No plastic, no problem: Virtual cards keep your money (and info) safe

According to SpendTrend25, virtual cards are fast becoming South Africa's preferred way to pay, thanks to their unmatched convenience and security. Here's why switching to virtual makes sense - and how it could boost your Ðiscovery Miles.

45% of South Africans already use a virtual card, according to the latest SpendTrend25 insights from Discovery Bank and Visa - and that number's only going up. But here's the catch: some people aren't using them regularly, which means they're missing out on the full benefits of this innovative technology.

If you've got a virtual card sitting unused in your app, or you're not sure what all the fuss is about, this is for you! Let's break the topic down.

Virtual cards: What are they and why should you care?

A virtual card is a digital version of your physical bank card, stored securely in your banking app and ready to use immediately. It has:

- A unique 16-digit card number

- A CVV and expiry date

- All the benefits of a physical card - like travel insurance, purchase protection, extended warranties, and rewards

But here's the kicker: virtual cards are also:

- Safer - it removes the risk of physical card skimming.

- More convenient - you can now leave your wallet or purse at home and just transact online or in-store with your smart device.

- More flexible - you can pause, cancel, or reactivate your card instantly. Plus, virtual cards are replaced automatically when they expire - so there's even less admin and waiting periods for you!

- More rewarding - The maximum base Ðiscovery Miles earning rate is linked to the use of a virtual card for all of your day-to-day online and in-store spending. So, to earn the maximum potential base Ðiscovery Miles, simply pay with a virtual card instead of a physical card.

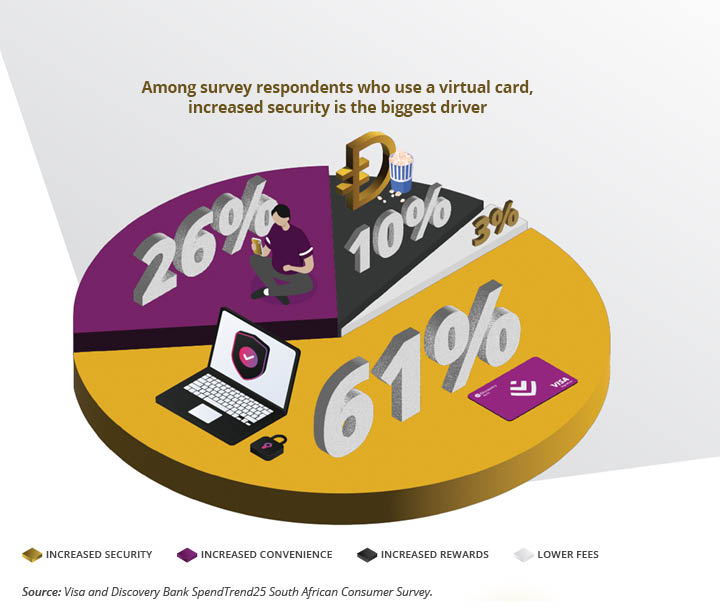

Why virtual cards are gaining ground in SA

More Ðiscovery Miles, less effort: Just go virtual

Want to earn the maximum Ðiscovery Miles on everyday spending? Here's how:

- Log in to your Discovery Bank app.

- Tap on the More menu.

- Select PayShap

- Follow the steps to register your ShapID.

To enable sending and receiving PayShap Requests:

- Use your virtual card: Earn up to 1 Ðiscovery Mile per R15 spent, depending on your Discovery Bank product and Vitality Money status.

- Use your physical card (even in a digital wallet): You'll earn just 1 Ðiscovery Mile per R200 spent.

If you're not already using your virtual card, you're essentially leaving money on the table!

Double up your Ð: Add family virtual cards too

Good news - your secondary cardholders can generate and use their own virtual cards. Every tap they make adds to your shared Ðiscovery Miles total, helping your family earn rewards faster.

Virtual card ≠ digital wallet

It's worth repeating: Just adding your physical card to a digital wallet doesn't make it a virtual card.

To get all the security and Ðiscovery Mile benefits, your card must be generated in the Discovery Bank app. (It's the one that's white with "VIRTUAL" printed on the top right corner). Once created, link it to your preferred wallet - Apple Pay, Google Pay, Samsung Pay, Fitbit Pay, Garmin Pay, or SwatchPAY! - and you're good to go.

Have any of the below?

Your virtual card is free, instant to set up, and ready to go whenever you are. Scroll to the bottom of this article for step-by-step instructions on how to add yours to your favourite digital wallet.

The Future of Banking. Now.

*This article is meant only as information and should not be taken as financial advice. For tailored advice, please contact your financial adviser.

*Điscovery Miles do not constitute currency or any other medium of exchange in circulation in South Africa. Rewards are based on your engagement in Vitality programmes, Discovery products, and monthly qualifying card spend. Discovery Bank, Auth FSP. Limits, terms and conditions apply.

*Discovery Bank Ltd. Auth FSP 48657. Limits, Ts & Cs apply. Rewards based on your engagement in Vitality programmes, Discovery products, and monthly qualifying card spend. Credit initiation and service fees may apply. Subject to credit approval.