How to maximise savings with Vitality Drive and Discovery Insure

July is National Savings Month, and with Discovery Insure and Vitality Drive, it's easier than ever to ease the pressure on your wallet. From fuel cash back to child car seat savings, smart driving doesn't just keep you safe - it saves you money, too.

July is National Savings Month, a time when South Africans are encouraged to examine their spending and foster better financial habits.

We understand that's easier said than done in today's economy. According to Discovery Bank's 2025 SpendTrend report, many consumers are resorting to using their long-term savings to cover immediate costs.

But here's some good news: with Discovery Insure and Vitality Drive, you can earn monthly fuel cash back and get discounted car services just for driving well. Take a look at the benefits that can help ease your financial load and put more of your hard-earned rands back in your pocket.

Get up to R1,500 in fuel rewards

Discovery Insure clients on Vitality Drive earn Vitality Drive points for driving well, improving their driving behaviour and making sure their vehicles are safe to drive. The more points you earn, the higher your Vitality status - and the more you save.

Filling up can be costly. But you can get up to R1,500 in fuel rewards every month when you fill up at bp or Shell, or load money onto your Gautrain Swift card.

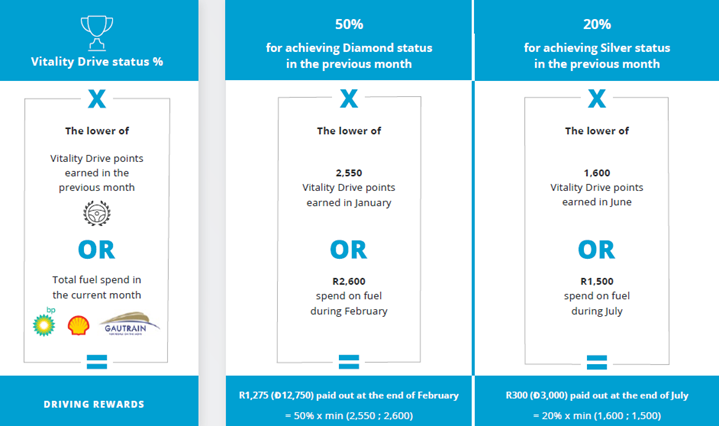

This is how we calculate your monthly fuel rewards:

Vitality Drive clients who have a Discovery Bank account are automatically opted in to get their fuel cash back paid out in Ðiscovery Miles, making this the best way to earn the most Ðiscovery Miles in a single transaction.

Get up to 20% off on brand-new tyres

A set of new tyres can easily break the bank. Fortunately, all Vitality Drive clients can get up to 20% off tyre purchases at Tiger Wheel & Tyre based on their Vitality Drive status earned in the previous month. To qualify, the invoice must include tyres. The bonus? The discount will also apply to all other costs on the invoice, such as wheel alignment. Simply show your Vitality Drive card to get the discount.

Get up to 20% off on your next car service

Based on your Vitality Drive status earned in the previous month, you can save up to 20% when you take your insured vehicle to your nearest Bosch servicing centre for servicing or maintenance.

Simply book an appointment online using your ID or passport number, vehicle registration, or Vitality Drive card. At your appointment, let the agent know that you are a Vitality Drive client and show your Vitality Drive card or ID to make sure that you get your discount.

Get up to 50% off car seats

Have kids? Then you know how expensive life can get! Vitality Drive clients can get up to 50% off the purchase of a selected child car seat every year. The discount applies to child car seats from our partners Born Fabulous and Babies R Us, and is based on the Vitality Drive status you earned in the previous month. See the one pager on how to get your discount.

Save with a 0% premium renewal increase

If you've achieved Diamond Vitality Drive status for at least nine of the past 12 months and remained claim-free during that period, you qualify for a guaranteed 0% increase on your comprehensive vehicle premium at your plan anniversary, valid for one year.

Save on your Uber rides

You can also save on getting from A to B with up to 50% off all Uber rides between 6pm and 6am. To enjoy this benefit, simply:

- Log in to your Discovery profile at www.discovery.co.za

- Navigate to the Car and home insurance tab and select Other rewards and benefits

- Select Drive Me discounts

- Click Learn more about Uber driving services, and then Activate Uber benefit.

Whether it's fuel savings, discounted services, or car seats for your kids, these benefits help stretch your rands further. So, make every kilometre count - and start saving today.

Get a quote with Discovery Insure today.

To find out more, call us on 0860 751 751 or speak to your financial adviser.

Your phone can now talk to us if you can't

With Discovery Insure's panic button, your phone can talk to us if you find yourself in danger and need help fast. Press your Android smartphone's power button at least five times in quick succession to alert us if you find yourself in an emergency situation. We'll be able to track exactly where your vehicle is and send a response team to help.

Discovery Insure's Impact Alert sends help when you need it most

Wish you had the technology to call for help when you most need it? Discovery Insure's Impact Alert feature can detect when you've been in an accident. If we can't get hold of you immediately, we'll send emergency assistance to your location, while our Vehicle panic button can be used to alert emergency services when you're in your car and need help.