How much should I save now to have enough when I retire?

Knowing your retirement savings goal is the first step to ensuring you'll have enough savings to last for your lifetime once you retire. Here are some tips on how to calculate how much you'll need, and how to catch up if you're behind.

One of the first steps to take when planning for retirement is getting a realistic idea of how much you'll need in total. This amount differs for each person. If you base it on maintaining your current standard of living, you can calculate it as a percentage of your current annual income.

Estimate a target goal

Many financial planners use a replacement ratio of 75% of your current salary. To set a target goal for this replacement ratio, a good estimate is to multiply your monthly salary by 200. The total you get is the amount you'd need if you retired today at a 75% replacement ratio. For example, say you currently earn R40,000 a month, which covers your living costs with some to spare.

R40,000 x 200 = R8,000,000. So R8 million is around the total amount you'll need saved at retirement in today's terms.

The replacement ratio of 75% is just a rule of thumb based on the assumption that you won't have a home loan or any other large debt by retirement age, so your monthly expenses should be lower. That said, people are living for longer and medical expenses tend to rise after retirement, so speak to a financial adviser about what replacement ratio is realistic for you to work towards.

Know how much you need to retire

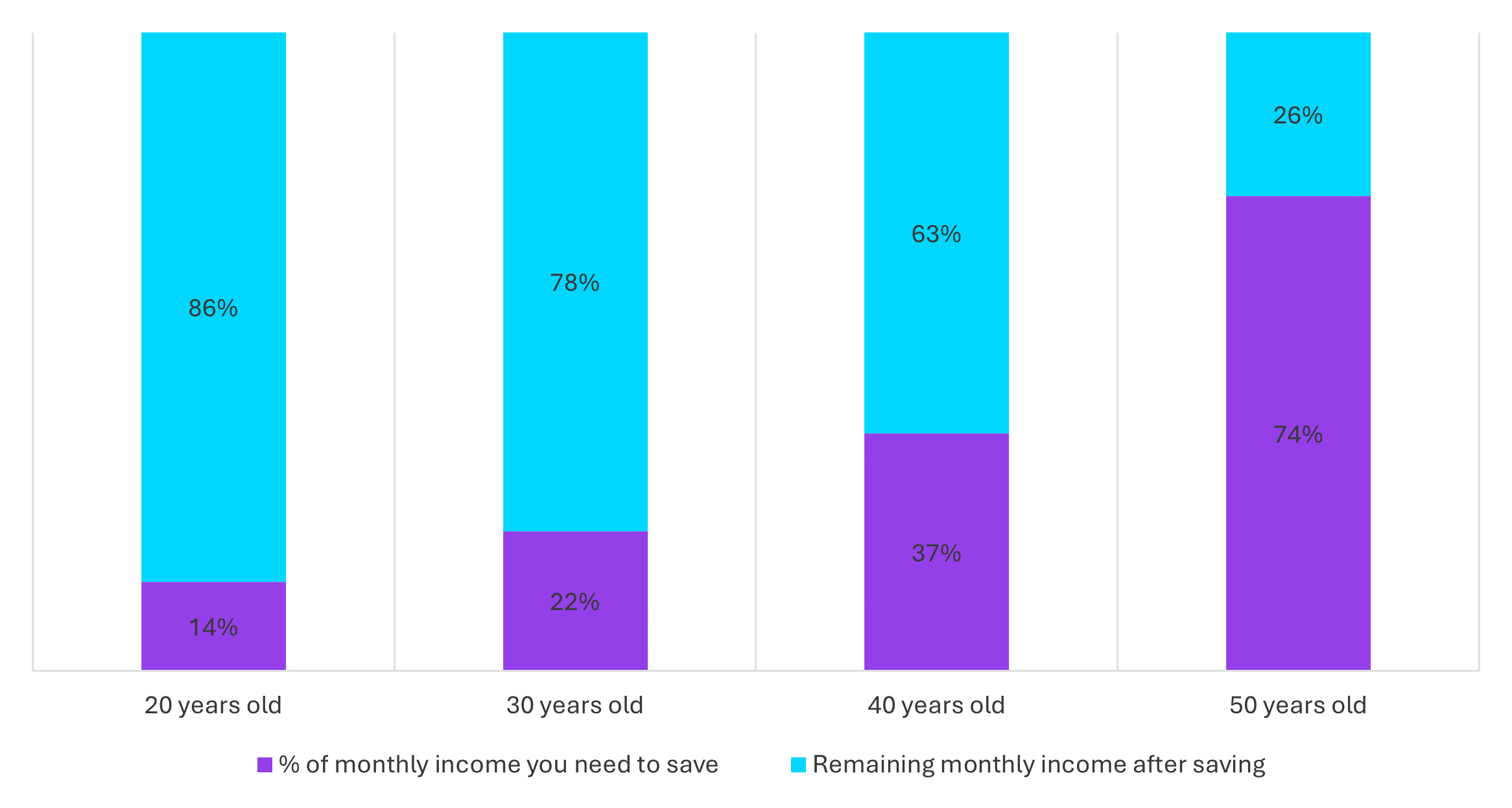

You can also use the graph below to calculate how much you need to put towards retirement savings, based on when you start contributing*.

*Assuming you require a 75% replacement ratio.

The graph above shows that the earlier you start, the less you'll need to save each month and in total to be financially independent and afford a comfortable retirement. The later you start, the more you'll need to save to achieve the same target goal.

Make the most of your time

Most of us only start saving at age 28, if not later, instead of when we start working. But it's not just about catching up on the savings you've missed out on over the past couple years, it's also about making up for the compounded returns.

When you save, you earn interest on the savings you put in, plus interest on that growing amount of interest. In other words, your money can grow exponentially - if you leave it alone to accumulate for as long a period as possible.

Compounding is the simplest way to create wealth because money you have already saved keeps earning you more money. And the longer you wait to start saving, the more capital you will need to achieve the same goal. But don't let this discourage you - whatever stage you're at, the most important thing is to just start!

Practice healthy money habits to achieve your savings goal

In summary, there are three basic steps to achieve your retirement savings goal:

- Start as early as possible. This lets you benefit from compound growth, so you can save a lower percentage of your salary over your lifetime and still achieve your retirement goal.

- Contribute consistently over time. Discipline in saving can make or break your financial success.

- Always preserve your retirement savings if you change jobs.

For ideas on how to bump up your retirement savings to where they need to be, check out these tips to boost your savings.

This document is meant only as information and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06, a licensed life insurer, an authorised financial services provider and registered credit provider, NCR registration number NCRCP3555. All boosts are offered through the insurer, Discovery Life Limited. The insurer reserves the right to review and change the qualifying requirements for boosts at any time. Product rules, terms and conditions apply.

Secure your financial future through our wide range of investments

We know that not everyone is at the same stage in their lives and everyone has their own reasons for investing. That's why we have designed products to meet your needs, whatever stage you're at. So, tell us about yourself so you can consider investments that are relevant to you.