Discovery Bank announces crypto trading with Luno, new AI security and service features, motor insurance, and new rewards partners, including MultiChoice

We're building the bank of the future, and we're excited to share what you'll experience next. Everything we do has a purpose - to give you more value, to reward you for managing your money well, and to give you the safest and best banking experience in South Africa.

Bank like no other: Connect to sophisticated safety features and innovative products

We're redefining banking with the Discovery Bank app - an integrated banking platform that connects you to products, services, and rewards that protect your financial wellbeing in every way.

For an overview of what's new in the bank of the future, watch the recent Summer 2025 Product Update here.

Read more about these updates:

- Luno crypto trading, with real-time tracking and rewards.

- TRUST alert system for sophisticated banking safety.

- Activation of Discovery Insure car insurance in the banking app.

- DStv partnership with subscription savings, more Ðiscovery Miles partners, and special offers.

First of its kind in Africa: Integrated crypto trading with Luno

A fully digital bank, we offer you a comprehensive suite of products, including flexible savings options, home loans and personal loans, real-time Forex, and share trading.

Encouraging you to save for the long term and diversify portfolios, we will add crypto trading, formally regulated and adopted by over 560 million people globally, to our Discovery Invest and EasyEquities investment options from December 2025.

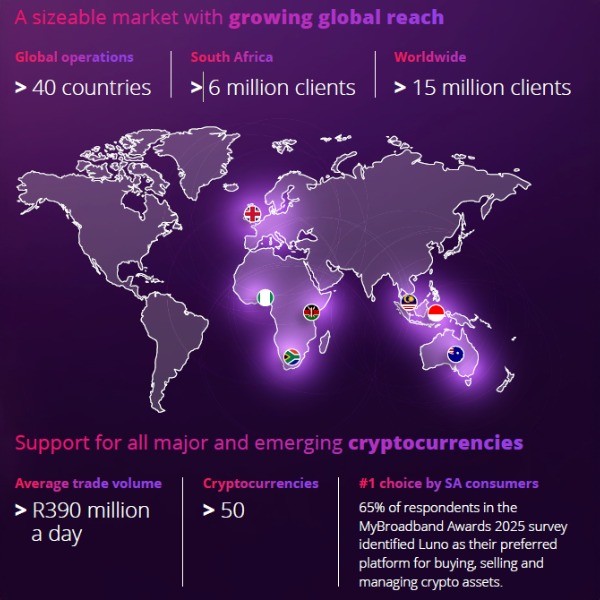

As a bank known for bringing you the future of banking now, we are thrilled to be the first mobile bank to partner with Luno , a leading crypto platform that is used by over 15 million clients. As we integrate platforms, you'll have the option to easily trade in cryptocurrencies through the Discovery Bank app. Your crypto balances and trades are available 24/7.

Plus, you'll be rewarded with Vitality Money Savings points for crypto balances in your secure Luno wallet.

Here's how it will work to trade in more than 50 cryptocurrencies:

- Register for a Luno account in the Luno app.

- Link your Luno account in the Discovery Bank app:

Go to: More > Add Account > Luno and log in with your Luno credentials. - Transfer funds from your Discovery Bank account to a linked Luno account in real time for free in the Discovery Bank app:

Go to: Transact > Transfer and select the relevant account.

About Luno

Luno brings secure, regulated access to the leading cryptocurrencies such as Bitcoin, Ether, Tether and more. With our new integration, Discovery Bank clients will enjoy the same robust safeguards to trade confidently that are already enjoyed by over 15 million Luno users worldwide.

James Lanigan, CEO of Luno, the largest cryptocurrency wallet and exchange operating in Africa, says, "We are extremely excited to partner with Discovery Bank. This is a first-of-its-kind solution in Africa to integrate digital asset investing directly into a major mobile banking platform, and this partnership is a clear signal that crypto has moved from a niche to a mainstream investment choice for those looking to diversify their investment portfolio with digital assets. We're excited to see more people start their digital-asset-investment journey through this partnership."

Visit the Luno website for fees and limits applied by Luno for trading and investing.

Pause and think twice: TRUST alert to give you greater banking safety

We're always improving protection on your account, offering a multi-layered system to help you stay safe every day and even under duress. New safeguards such as persistent fraud warnings, enhanced card and device management, and the Digital Account Vault with Panic Code work together in the app to reduce risk and increase your control.

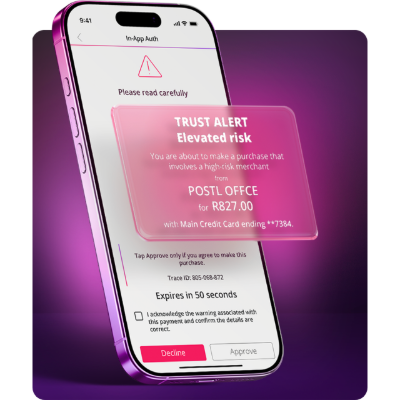

To keep you a step ahead, we're adding TRUST™ alert to empower you when you're transacting. TRUST alert uses pattern data and instant analysis of security threats to give you a pre-payment check that scores every in-app and 3D Secure payment transaction's risk in real time - because keeping your money safe is a priority for us.

When there is any risk to your money, you'll get a clear warning alert and options - so you can pause, review, and choose what happens next. This empowers you and helps you to make informed decisions about every transaction.

TRUST alert gives you clear warnings at the point of payment

Use Discovery AI and in-app calling for service like no other

Available now!

Earlier this year, we took personalisation to the next level with Discovery AI - your virtual private banker that learns, adapts, and responds to your needs. It gives you tailored insights and guidance, making managing your money effortless.

Now, try out Discovery AI's latest enhancements, including new travel, card delivery and security features.

We introduced in-app calling in September this year, offering secure, direct contact with a banker instantly. This lets you place verified calls directly from the banking app for the safest, quickest path to support.

Real-time context (recent activity, products, risk signals and more) helps route your call to the right specialist the first time. Calls work over mobile data or Wi-Fi, so help is available wherever you are.

It's the quickest, easiest way to get the support you need.

Activate car insurance from the Discovery Bank app

Available 1 December 2025

Hylton Kallner, CEO of Discovery Bank, says, "Our new app experience brings all Discovery products together in a single, intuitive platform. We are incorporating super-app navigation to make accessing products even more convenient, with quick taps and hassle-free transitions. The first of these, the ability to activate car insurance with Discovery Insure without leaving the Discovery Bank app."

With pre-populated information and smart data, the Discovery Bank app will offer you fast, accurate risk assessments, quotes and easy car insurance activation at the same speed as completing banking transactions with us.

Special offer: Complete your car insurance quote in the Discovery Bank app or with your Financial Adviser between 1 December 2025 and February 2026 and receive 1,500 Ðiscovery Miles on us.

Going forward, the in-app calling functionality will also integrate with other Discovery products, enabling you to connect with specialist agents and even your Financial Adviser to assist you with activating medical scheme, life insurance and investment products with a call from the Discovery Bank app.

This brings you the power of accessing the full Discovery product ecosystem from the palm of your hand.

Ðiscovery Miles: More rewards for everyday value

At Discovery Bank, we turn healthy behaviours, from spending responsibly to healthy food choices, staying active, or driving well, into real financial benefits with our rewards currency, Ðiscovery Miles. We have expanded the partner network, and added MultiChoice to entertainment benefits, giving you more value and more Ðiscovery Miles.

Save on DStv as Discovery Bank partners with MultiChoice

Available 1 April 2026 - special offer available now

From April 2026, you can earn up to 25% back in Ðiscovery Miles on DStv decoder packages, and up to 50% back in Ðiscovery Miles on streaming packages when you pay for your DStv subscription with a Discovery Bank account debit order.

Special offer: While this benefit will start in April 2026, we have a special launch offer for you. Earn up to 25% back in Ðiscovery Miles on DStv decoder packages you pay for with a Discovery Bank debit order between December 2025 and March 2026.

Terms and conditions apply.

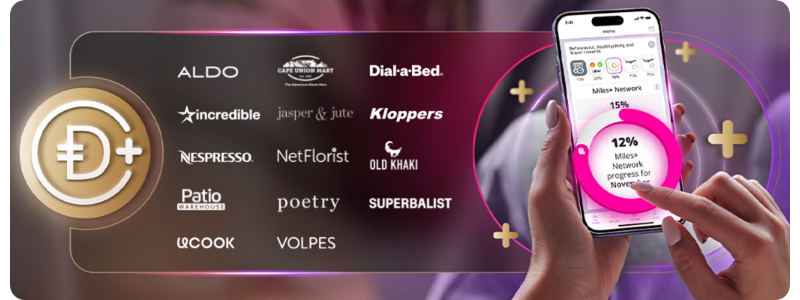

Ðiscovery Miles+ Network giving you up to 15% back at more partners

Available now

The Discovery Bank Home Partner Network has evolved into the Điscovery Miles+ Network, making savings on purchases go further than ever.

It's now possible to earn up to 15% back in Ðiscovery Miles across an expanded network of home, fashion, and lifestyle partners in the Ðiscovery Miles+ Network. This benefit applies on any item you buy at these partners when you shop in-store and online.

Shop online or in-store any day of the month, pay with your Discovery Bank virtual card, and get up to 15% back in Ðiscovery Miles at the following partner stores:

* ALDO * Cape Union Mart * Dial-a-Bed * Incredible * Jasper & Jute * Kloppers * Nespresso * NetFlorist * Old Khaki * Patio Warehouse * Poetry * Superbalist * UCOOK * Volpes *

Earn back parking costs in Ðiscovery Miles with admyt

Available 1 December 2025!

In time for the holiday season, you can also earn Ðiscovery Miles back when using the admyt parking app, powered by license plate recognition technology.

Simply park, shop, go - and get rewarded! From December 2025 to January 2026, when you park with admyt and make an in-store purchase of R250 or more within the four hours before leaving the parking, we'll automatically refund your parking fee in Ðiscovery Miles.

It's easy to use this innovative payment solution and earn Ðiscovery Miles. Simply:

- Download the admyt app and link your Discovery Bank card.

- From 1 December 2025 to 31 January 2026, park using the admyt app at over 70 locations across South Africa, including Sandton City, V&A Waterfront, Mall of Africa, Canal Walk, and Ballito Junction.

- Make an in-store purchase of R250 or more with a Discovery Bank card within four hours of leaving the parking.

- We'll automatically refund your parking fee in Ðiscovery Miles.

More special offers just for you

This article is meant only as information and should not be taken as financial advice. For tailored advice, please contact your financial adviser.

Điscovery Miles do not constitute currency or any other medium of exchange in circulation in South Africa. Rewards are based on your engagement in Vitality programmes, Discovery products, and monthly qualifying card spend. Discovery Bank, Auth FSP. Limits, terms and conditions apply.