We're the shared-value bank that offers the best interest rates

Discovery Bank has the best interest rates in South Africa. We're able to offer these competitive interest rates across our transactional and savings products through our unique shared-value banking model and Vitality Money.

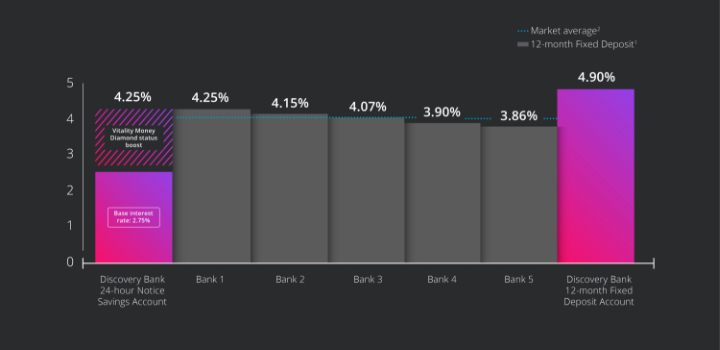

For example, our clients can get the best of both worlds if they're on Diamond Vitality Money status because the interest rate on our 24-hour Notice Savings Account is equivalent to the average market interest rate on a 12-month fixed deposit account. And, for clients who're able to save their funds in a 12-month fixed deposit account, their returns greatly outperform the market average.

1Interest rates are based on a nominal annual compounded monthly interest rate (NACM) and an investment amount of R10 000 for comparable products with the five biggest banks, based on retail deposits.

2Discovery Bank is excluded from the market average calculation.

How we offer these interest rates

Our shared-value banking model helps clients understand how financially healthy they are by measuring key financial behaviours. This financial data enables us to accurately determine our clients' financial health and reward them for their healthy behaviour.

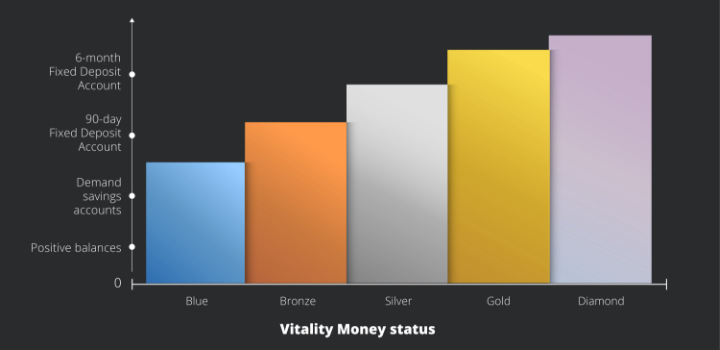

Traditional banks use the duration of investment and product type to set interest rates. Discovery Bank's analysis shows that the better an individual manages their money, the longer they save for, which means they save more. In fact, clients on Gold and Diamond Vitality Money status save at three times the rate of clients on Blue Vitality Money status.

This is why Discovery Bank can share value back with clients through market-leading interest rates. For example, our 24-hour Notice Savings Account allows clients who engage with Vitality Money and manage their money well to get the best of both worlds and earn equivalent interest rates of a 12-month fixed deposit with fewer restrictions.

Clients who manage their money well are a lower risk

Clients on Gold and Diamond Vitality Money status keep their money invested for longer periods than clients on Blue Vitality status.

People who manage their money well save for longer. So, while traditional banks only differentiate through the duration of investment periods based on the product type they offer, we do things differently. We're able to accurately measure our client's financial health. Our analysis shows that the better our clients' Vitality Health status, the more likely they are to keep their savings invested with us for a longer duration.

For that reason, we believe that clients should not be unnecessarily penalised for access to their funds and or have their interest rate compromised.

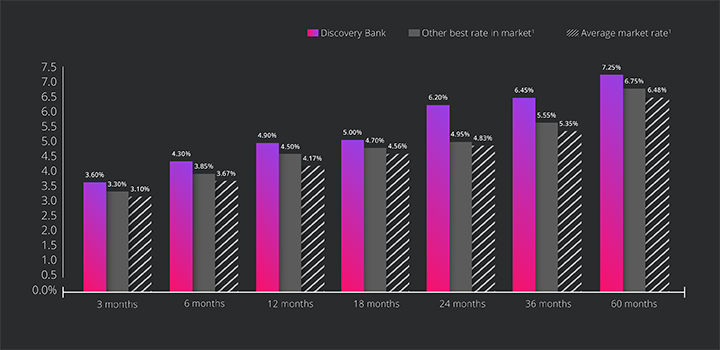

Saving over a longer term with us pays off

We also have the best interest rates in the market for clients who are willing to save for longer. Clients earn up to 8.71% interest on savings over a 60-month period paid at maturity.

1Interest rates are based on a nominal annual compounded monthly interest rate (NACM) and an investment amount of R10 000 for comparable products with the five biggest banks, based on retail deposits.

2Discovery Bank is excluded from the market average calculation.

Discovery Bank continues to grow from strength to strength

Discovery Bank is the fastest growing bank by retail deposits in South Africa. As of May 2021, we hold R8.1 billion in deposits and grew an astonishing 281% over the past 12 months in retail deposits, while the rest of the market in South Africa only grew by 7.6% within the same period.

Discovery Bank Limited. Registration number 2015/408745/06. An authorised financial services and registered credit provider. FSP number 48657. NCR registration number NCRCP9997. Limits, terms and conditions apply.