Economic and Fund highlights

2018 was a difficult and volatile year for global markets and one of the most challenging in over a decade. Equity markets - locally and abroad - experienced heavy losses and there was not much cause for holiday cheer in December as US shares plummeted, posting their biggest losses since the Great Depression.

The global situation was largely the same, reflected in the -9.4% and -14.5% declines in the MSCI ACWI USD and MSCI GEM USD indices. On the back of this volatility, wary investors flocked to safer asset classes, which spurred a rally in global bonds that delivered their best returns since July 2017.

South Africa experienced a technical recession in 2018

Back home, South Africa experienced a technical recession the first half of 2018. Political tension, corruption scandals, labour concerns and mismanagement within state-owned enterprises overshadowed the euphoria from South Africa's newly-appointed President earlier in the year.

After a strong run in 2017 (up 21%), the JSE posted its worst performance since the crash of 2008, down 8.5% in 2018. The Shareholder Weighted (SWIX) Index posted its worst performance in a decade, largely due to a fall in the industrial sector led by heavy-weight Naspers, which delivered its worst performance in 17 years (-16%).

Yet it is not all doom and gloom

Data released showed that South Africa's economy grew over the quarter to September 2018 by a seasonally-adjusted 2.2%, the strongest growth rate experienced in almost a year.

The JSE's trailing multiple of 16.4x is above its 20-year mean of 15.5x, well below the 18-21 x multiples the index traded at three years ago. This presented bargain hunters with some interesting buying opportunities.

President Cyril Ramaphosa is making great strides to combat corruption, enforce fiscal discipline and is determined to resolve issues within state-owned enterprises as well as, encourage foreign investment and stimulate growth, which all bodes well for investors.

The Reserve Bank kept rates on hold and expects inflation to stay below 5%

Despite a slight increase in inflation to 5.2% in November 2018, the South African Reserve Bank kept rates on hold. It is interesting to note that there was a significant decline in the Reserve Bank's inflation forecasts, with the 2019 average shifting from 5.5% to 4.8%. The Bank now expects inflation to remain below 5% through 2019. Because of this, the Reserve Bank's quarterly projection model now sees only one more 25 bps hike by the end of 2021. This is down from the 75 bps in further hikes, which they projected in November 2018. The reasons cited for this move are:

- Lower oil prices

- Lower realised food price inflation

- A slightly stronger currency

Macroeconomic outlook for 2019

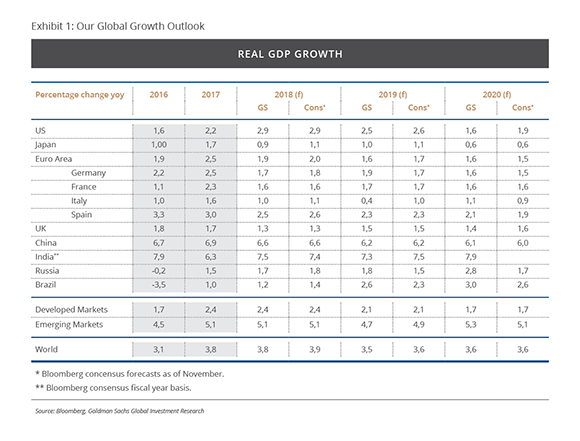

The macroeconomic outlook for 2019 will be challenging, as global growth is expected to slow from 3.8% in 2018 to 3.5% in 2019.

Outlook for the US

In the US, the Federal Open Market Committee (FOMC) forecasted longer-term growth of 1.9%, with consensus growth numbers in 2018 being revised higher: from 2.6% to 2.9%. This is, mainly because of tax cuts, which boosted consumer and business confidence. US job data came in better than expected - 312 000 compared to a forecasted 177 000.

While unemployment levels crept up in December, they still remain near 49-year lows. The personal consumption expenditures price index, advanced in line with market expectations in December, at 1.9% up from 1.8% and still below the Federal Funds Rate's target of 2%, which should slower the pace of current tightening.

In 2019, a hawkish looks set to tighten monetary policy: we can expect one to two- rate hikes of approximately 25 bps.

With increased tariffs and less fiscal stimulus, we can expect growth to normalise, resulting in lower growth numbers.

Outlook for China

As trade wars continue, China's growth prospects remain constrained. China's Purchasing Managers' Index (PMI) dropped below 50 in December, the first time in two years, as policymakers grapple to balance higher debt with a slowing economy. This has been further compounded by:

- Slower credit growth and domestic demand

- Trade tension

- Global economic slowdown

In response, fiscal policy has moderated, the People's Bank of China decreased short-term interest rates to 2%, with authorities stating that policy will be eased further, if need be, to relieve pressure.

China's growth rate has declined in the past six years from 9.8% to 7.1% and is forecasted to be 6.2% in 2019. To this end, one can expect growth to decelerate, yet, at a slower rate.

Outlook for Europe

Growth in Europe slowed in 2018. Initial growth forecasts of 2.4% were revised downwards to 2% by the end of the year, with their Purchasing Managers' Index data moving ever closer to contraction territory at 51.4 in December. Yet, in 2019 they should get support from:

- Strong employment levels

- Higher wages

- Accommodative monetary policy

Brexit negotiations will have a major impact in 2019 with consensus forecasts suggesting UK's growth to be 1.5% - suggesting a smooth Brexit, with government spending and tax cuts lending support.

While risks remain, there are many positive signs in Europe:

- Household income continues to grow

- Unemployment is at 8.1%, the lowest level in over 10 years

- Credit conditions remain supportive of growth.

Although policy is expected to normalise, with net purchases expected to wind down, one can still expect a reinvestment of maturing assets to continue for a while.

What we can expect in the future

Looking forward, most developed economies are estimated to slow, with many of the largest developed markets showing signs of overheating. Yet, there will be buying opportunities and investors can expect heightened levels of volatility.

A primary concern for investors is short-term capital loss

Short-term volatility is not indicative of a long-term trend. The advantage of long-term investing lies in the relationship between volatility and time:

- Any investment held for a longer period tends to display less volatility than those held over shorter periods.

- The longer an investor remains invested, the more likely they are to achieve their investment objective, irrespective of whether their investment sustained losses in the short-term or not.

One of the must-learn disciplines for an investor is therefore, mastering the art of doing nothing.

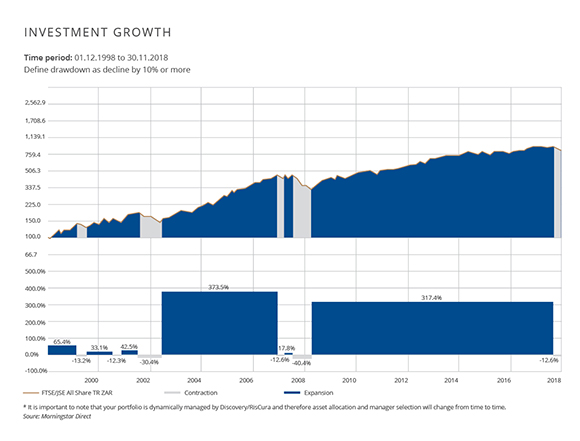

The following chart depicts the JSE growth over 20 years and highlights drawdowns over 10%

Light blue shading represents contraction periods over the last 20 years, which are rare and usually followed by extended periods of expansion. Of interest: The market crash in 2008, which saw the JSE decline by 40.4%, entered a protracted period of growth, seeing 317.4% of value being created for those investors that remained invested.

Lesson: Markets trend upwards but not necessarily symmetrically, thus drawdowns should be expected. Knowing this, the prudent Investor will always remain committed to their long-term investment strategy.

FUND REVIEW

Discovery's multi-asset class funds

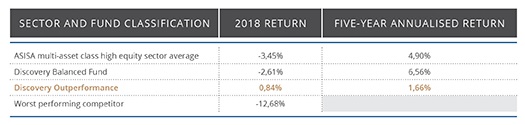

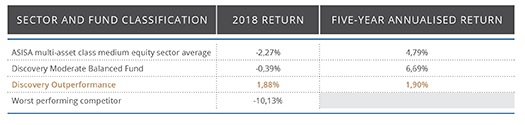

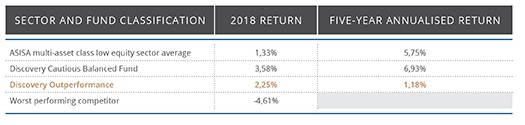

Given the global backdrop, the majority of multi-asset class funds underperformed in 2018 when compared to their longer-term averages. The Discovery multi-asset funds, when compared over longer, more meaningful periods, outperformed the peer group average.

Discovery annualised return since inception relative to annualised inflation over the same period:

11.6% vs 5.4% = 6.2% annualised real return

Discovery annualised return since inception relative to annualised inflation over the same period:

8.9% vs 5.4% = 3.5% annualised real return

Discovery annualised return since inception relative to annualised inflation over the same period:

8.1% vs 6.1% = 2% annualised real return

Source: Morningstar as at December 2018

Discovery's single asset class funds

The Discovery Fund Range continues to deliver, consistent, real returns for investors

- The Discovery Diversified Income and Discovery Money Market Funds generated annualised returns of 7.8% and 7.02%, respectively since inception in November 2007. These returns were well above the annualised inflation rate of 5.71% for the period.

- The Discovery Dynamic Equity and Discovery Equity Funds generated annualised returns of 6.6% and 6.0% respectively, since their relevant inception dates. These returns, once again, were above annualised inflation over the corresponding periods of 5.3% and 5.4%, respectively.

- The Discovery Flexible Property Fund has produced an annualised return of 10.62% since inception, compared to annualised inflation of 5.43% for the corresponding period, generating an annualised real return of 5.19% for investors.

-

The Discovery offshore funds have a proven investment process and provide a hedge against rand depreciation:

- The Discovery Global Equity Feeder Fund has delivered an annualised return of 12.1% over the past decade, comparing favourably to average inflation of 5.41% for the same period.

- The Global Value Equity Feeder Fund delivered annualised returns of 13.3% since inception in February 2013, comparing favourably to average inflation of 5.35% over the same period.

- The Discovery Worldwide Best Ideas Fund delivered an annualised return, since inception, of 9.59%, while average inflation was 6.86% over the same period.

In this podcast series, our Portfolio managers discuss how our funds have performed.

Discovery Flexible Property Fund

Peter Clark, portfolio manager for the Discovery Flexible Property Fund on what 2019 may bring for the local property market based on the large movements in the sector in 2018.

Discovery Diversified Income Fund

Malcolm Charles, portfolio manager for the Discovery Diversified Income Fund speaks to Lindsay Williams on predictions for the political landscape, the market in 2019 and why cautious optimism is the best attitude.

Discovery Balanced and Moderate Balanced Funds

Lindsay Williams speaks to Samantha Hartard, portfolio manager for the Discovery Balanced and Moderate Balanced Funds about a difficult global backdrop, performance of bonds and resources and fund positioning moving into Q2 of 2019.

Discovery Global Value Equity Fund

Steve Woolley, Discovery Global Value Equity Fund portfolio manager, talks about global equity value disruptions and why it is an exciting time to be a value investor.

Discovery Equity Fund

Terry Seaward, portfolio manager for the Discovery Equity Fund discusses systematic decision-making to avoid behavioural biases and unpacks the portfolio's factor model in choosing great stocks.