New research: The expansive SpendTrend24 explores consumer spending insights in 14 cities worldwide

Building on the success of last year's landmark SpendTrend23, Visa and Discovery Bank have collaborated once more to compile SpendTrend24 - new original research that analyses and compares consumer spending in South Africa's three largest cities with that in 11 other cities in emerging and developed markets around the world.

The latest research combines Visa and Discovery's extensive datasets and world-class analytical capabilities to glean insights from over 13 billion transactions made on more than 60 million credit cards.

The expansive scope of SpendTrend24 provides a unique lens through which to understand consumer priorities, payment trends, and the impact of macro-economic conditions on spending habits worldwide. Despite the financial challenges consumers are facing, this data-driven analysis can help industry stakeholders gain a clearer understanding of emerging global trends and opportunities.

Watch the recording of the launch of the SpendTrend24 report

At an exclusive launch event at Discovery's Head Office in Sandton, Lineshree Moodley, Country Manager for Visa South Africa, and Hylton Kallner, Chief Executive Officer of Discovery Bank, unpacked the new report's research and findings.

Together, they delved into South Africa's comparative rate of economic adaptability and resilience, as well as shifts in consumer behaviour that can help shape business strategy for growth in the future.

Download the full SpendTrend24 report now

More about SpendTrend24 report - the most comprehensive report of its kind

What is SpendTrend24?

SpendTrend24 is a unique collaboration between Visa and Discovery Bank, offering an in-depth look into credit card spend behaviour. Combining Visa and Discovery's extensive datasets and world-class analytical capabilities, we wanted to identify and understand changes in consumer spending patterns in 2023 compared to 2022 and pre-pandemic 2019, for Discovery Bank clients, the broader South African population, and select global cities.

Our goal with SpendTrend24 is simple: to provide practical insights into evolving consumer behaviour, both locally and globally.

We analysed spend data across 14 cities worldwide

We analysed spending data from 14 cities around the world, including three South African cities, five emerging market cities, and six developed market cities. These cities were chosen based on economic and market data to provide relevant comparisons. The Visa dataset analysed included over 60 million credit cards, covering in excess of 13 billion transactions between 2019 and 2023. The selected international cities have a combined population of over 100 million people and a GDP of nearly USD 4 trillion.

What did SpendTrend24 find?

- Global consumer spending and saving habits are evolving, focusing on budgeting, value and trade-offs amid interest rates that are higher than before the pandemic.

- Despite a challenging macro-economic environment, South Africa has proven to be highly resilient compared to global peers based on spend data.

- Groceries, retail, travel and fuel make up nearly two-thirds of South African spend.

- Variances exist in share of category spend across markets and segments.

- The benefits and increased security of digital payment options are driving rapid adoption globally, with consumers in global cities increasing their use of digital wallets and online purchases.

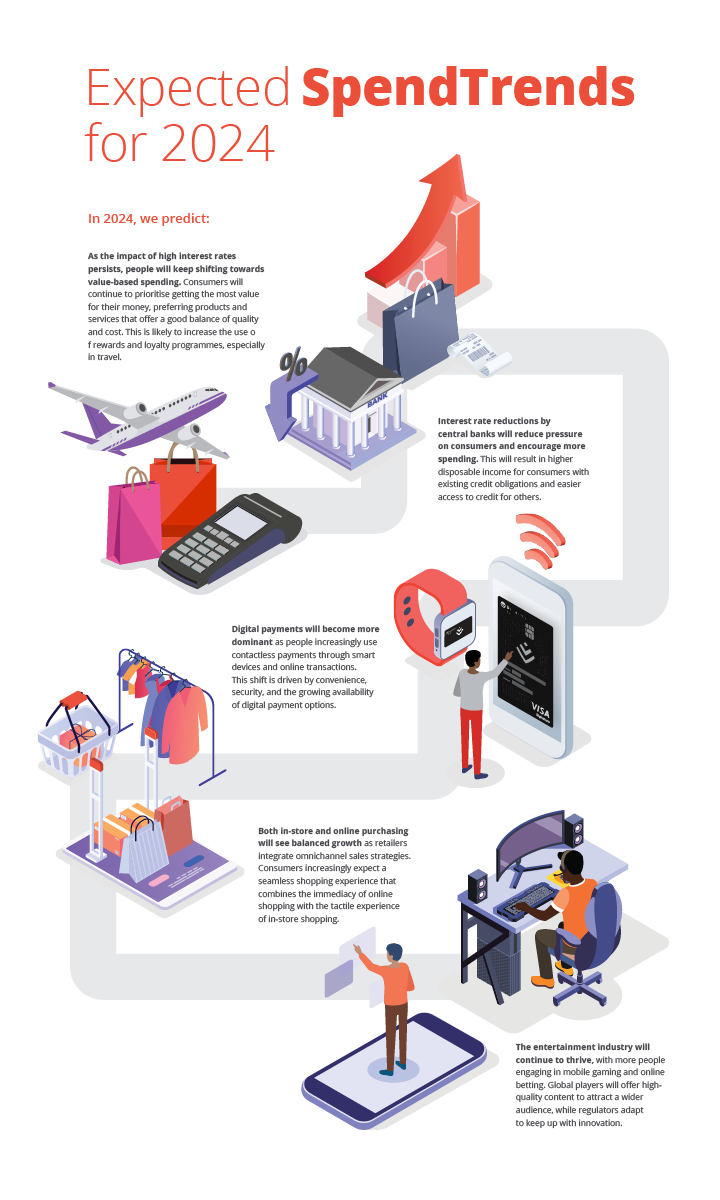

Expected SpendTrends for 2024

Based on the extensive research, Discovery Bank is predicting the following trends to continue or change in 2024:

Want to read all the findings, insights, and expert predictions for 2024 from Visa and Discovery Bank?

NOTICE OF CONFIDENTIALITY AND DISCLAIMER

VISA DISCLAIMER

Case studies, statistics, research and recommendations are provided "AS IS" and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. When implementing any new strategy or practice, you should consult with your legal counsel to determine what laws and regulations may apply to your specific circumstances.

The actual costs, savings and benefits of any recommendations or programs may vary based upon your specific business needs and program requirements. By their nature, recommendations are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Assumptions were made by us in light of our experience and our perceptions of historical trends, current conditions and expected future developments and other

factors that we believe are appropriate under the circumstance. Recommendations are subject to risks and uncertainties, which may cause actual and future results and trends to differ materially from the assumptions or recommendations. Visa is not responsible for your use of the information contained herein (including errors, omissions, inaccuracy or non-timeliness of any kind) or any assumptions or conclusions you might

draw from its use. Visa makes no warranty, express or implied, and explicitly disclaims the warranties of merchantability and fitness for a particular purpose, any warranty of non-infringement of any third party's intellectual property rights, any warranty that the information will meet the requirements of a client, or any warranty that the information is updated and will be error free. To the extent permitted by applicable law, Visa shall not be liable to a client or any third party for any damages under any theory of law, including, without limitation, any special, consequential, incidental or punitive damages, nor any damages for loss of business profits, business interruption, loss of business information, or other monetary loss, even if advised of the possibility of such damages.

Visa does not accept any responsibility or liability (whether arising due to breach of contract, negligence or any other reason) for any incomplete or inaccurate information; or for any loss which may arise from reliance on, or use of, information contained in this document. All brand names and logos are the property of their respective owners and are used for identification purposes only.

DISCOVERY DISCLAIMER

All the data used in the analysis for this report has been anonymised to protect personal and other client information and privacy. Discovery Bank is not legally responsible for any misrepresentations in the document, with all comparison product and interest information sourced from the respective institutions' websites and available marketing material. Discovery Bank Limited, Registration number 2015/408745/06, an authorised financial services and registered credit provider.

FSP number 48657. NCR registration number NCRCP9997. Limits, terms, and conditions apply.