Let your healthy behaviour get you premium discounts and cash back when you join Discovery Life!

Welcome to the Future of Life Insurance rewards.

Fill in a few details to get a quote in 60 seconds and get your policy activated in less than 30 minutes* today. You can also call us on 0860 000 628 or speak to your financial adviser.

Terms and conditions apply.

Experience the next generation of life insurance rewards now

Reimagine the way you see life insurance. The Discovery Life Plan has been designed to bring you shared value for managing your health and wellness through engagement with Vitality and making your everyday financial behaviour count. This is in addition to comprehensive cover for you and your family.

You can get:

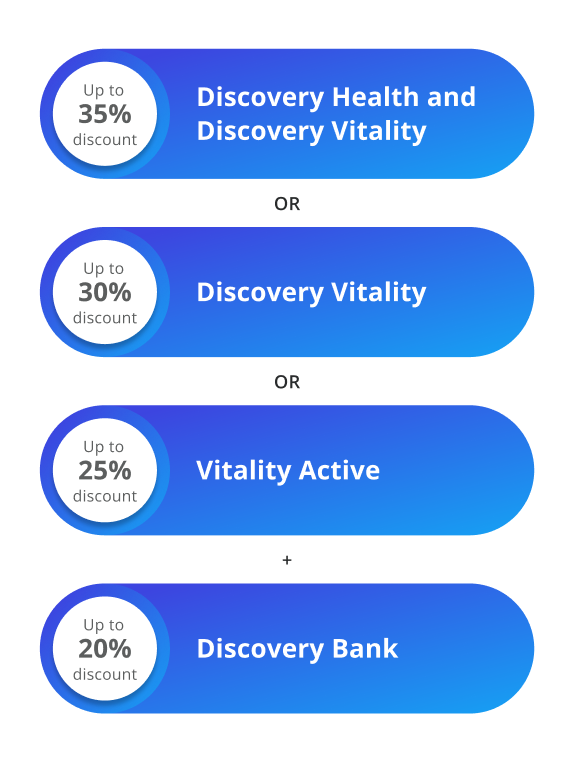

Upfront and ongoing premium discounts of up to 48% by linking your Discovery Life insurance policy with other Discovery products.

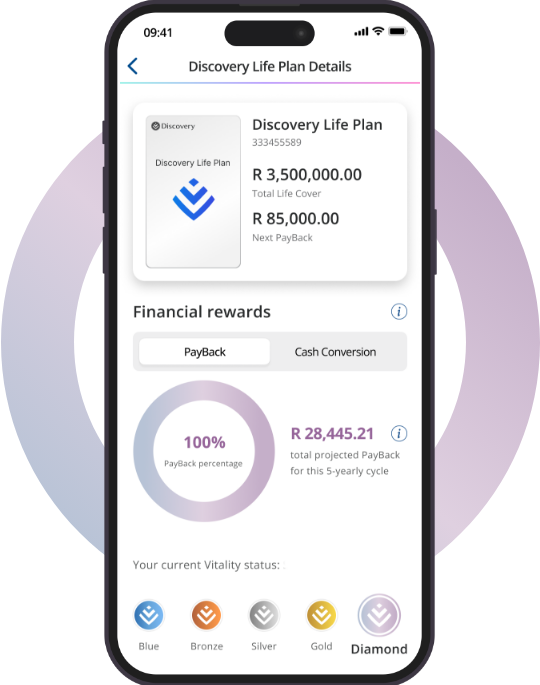

Up to 100% of your life insurance premiums back in cash for living healthier.

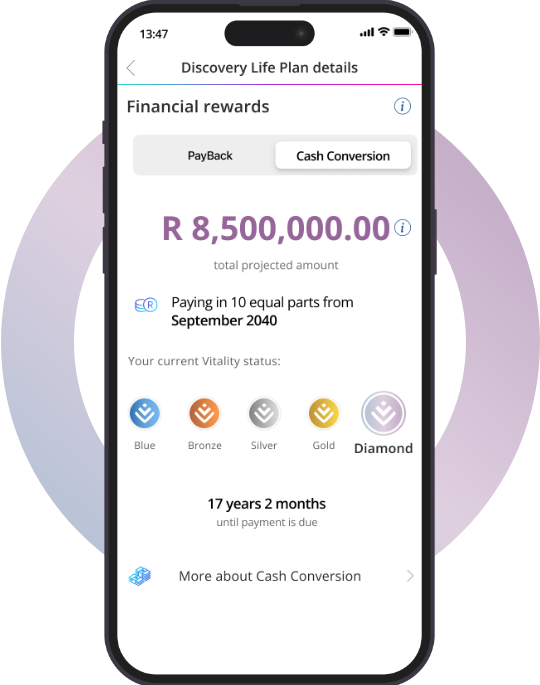

Additional retirement funding with up to 100% of the value of your Life Fund paid out in 10 yearly payments from age 65** with the Cash Conversion Benefit, which is available for an additional premium.

Upfront and ongoing premium discounts of up to 48%

Unlock upfront premium discounts of up to 48% that can be maintained throughout your policy by integrating (linking) your Discovery Life insurance policy to your other Discovery products. Qualifying products include Vitality, a qualifying medical aid administered by Discovery Health or a qualifying Discovery Bank account.

Supplement your retirement funding with the Cash Conversion Benefit**

The Cash Conversion Benefit, which is available for an additional premium, pays out up to 100% of the value of your Life Fund, without reducing your cover. The payments are made in 10 equal yearly installments from age 65. You can grow the value of these payments by managing your health and wellness before retirement to supplement your funding in retirement.

Maximising and tracking your financial rewards

To maximise your financial rewards, integrate (link) your current Discovery products and manage your health and financial wellness.

Download the Discovery app to see how many more rewards you can earn and start watching your everyday healthy actions turn into financial rewards!

* Eligible lives underwritten in 30 minutes.

** The Cash Conversion benefit, available for an additional premium, is a risk benefit, not an investment product. Therefore, this benefit does not have any lapse or surrender value before the payouts become due. This means we will not owe you any money or benefits if you cancel your policy before your payout is due.

Discovery Life Limited, registration number 1966/003901/06, is a licensed life insurer, and an authorised financial services and registered credit provider, NCR registration number NCRCP3555. Product rules, terms and conditions apply.