Fund spotlight: Discovery Global Value Equity Feeder Fund

Value as an investment style has a compelling long-term track record. The Discovery Global Value Equity Feeder Fund has returned 17.59% per annum since inception four years ago.

Discovery Global Value Equity Feeder Fund

|

Fund strategy |

This fund is a collective investment scheme that aims to achieve long-term capital growth by investing in shares of companies around the world. It follows a contrarian value investment approach by investing in stocks that have typically fallen in value by 50% or more and that are out of favour with the market, but with strong fundamentals and solid future growth prospects. The fund is downside aware, its investment into high-calibre out-of-favour companies is always with a margin of safety. |

||||

|

Fund manager |

Alessandro Dicorrado and Steve Woolley, Investec Asset Management, London |

||||

|

Track record |

Launched 20 February 2013 |

||||

|

Who should invest |

Long-term investors seeking exposure to international markets. |

||||

|

Risk profile |

High, 100% offshore exposure with typically between 30 and 35 stocks globally |

||||

|

Benchmark |

MSCI All Country World Index in rands |

||||

|

Sector |

Asisa Global Equity General |

||||

|

Historical performance to end of May 2017 |

Fund |

Peer group average |

Quartile ranking |

||

|

1 Year |

1.74% |

- 3.77% |

1 |

||

|

3 Years |

13.35% |

11.74% |

1 |

||

|

Annualised since inception (21 February 2013 to 31 May 2017) |

17.59% |

10.04% |

2 |

||

Performance figures as at 31 May 2017. Data is sourced from Profile Data, Morningstar and Investec Asset Management. Figures are shown net of fund management fees and are annualised.

Why invest in value equities now?

Value as an investment style has a compelling long-term track record. According to the fund manager, now could be a great time to invest in value equities. Value has undergone an unusually long period of underperformance both in South Africa and globally. Historical evidence shows that the average value rally has lasted for 27 months and sees 27% outperformance*. The current global value rotation has lasted just six months with an 8% outperformance.

* Source: MSCI, Morgan Stanley Research January 2017.

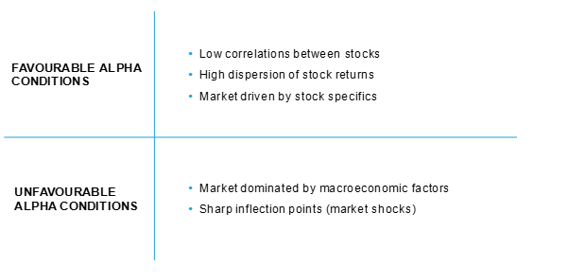

The most favourable conditions for the Discovery Global Value Equity Feeder Fund

Due to the focus on value as an investment style, the Discovery Global Value Equity Feeder Fund could experience periods of relative underperformance when markets are driven by positive price momentum in specific sectors.

Historically, we know that the market reverts. These periods of dislocation are as a result of sentiment-driven market exuberance and typically do not last. Over time, strong returns are generated by investing in undervalued companies that have lagged.

Interview with portfolio manager Alessandro Dicorrado

Alessandro talks about what has added to performance in the fund, what has detracted from performance and how the fund is positioned for opportunities going forward.

What has done well this year for the fund?

Alessandro Dicorrado: This year we’ve had a continuation of the rally in what we like to call high-quality industrial names, which are machinery manufacturers and market leaders in their segment, something like Deer, Rolls Royce, and a Japanese ball bearings manufacturer called THK. Those have all done very well. The other thing that has done very well for us is the UK stocks that we’ve bought post-Brexit. After Brexit was voted in June 2016 we bought a host of domestic UK stocks, which fell 30% to 40% on the day. Those have continued to recover very well. Our single biggest contributor to performance this year is a UK builder’s merchants that we bought after Brexit.

What challenges has the fund faced? What sort of impact have the challenges had on the fund?

Alessandro Dicorrado: We have certainly faced many challenges this year. One is thematic and one is more idiosyncratic to specific stocks. The thematic challenges are that we’ve seen a reversal in the value rally that we witnessed last year. The fund has actually done quite well in the sense that we sold a lot of the stocks after they did well last year. We basically have no exposure to energy and mining but still have big exposure to financials, which has dragged our performance a little bit.

The detractors from performance have been our bank holdings: Bank of America, Citygroup, Washington Federal.

Another problem we had is the idiosyncratic one that I was mentioning. The fund has underperformed by almost three percentage points. Two percentage points of that is due to one stock which is Cignet Jewellers. It’s a jewellery distributor and retailer in the West, and it’s by far the market leader. It’s a very good company but it has what we consider to be temporal issues and that has detracted two percentage points from the fund.

Since the end of May, it’s actually bounced back quite nicely so the fund’s performance to the end of May relates to the absolute low of the stock. It’s up about 30% since then so it has started to recover.

We think we’re going to make quite a lot of money from this stock but in the short term there’s always a bit of pain to be taken.

Where there are challenges there are opportunities. What opportunities have you identified going forward?

Alessandro Dicorrado: We continue to see financials, especially UK and US financials, as undervalued compared to the rest of the market.

We are also starting to see quite a lot of emerging market stocks that present quite good value, such as some Latin American utilities. We see some UK-focused stocks that continue to look cheap because of political uncertainty as good opportunities.

The US is an expensive market but we continue to find pockets of value. This jewellery retailer I was mentioning before is a good opportunity, we’re also buying some post-bankruptcy names in the US, which tend to be overlooked by investors until attention starts to go back to them. We have had to look quite hard but we continue to find those opportunities.

Finally and briefly, what potential risks are there that could impact the fund as you see them?

Alessandro Dicorrado: The biggest risk is a continuation of what has been the present theme of the last eight or nine years, which is extremely low interest rates, extremely flat yield curves, and deflation. Any return to that scenario would be negative for the fund.

We don’t think it will be a disaster but I think it will probably lead to some underperformance because everything that looks like a bond, such as consumer staples or a bond on proxy stocks would do very well and financials would get hit.

Generally, it looks like that is a narrative of the past now but if it did return that could be a risk for the fund.

Nothing contained in this article should be construed as financial advice and is meant for information purposes only.