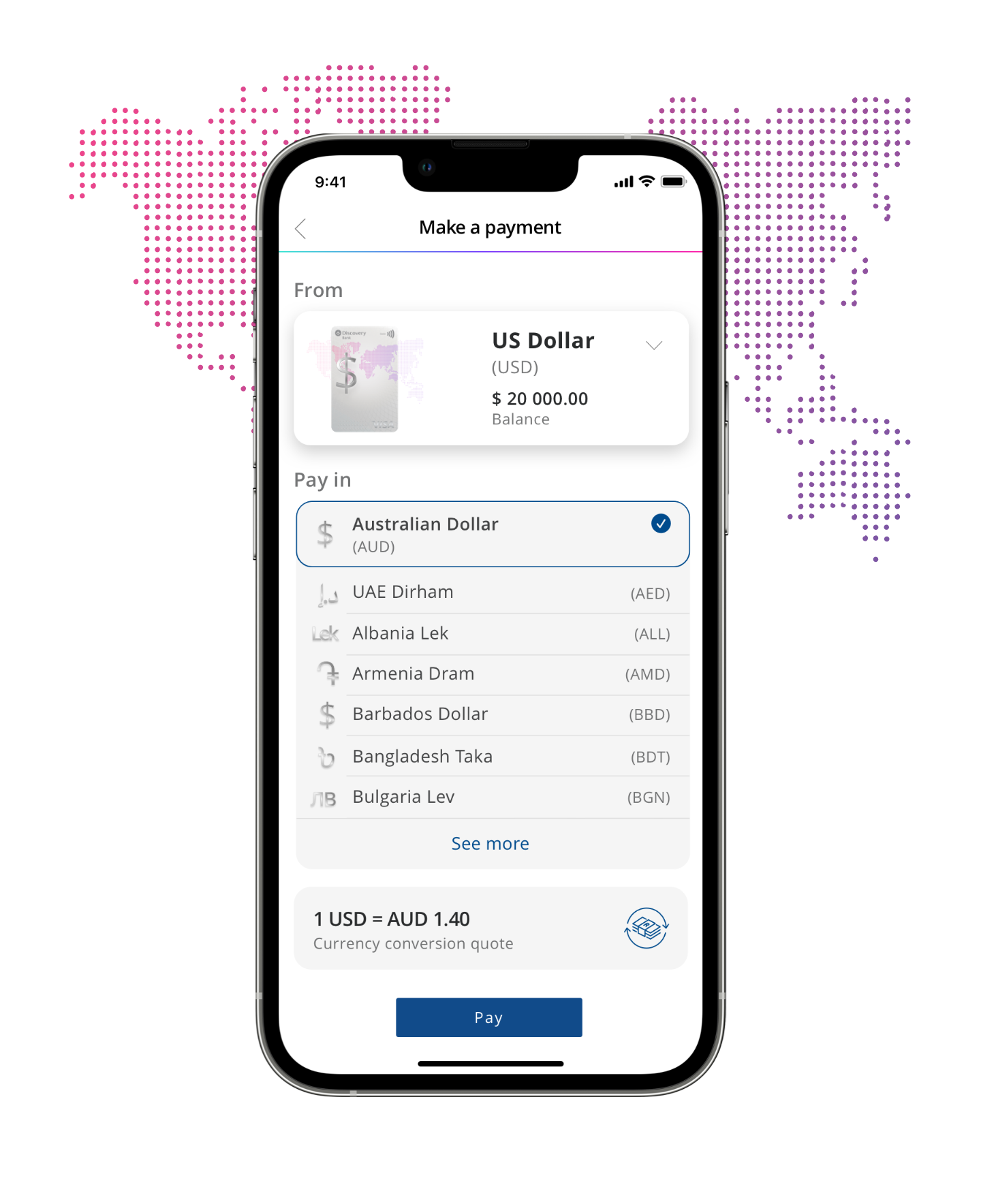

The Multicurrency card is linked to any forex accounts you have with Discovery Bank (British Pound, Euro or US Dollar).

It's also linked to a nominated South African Rand account you chose when opening your forex accounts.

You can use this one card for international transactions in various currencies and it'll automatically link to the relevant forex account based on the currency you're transacting in. For example, if you travel to the United States and use your card there, it'll automatically charge the transactions to your US Dollar Account. If you use your multicurrency card at an online merchant who uses British Pounds, it'll automatically process the transaction from your British Pound Account. If the account has insufficient funds your transaction will decline.

If you transact in a currency for which you don't have a forex account, the transaction will be processed to your nominated South African Rand account. If your nominated South African Rand account has insufficient funds, the transaction will also decline.

Your multicurrency card is blocked for transacting in South African Rands, at a South African ATM or with a merchant located in South Africa. This means that these transactions will fail.