The art of investing

When dealing with clients, there are common key concepts that you often have to communicate as a financial adviser. Internationally renowned Certified Financial Planner and illustrator, Carl Richards, who has been featured on the Oprah Winfrey Show and is a regular contributor to the New York Times, uses simple illustrations to help you unpack these ideas in a way that your client can quickly understand.

In this article, we present you with five of Carl’s illustrations that you can use to take your clients through the complexities of the investment process in the simplest way.

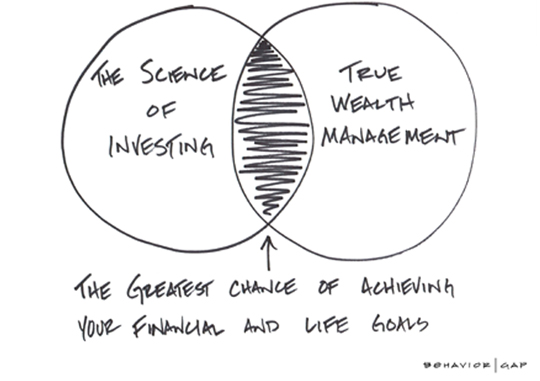

1. The science of investing

This drawing ties into the value of a financial adviser. One of the big mistakes that many investors make is thinking about investing in isolation. What’s worse, when they do think about investing, it is often based on what they hear from their friends or what they read in the media. However, Richards points out that there is actually a science to investing and a proper way to go about the investment process. “Investing done properly can look very different and have very different outcomes compared to investing based on hearsay and uninformed decisions,” he cautions. True wealth management refers to the simple exercise of ensuring that you don’t live beyond your means.

This is where a financial adviser can play a key role in terms of assisting their clients with a budget and guidelines in terms of managing that budget. It’s easy enough for any client to draw up a budget based on their income and expenses – the trick is sticking to the budget when temptation knocks. Or when the client is faced with an expense they failed to budget for, such as a car accident. When a client works with a financial adviser to mix the science of investing and true wealth management – looking at everything holistically as part of a financial plan – that’s where the adviser is able to help the client realise their financial goals as well as their life goals.

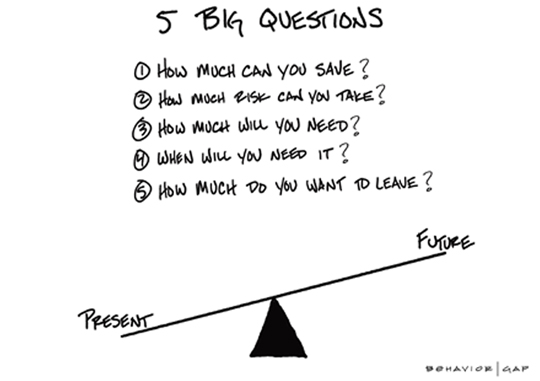

2. Five big questions

When investors focus on financial goals, they are often too focused on one thing – the rate of return. But there are other questions that can help an investor balance the present and the future. These five starting questions are the baseline for you as an adviser to help your client build the best investment portfolio for them, based on their individual profile and their needs.

How much can you save? This is your starting point because sometimes clients are hesitant to enter the investment market simply because they believe that they must have a massive lump sum to start with. As their financial adviser, you play a role in coaching them on how to start saving so that they can work up to investing.

How much risk? This question ties into the return required on the investment. There is no return without risk – the general rule is that the higher the return, the higher the risk and the client may not have the risk appetite for a particular product.

The next three questions help balance the risk profile of the client and allow you to determine their financial goals in respect of this particular investment.

How much will you need? This gives you and the client an end goal to work towards.

When will you need it? This determines the timeline of the investment.

What do you want to leave? This is the final question and talks to the financial legacy the client wants to leave behind when they die.

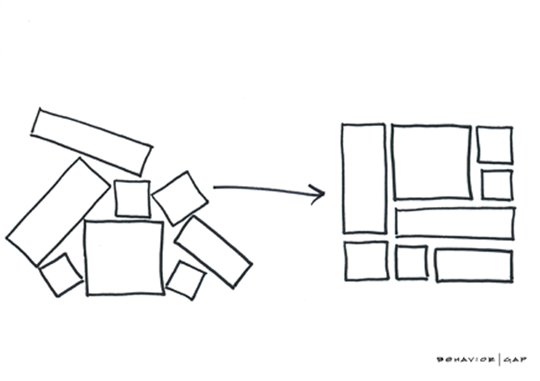

3. Portfolio design

Very few clients start out with a perfect financial plan. More often than not, they start earning money and debt piles up as they take on mortgages, buy cars and build their families. Somewhere along the way, they may consult a financial adviser and start saving towards their retirement. However, this is often compulsory saving and not voluntary investing. The end result is that the investor thinks of each investment or savings goal individually and this can sometimes look like a smorgasbord, buffet or a mismatched collection – a random pile. When investing is done properly, the financial adviser helps the investor carefully consider each investment on its own merits and how it interacts with the whole portfolio or the contribution it makes to the whole. So the client’s investment portfolio is designed in a purposeful manner as opposed to a random collection of investments.

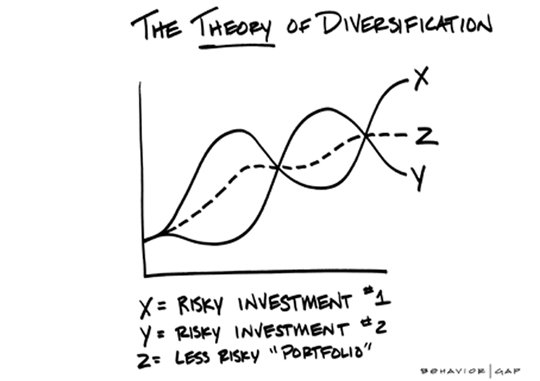

4. Theory of diversification

“Diversification is magic,” Richards says. He says that you can take two investments that have different characteristics and by blending them together, the combination of the two makes your portfolio less risky. The idea is that when one investment is performing poorly, the other one may be performing well so the overall investment experience becomes a smoother ride.

“By choosing to blend different, complementary investments, the investor spreads out their risk and creates opportunities for different parts of our portfolios to zig when others zag,” Richards explains.

He notes that it can become really easy to focus on the investments that are doing well and compare them with the ones that aren’t doing equally well, but argues that it is this comparison that makes diversification so useful to the average investor. “We have no way of predicting the winners and the losers. Diversification helps us cover a range of possibilities,” he says.

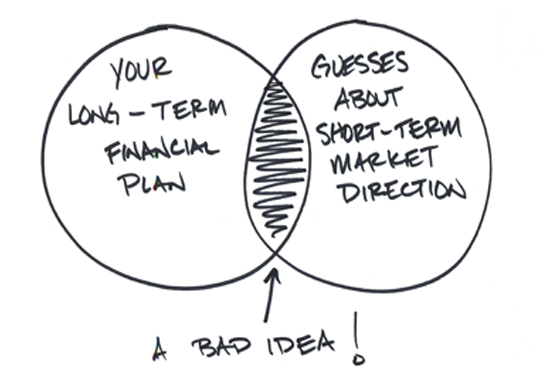

5. Plans and guesses

Finally, investments are often intended to be long-term instruments – starting from five years and going up to as much as 40 or 50 years in timelines. It doesn’t make sense to be planning for these events so far in the future and then to reassess an investment strategy every month. “That’s like planting an oak tree and digging it up every month to see if the roots are growing,” Richards laughs. (Oak trees take 20 years to reach maturity and can “live” for more than 100 years). In a similar way, it’s a terrible idea to have a long-term investment plan that is designed to achieve a specific goal and then to try to adjust that long-term strategy by making short-term guesses about which way the market is moving right now. This illustration speaks to the point that investors need to be educated to simply leave their investment alone, and resign themselves to the fact that the small “paper losses” in the short-term will be outweighed by the overall growth of the portfolio in the long-term. Basically, sticking to a long-term investment strategy pays off in the end, if left alone.

Sources

www.behaviourgap.com and a skype interview with Carl Richards.

Disclaimer

This article is meant only as information and should not be taken as financial advice. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider.