Investing during a recession

When markets are volatile, as they currently are, investors often react emotionally by making changes to their investment portfolio. These changes include withdrawing from investments entirely, switching from one fund to another, or changing asset classes.

Between the start of the year and the end of August 2018, the JSE All Share Index gained 0.3%. Over the same period, the All Bond Index returned 4.5%, SA Cash gained 4.8% and listed property fell by a whopping 20.1%1. Early in September, data released by Stats SA showed that the country has slipped into a technical recession.

A recession occurs when there are two or more quarters of declining growth. The economy shrank by 0.7% in the second quarter of 2018, following a contraction of 2.6% in the first quarter of the year. This investment climate may have raised some concerns for investors.

That's why Discovery Invest has launched a campaign designed to help navigate the investment journey during a technical recession. Our series of articles will cover the following topics:

- Investing trends during a recession

- Three things history teaches us about investing

- The impact of global markets on South African investments

- Behavioural finance – what happens when you react to short-term market news?

- What affects investment returns?

When markets are volatile, investors should avoid knee-jerk reactions

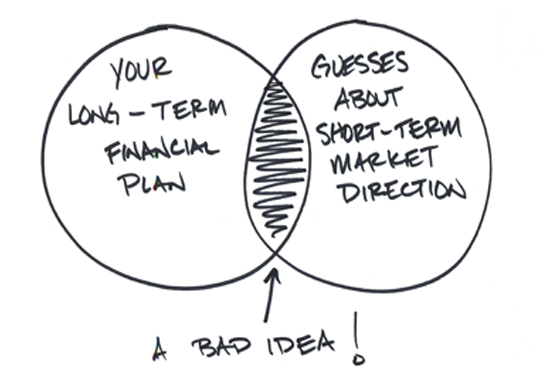

Investments are often intended to be long-term instruments – starting from five years and going up to as much as 40 or 50 years in timelines. It doesn't make sense to plan for these events so far in the future and then to reassess the investment strategy every month. The illustration below from New York Times columnist and Certified Financial Planner, Carl Richards of TheBehaviorGap.com, is a reminder that it is a bad idea to react to short-term market movements.

"That's like planting an oak tree and digging it up every month to see if the roots are growing," according to Richards. (Oak trees take 20 years to reach maturity and can "live" for more than 100 years.)

In a similar way, it's a terrible idea to have a long-term investment plan that is designed to achieve a specific goal and then to try to adjust that long-term strategy by making short-term guesses about which way the market is moving right now. This illustration speaks to the point that as an investor, the best thing you can do is simply leave your investment alone, and remember that the small paper losses in the short term will be outweighed by the overall growth of the portfolio in the long term. Basically, sticking to a long-term investment strategy pays off in the end.

Why Discovery Invest should be your partner of choice

Despite the current difficult economic environment:

- The Discovery Balanced Fund had a return of 9.07% for the year to end August 2018 against a benchmark return of 3.80%2

- The Discovery Diversified Income Fund had a return of 8.47% for the year to end August 2018 against a benchmark return of 7.29%2

- Our flagship fund, the Discovery Balanced Fund, was the 7th biggest flow taker in the industry, with net flows of R989 million for the second quarter of 2018, making it the 12th biggest retail fund out of more than 1 000 funds in the country (excluding money market funds), as per ASISA (www.asisa.co.za)3

- The Plexcrown Survey for quarter two 2018 shows Discovery Invest retaining a place among the top five asset managers in the country4.

These accomplishments should reassure clients that their investments are in the right place and there is no need to venture off track by reacting to short-term market movements or downward cycles.

- 1Returns sourced from Bloomberg for period from 1 January 2018 to end August 2018.

- 2Returns from Profile Data to the end of August 2018

- 3https://www.asisa.org.za/media-release/local-cis-industry-grows-investor-assets-to-r2-3-trillion/

- 4Plexcrown Survey for quarter two 2018: http://www.plexcrown.co.za

- www.TheBehaviorGap.com and Skype interview with Carl Richards

Disclaimer

Nothing contained herein should be construed as financial advice and is meant for information purposes only. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider.

What to know before investing in collective investment schemes (unit trusts)

Before you invest in a collective investment scheme, there is important information you should know. This includes how we calculate the value of your investment, what affects the value of your investment, and investment charges you may have to pay. This notice sets out the information in detail. Speak to your financial adviser if you have any questions about this information or about your investment.

What the investment is

This Fund is a Collective Investment Scheme (also known as a unit trust fund) regulated by the Collective Investment Schemes Control Act, 45 of 2002 (CISCA). Collective investment schemes in securities are generally medium- to long-term investments (around three to five years).

Who manages the investment?

Discovery Life Collective Investments (Pty) Ltd, branded as Discovery Invest, is the manager of the Fund. Discovery Invest is a member of the Association of Savings and Investment South Africa (ASISA).

You decide about the suitability of this investment for your needs

By investing in this Fund, you confirm that:

- We did not provide you with any financial and investment advice about this investment

- You have taken particular care to consider whether this investment is suitable for your own needs, personal investment objectives and financial situation.

You understand that your investment may go up or down

1. The value of units (known as participatory interests) may go down as well as up.

2. Past performance is not necessarily an indication of future performance.

3. Exchange rates may fluctuate, causing the value of investments with international exposure to go up or down.

4. The capital value and investment returns of your portfolio may go up or down. We do not provide any guarantees about the capital or the returns of a portfolio.

How we calculate the unit prices and value the portfolios

1. We calculate unit trust prices on a net-asset value basis. (The net asset value is defined as the total market value of all assets in the unit portfolio, including any income accrued and less any allowable deductions from the portfolio, divided by the number of units in issue.)

2. The securities in collective investment schemes are traded at ruling prices using forward pricing. (Forward pricing means pricing all buy and sell orders of units according to the next net-asset value).

3. We value all portfolios every business day at 16:00, except on the last business day of the month when we value the portfolios at 17:00.

4. For the money market portfolio, the price of each unit is aimed at a constant value. This means that all returns are provided in the form of a distribution and that a change in the capital value will be an exception and only due to abnormal losses.

5. Buy and sell orders will receive the same price for that day if we receive them before 11:00 for the money market portfolio and before 14:00for the other portfolios.

6. We publish fund prices every business day, with a three-day lag, on www.discovery.co.za

About managing the portfolio

1. The portfolio manager may borrow up to 10% of the portfolio's market value from any appropriate financial institution in order to bridge insufficient liquidity.

2. The portfolio manager can borrow and lend scrip.

3. The portfolio may be closed in order to be managed according to the mandate (if applicable).

Fees and charges for this investment

There are fees and other charges for this investment.

The fees and charges that apply to this investment are included in the net asset value of the units and you do not have to pay any extra amounts. These fees and charges may include:

- The initial fund management fee

- Commission

- Incentives (if applicable)

- Brokerage fees

- Market securities tax

- Auditor fees

- Bank charges

- Trustee fees

- Custodian fees

You can ask us for a schedule of fees, charges and maximum commissions.

The total expense ratio

- "Total Expense Ratio" means a measure of a portfolio's assets that have been expended as payment for services rendered in the management of the portfolio or collective investment scheme, expressed as a percentage of the average daily value of the portfolio or collective investment scheme calculated over a period of a financial year by the manager of the portfolio or collective investment scheme.

- A percentage of the net asset value of the portfolio is for fees and other charges relating to managing the portfolio. The percentage is referred to as the total expense ratio (TER).

- A higher TER does not necessarily imply poor return, nor does a low TER imply good return.

- The current TER is not an indication of any future TERs. If fees go up, the TER is also expected to increase.

- During any phase-in period, the TERs do not include information gathered over a full year.

Transaction costs (TC)

1. Investors and advisers can use transaction cost (TC) as a measure to work out the costs they will incur in buying and selling the underlying assets of a portfolio.

2. The transaction cost is expressed as a percentage of the daily net asset value of the portfolio calculated over three years on an annualised basis. (This means the amount of interest an investment earns each year on average over three years, expressed as a percentage.)

3. Transaction cost is a necessary costs in administering the Fund. It affects the Fund's returns. It should not be considered in isolation as returns may also be affected by many other factors over time, including:

- Market returns

- The type of fund

- The investment decisions of the investment manager

- The TER.

4. Where a fund is less than one year old, the TER and transaction cost cannot be calculated accurately. This is because:

- The life span of the fund is short

- Calculations are based on actual data where possible and best estimates where actual data is not available.

5. The TER and the TC shown on the fund sheet are the latest available figures.