Is the 4% rule still relevant for retirement planning?

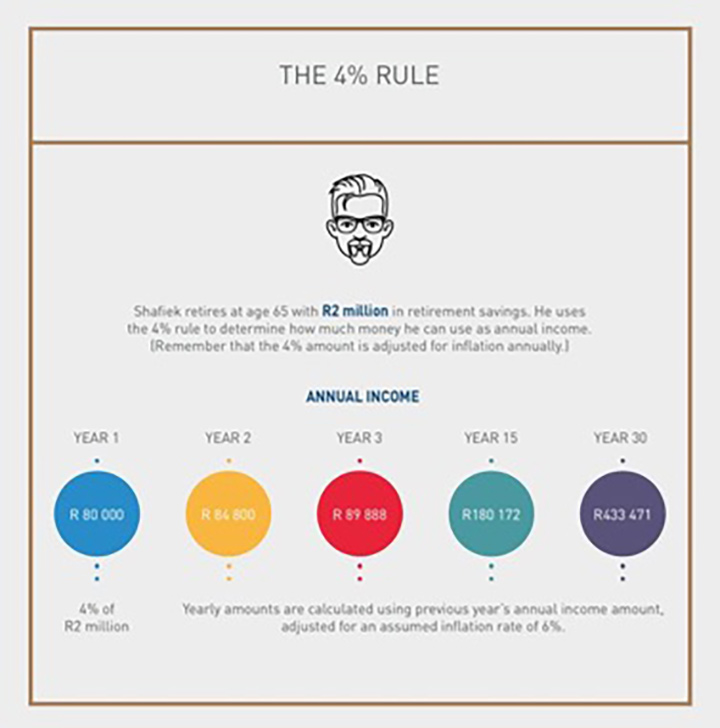

Traditionally, financial advisers, savers and retirees have relied on the 4% rule when working out how much to save for retirement and what kind of annual income retirement savings would provide. Here’s how it works and whether you should still follow it.

The 4% rule was first proposed by Californian financial planner William Bengen in the 1990s. Simply put, the rule says that if retirees withdraw 4% of their savings annually (adjusting this amount for inflation every year thereafter), their nest egg will last at least 30 years. The rule also requires retirement savings to be split equally between shares and bonds.

How does the 4% rule play out?

This method is also used to determine the lump sum investors need to provide an acceptable annual income when they retire. For example, assume you are retiring today with a final salary of R480 000 a year. You need a replacement ratio of 90% of your final salary. Ninety percent of R480 000 is R432 000.

To ensure you do not use all your saved retirement capital in 30 years, R432 000 should be 4% of your total savings. This means you would need R10.8 million saved to draw 4% or R432 000 annually. To put another way:

- You need R432 000 a year (90% of R480 000).

- R432 000 must be 4% of your total savings at retirement if you don’t want to deplete your nest egg.

- R432 000 is 4% of R10.8 million

- Therefore, you need R10.8 million saved at retirement to give you R432 000 a year.

Does it have relevance in the 21st century?

This retirement theory is not without its critics. Those who question the 4% rule’s relevance say it doesn’t take into account issues such as taxes or varying investment horizons, and also observe that financial conditions when the rule was formulated were very different to the reality in this century. For example, Bengen’s rule is based on the average long-term annual returns (since 1926!) of shares and bonds being 10% and 5.3%, respectively.

“The 4% rule started in the US in the 1990s when interest rates were a lot higher. With rates at an all-time low, the rule has broken down there – another reason to not use rules in planning,” says Craig Gradidge, investment specialist and director at Gradidge-Mahura Investments.

Bringing it home

“In South Africa,” says Gradidge, “rates and dividend yields are low, but still high enough to sustain the rule, but that could also change in time – and highlights the pitfalls of following any rules when planning for retirement."

A 2010 paper by Wade Pfau pointed out that the “US enjoyed a particularly favourable climate for asset returns in the twentieth century” and argued that “from an international perspective, a 4% real withdrawal rate is surprisingly risky.”

Tracy Jensen, Product Architect at 10X Investments, says although “the 4% rule still applies to retirement investing,” it needs to be applied differently in South Africa. “While the 4% rule still applies to retirement investing, South Africa is unique in the sense that regulations restrict the income drawn each year, between 2.5% to 17.5% of your investment balance. As a result, investors could have sufficient money to draw the income they desire but are restricted once they reach the 17.5% cap. Therefore, an adaptation of the rule is required in our context.”

A broad guideline

Gradidge also notes that while the basis of the 4% rule is sound, it still might not be relevant to many would-be retirees. “The 4% rule is simple mathematics; the less you draw from your capital, the longer the capital will last. Given historical data, the 4% rule suggests that capital can last into perpetuity if the investor only withdraws 4% of capital as income.”

Mathematically, this is true. Practically, however, the majority of people have not saved sufficient capital to allow them to take advantage of the mathematics. And so, adds Jensen, the 4% rule is “more of a broad guideline to help people make decisions in a complex environment,” rather than a hard-and-fast rule when working out how much of your retirement income you can spend.

Get a professional opinion

The Association for Savings and Investment South Africa (ASISA) has also offered guidelines on the issue of safe withdrawal amounts (or drawdowns) from investment-linked living annuities to help indicate how many years it is likely to take before your pension starts declining significantly.

They claim that someone who earns an investment return of 7,5% on their investment and uses a drawdown rate of 7,5% can expect to receive a real level of income (that takes inflation into account) for 10 years before their level of income starts to quickly diminish.

Perhaps the last word on the subject should go to Bengen himself. In an interview with the New York Times, his advice to those saving for retirement is perhaps applicable to every person saving for retirement. “Go to a qualified adviser and sit down and pay for that,” he said. “You are planning for a long period of time. If you make an error early in the process, you may not recover.”

Disclaimer: This article is meant only as information and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser. Discovery Life Investment Services Pty (Ltd), branded as Discovery Invest, is an authorised financial services provider. Registration number 2007/005969/07.Get the right help to ensure you reach your savings goals

Investment decisions are important and should not be made without expert financial advice. The right financial adviser will help you make the most appropriate investment choices for your future. Find an accredited financial adviser who will guide you on your savings and investment journey.

Discovery Invest: Get rewarded for saving towards your retirement

Find out more right here about the different ways you can invest through Discovery Invest, either local or offshore.

Take a look at the different fund types, their risks and rewards, their costs, and how they have performed over the years.

Related articles

Retirement and tax – what you need to know: Part 1

Tax laws have likely changed a lot since your youth and adulthood, and these changes can affect your retirement savings. While you need to consider the impact of tax when planning your retirement savings strategy, it shouldn’t be your primary concern. Here’s Part 1 of a handy guide.

Boosting your retirement savings through shared-value life cover

Life cover that allows you to get a substantial portion of your premiums back by encouraging and helping you to get healthy and stay healthy lets you benefit while you are still alive. Here is how Benna Koorsten boosted his retirement savings by R2.7 million.

Are you financially prepared for living longer?

We have all heard "50 is the new 40". It may be truer than you think. The world over people are living longer. Although longevity is a positive, financial behaviour combined with other knock-on effects of a longer life have to be considered.