This is our shared-value banking model

As you manage your money well, you create less risk and more value for your bank. We share this value back with you through improved interest rates and rewards through our powerful Vitality Money programme. We believe that when our clients do well, we do well and society benefits too. In fact, our shared-value banking model is so powerful, it made it to Fortune's Change the World list.

Value for clients

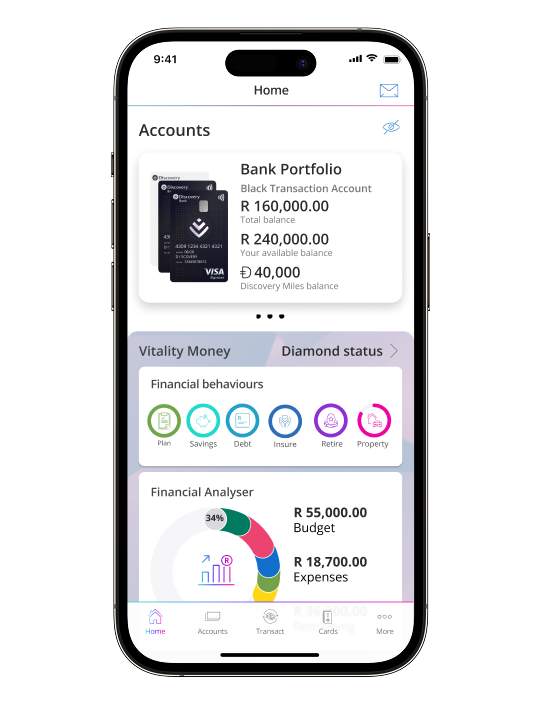

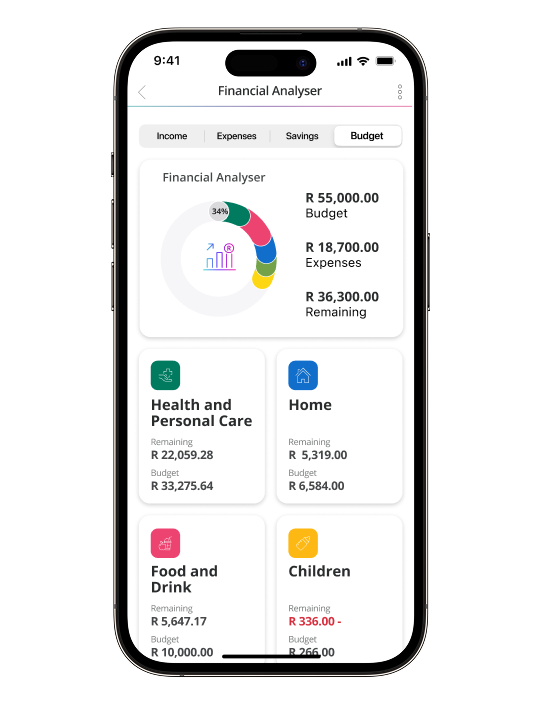

Actively engage with the Vitality Money programme to learn how you can better manage your money and improve five key financial behaviours that make up your overall financial health. Plus, you get to experience better value, better benefits and exceptional service along the way

Value for the Bank

As you engage more with Vitality Money and improve your usage of our products, deposits increase and defaults go down, which means you become a lower risk for the Bank and create more value. This value we share back with you through improved interest rates and rewards.

Value for your society

By becoming more financially healthy, you help build a more financially resilient society - a community that has more disposable income, more long-term savings, and one which is less reliant on family and the country.

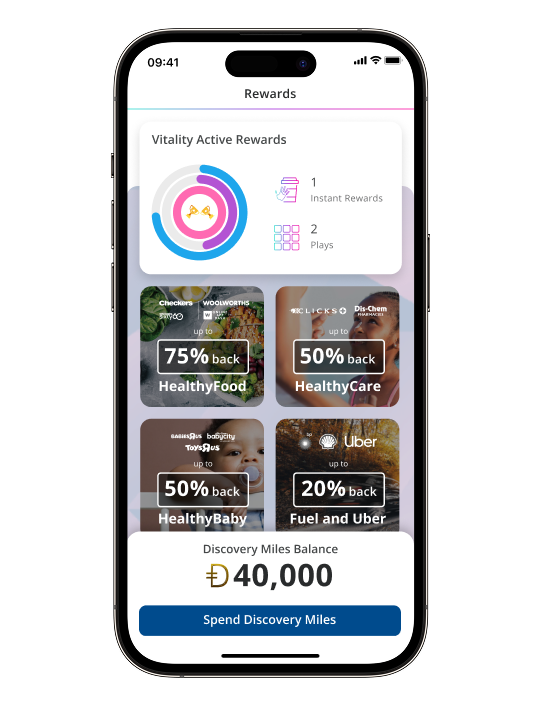

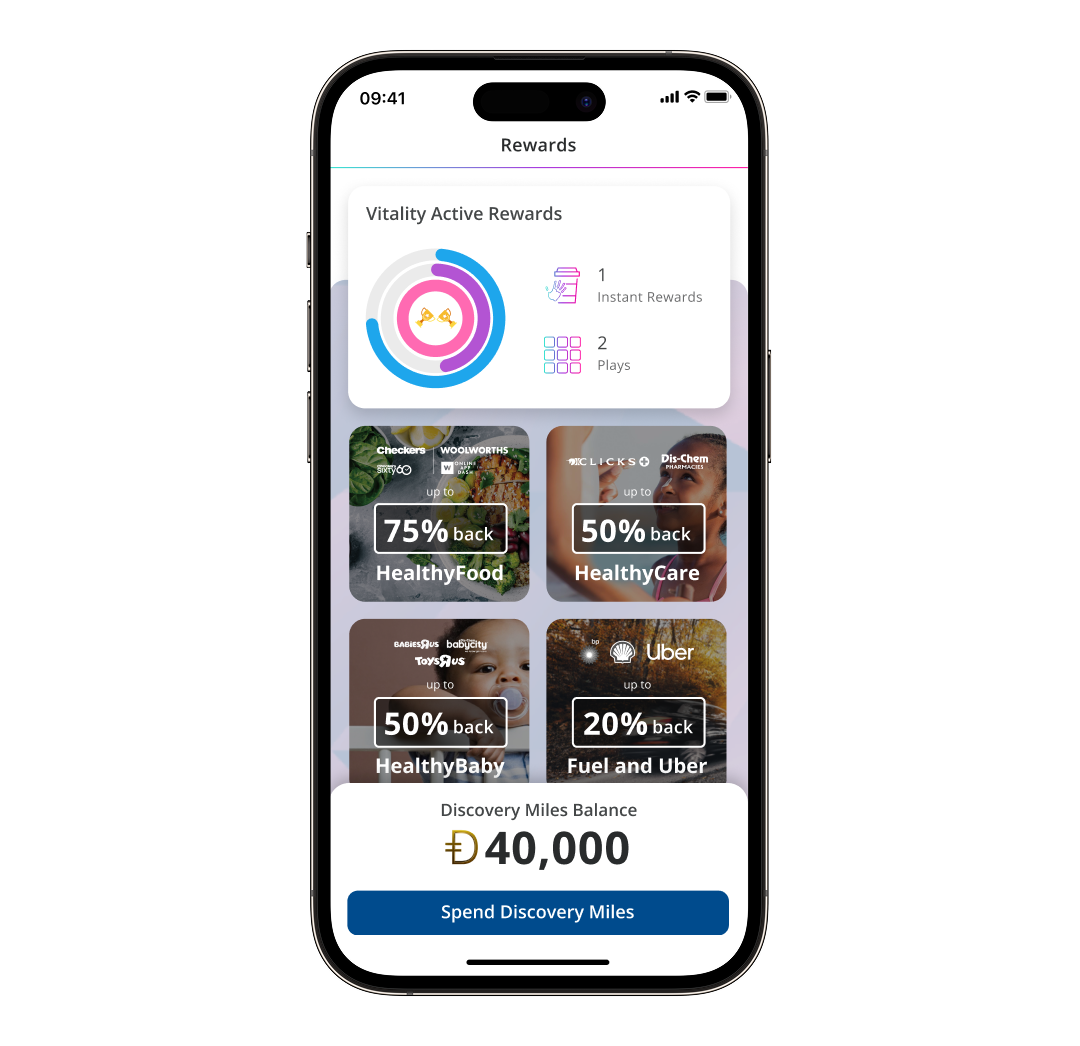

Your shared-value stack of rewards

Based on the product you choose, and your Vitality Money status - you'll unlock your own personal stack of shared-value rewards.

You can also use our interactive shared-value stack tool to see the value you could get with Discovery Bank based on your individual portfolio.

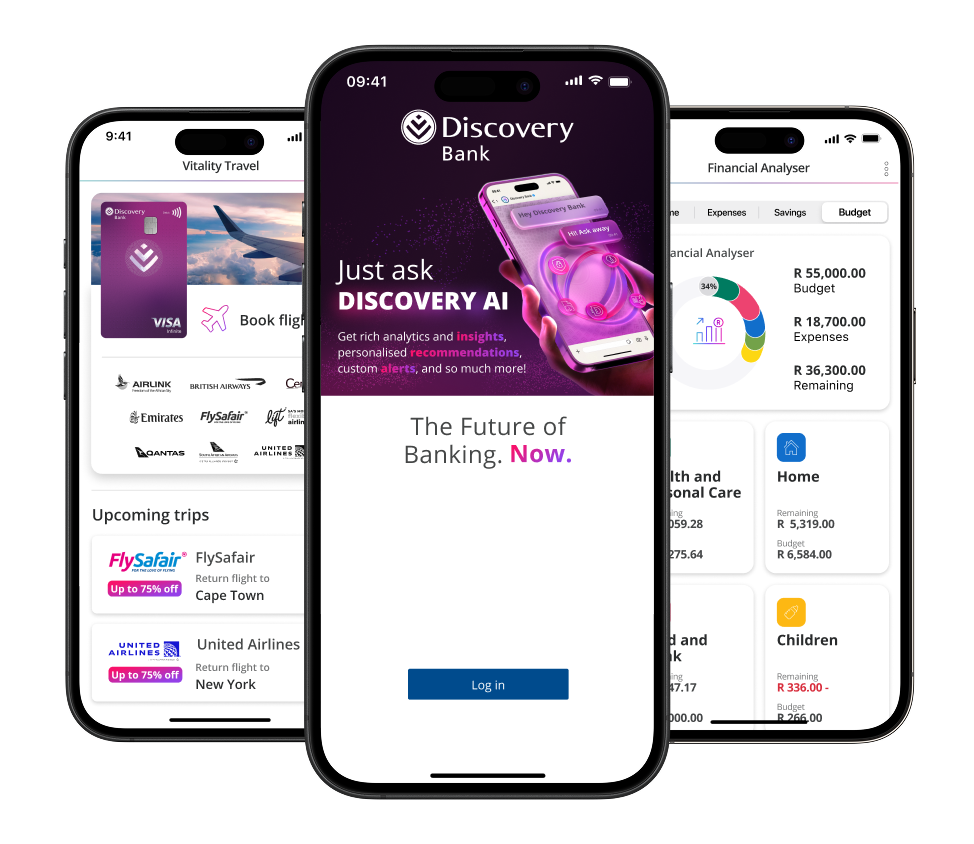

The Future of Banking. Now.

A future where your bank believes...

Anyone can be financially resilient and improve their money management. It is not about how much you earn, but how well you manage what you earn.

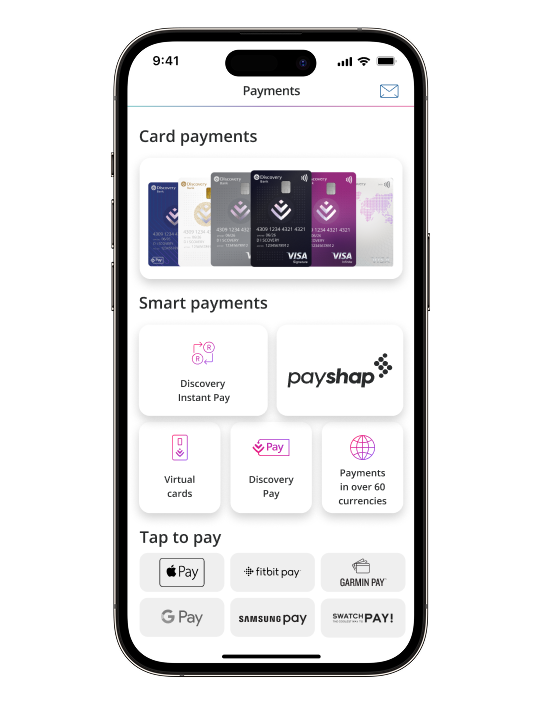

You should be able to bank anywhere, at any time - with convenient access to tools, knowledge and support to help you make better financial decisions.

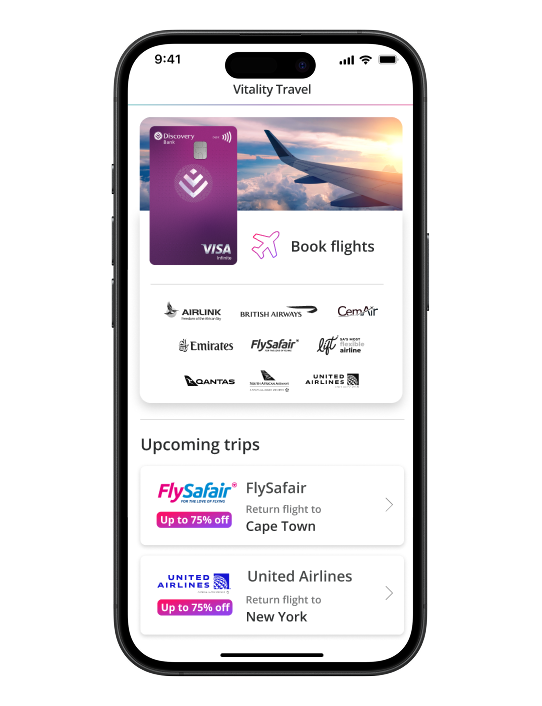

You should be rewarded for your positive financial changes with rewards and benefits equal to the effort you put into your financial wellbeing.

Banking is about building a community of people who are managing their money well and making a meaningful impact in society.

With the Future of Banking, you can enjoy

Best rated banking app

in South Africa

All of this is brought together simply, elegantly and seamlessly in the palm of your hand, powered by the Discovery Bank app. And if you need to speak to a banker, we've got you covered too - 24/7/365.

Go to your favourite app store to download the Discovery Bank app.

More about Shared Value Banking

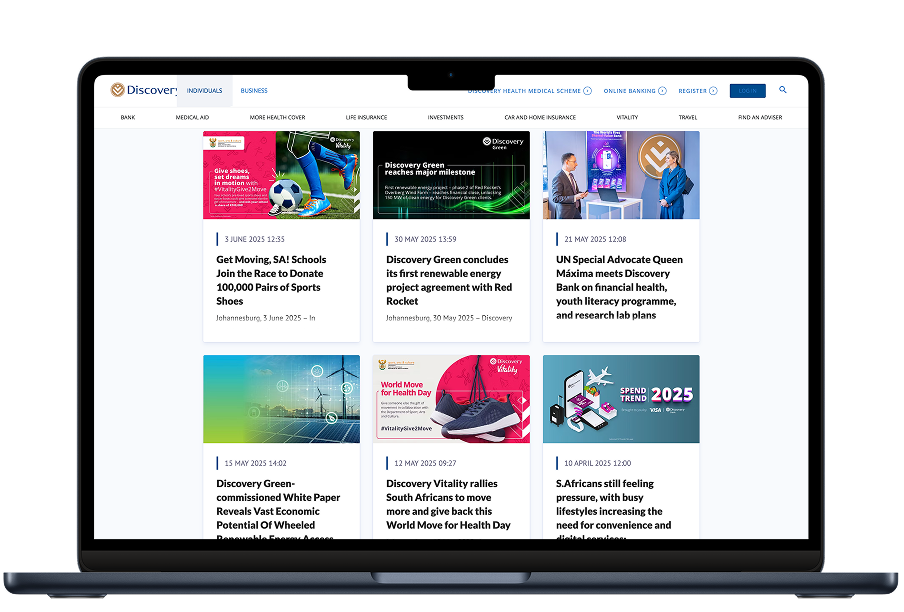

News and updates

We consistently drive innovation through our outstanding features and services, exceptional user interface, and seamless integration with various internal and external platforms.

Stay up to date with the latest news and updates through our news channels.

The Discovery Bank story

Bank to the Future celebrates Discovery Bank's journey from bold idea to thriving digital bank with over one million clients. It's a tribute to the team, values, and innovation that shaped a shared-value bank focused on financial health, reimagining banking through technology, purpose, and unwavering commitment.

Awards and recognition

We're humbled by awards we've received that validate Discovery Bank's collective efforts and drive to deliver the absolute best banking experience.

Don't just take our word for it.

Curious what the Banking experience is like? Hear it directly from our customers.