The two-pot wake-up call: Your future deserves a better plan

SpendTrend25 shows that many South Africans are dipping into retirement savings to cover everyday costs. Learn how to manage your two-pot withdrawals - and how Discovery Bank makes it easier to protect your long-term future while still meeting short-term needs.

How safe is your retirement nest-egg, and how often are you tempted to dip into it?

SpendTrend25 reveals a rising trend: South Africans are getting better at spending smarter... but we're also dipping into long-term savings to make ends meet.

In the latest edition of this annual consumer behaviour report, Discovery Bank and Visa show how financial strain is shifting the way we save and spend. One of the most telling signs? By November 2024, South Africans had withdrawn over R35 billion from their two-pot retirement savings.

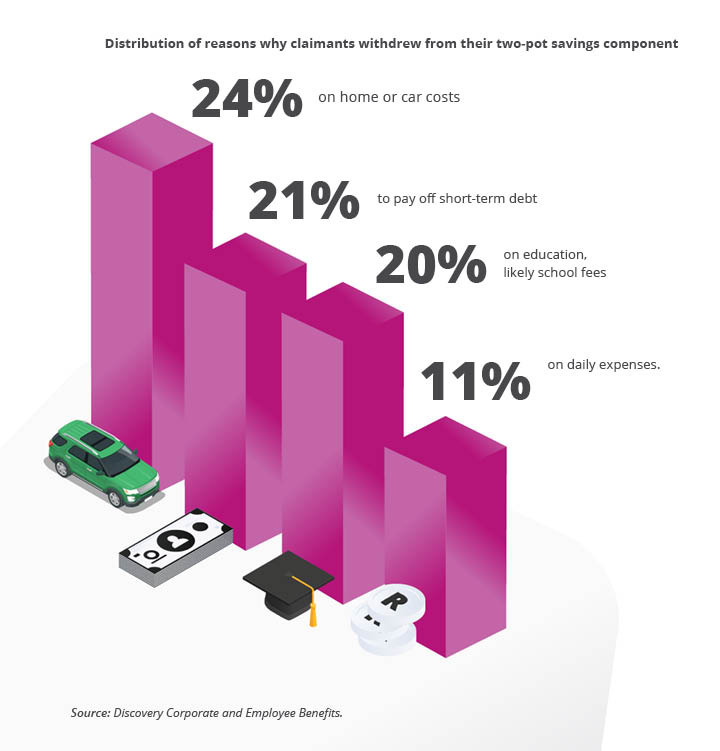

That's 1.9 million applications to access money meant for the future - spent mostly on everyday costs like home or car payments (24%), school fees (20%), short-term debt (21%) and daily expenses (11%).

While the new two-pot retirement system - introduced in September 2024 - is designed to provide relief in tough times, these numbers point to a deeper challenge: we're still battling to balance today's financial pressures with tomorrow's goals.

The good news? There's a better way to do both.

Tap into your savings - without tapping out your future

At Discovery Bank, we're all about helping you make your money work harder - for both now and later. That's why we've made it easier than ever to manage your Discovery Retirement Fund portfolio directly in the Discovery Bank app.

With a few taps, you can:

- See how much is in your savings and retirement pots

- Understand what you can withdraw (and what's best left untouched)

- Submit withdrawal requests safely and securely

- Use our Two-Pot calculator to see how your choices today impact your retirement tomorrow

And yes - you'll get the money in your linked Discovery Bank account within three business days, following SARS clearance. But we also encourage you to pause, calculate, and consider your long-term plan before you do.

Two-Pot temptation? Read these 4 golden rules first

- Be informed: Before you make any big money decisions, educate yourself generally on the Two-Pot retirement system (try these articles and check handy Two-Pot and retirement FAQs here).

- Check the cost of withdrawing early. Compound growth loves time. The longer your funds stay invested, the more they grow. Use this calculator to make an informed decision.

- Watch the tax. Withdrawals from your savings pot are taxed at your marginal rate - up to 45%. Make sure it's worth it.

- Think beyond the pot. Are there other options? Perhaps consider a low-interest Discovery Bank credit facility or loan tailored to your financial needs - it could cost less in the long run.

Need help finding wiggle room in your finances?

A qualified financial adviser can help you explore your options and work out the most sustainable solution. Don't have one yet? Simply leave your details and we'll arrange for an adviser to give you a call.

Ready to make smarter financial choices?

SpendTrend25 is your reminder that while flexibility is a gift, planning is a superpower. Explore your Discovery Bank app for powerful tools, personalised insights, and responsible credit options - all designed to support you now, and long into the future.

The Future of Banking. Now.

- This article is meant only as information and should not be taken as financial advice. For tailored advice, please contact your financial adviser.