The basics of investing are easy - perhaps easier than you might think. In recent months, we’ve covered a broad range of investment topics, such as Timing the market and Understanding your financial personality. But, while much groundwork and theory has been dealt with, there are some seemingly simple questions that you still may be too embarrassed to ask your friends around the braai.

Is there a minimum amount I need to invest?

This is one of the most common questions any investor starting out will have. In theory, you could buy a single share in any company listed on the JSE for whatever that share is trading at (it could be less than R1) – although brokerage and trading fees will be punitive on a transaction like this because they’re geared towards significantly larger purchases. In terms of investment products bought throughan investment institution, the costs of these will vary, but the minimum investment amount is generally R500.

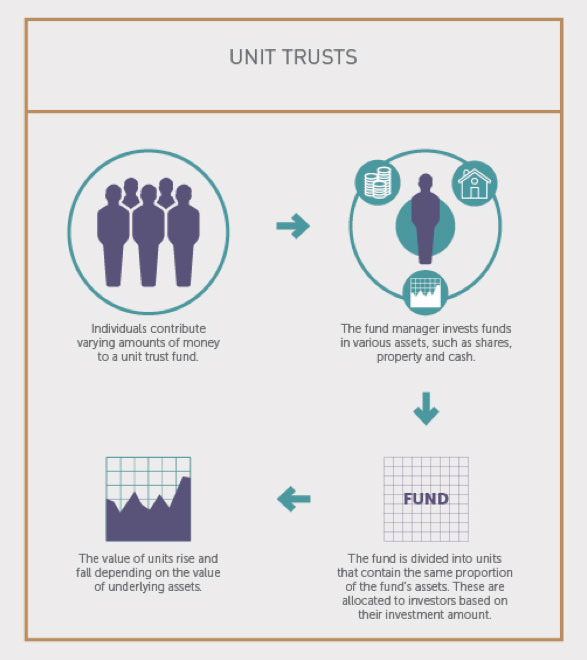

What is a unit trust?

A unit trust is a group investment run by a fund manager, who invests the money in various asset classes, such as shares or property. Individuals investing in the unit trust are given exposure to these assets, without them needing to pick and/or buy these assets themselves. The unit trust fund is divided into equal units, each containing the same proportion of the fund’s assets (for example, if the fund is 20% invested in Anglo American, 20% of each of your units will offer exposure to Anglo), and individuals are granted units based on the amount of money they invest. Unit trust prices can go up and down, depending on the value of the underlying assets.

Can I cash in my investments whenever I want?

There isn’t a definitive answer to this questions, because it depends on the investment. For example, with most retirement annuities you are only able to access your money at age 55, while endowment policies are designed to pay out after a specific number of years. You might be able to access your money under very limited circumstances (for example, health issues that prevent you from working), but early withdrawals often come with penalties. Unit trusts are much more flexible when it comes to withdrawals, although access to your money can depend on how you’ve invested in a unit trust.

What is a dividend?

“A dividend is a share of company profits,” says Simon Brown of investment educator JustOneLap. Companies aim to make a profit, and they will usethe profit in various ways, such as reinvesting in the business or entering new markets. However, a company may also decide to allocate a portion of net profits to shareholders – and this is called a dividend. Not every company will pay dividends, and those that do will pay according to their own payout schedule. Dividends are usually paid in cash, but can also sometimes be issued as shares.

How are shares and bonds different?

With shares, investors are buying a share in a company. Bonds, on the other hand, are a debt investment. Investors buying bonds will be lending a company or a government money for a fixed time period, and will be paid a fixed amount of interest in return. For example, investors are able to buy RSA retail savings bonds issued by the South African government. The money the government raises from the sale of these bonds is used for infrastructure projects.

Do I need a financial adviser?

“The right financial adviser can add value,” says Brown, “and there is certainly merit in finding an independent financial adviser.” Most people don’t know what to ask and there is an element of discovery, learning and homework that they need to take responsibility for themselves. And while most people would be okay to manage a few unit trust or exchange-traded fund investments, having the discipline to do so, keeping track of a portfolio and adjusting accordingly can be more challenging. Telling you not to panic in 2008 (when there was a notable stock market crash) would probably be the best illustration of the value of an adviser. “The right professional advice is always a good thing, and you should be happy to pay for this,” says Brown. Insist on openness and full disclosure.