When planning for retirement, many people establish how much they need to have saved when they retire so that they are able to live off the interest. In theory this sounds like a wise decision – investing your capital so that it creates interest, and then living off this interest while not touching the capital amount.

However, living off a set amount of interest won’t allow you to maintain a constant standard of living for your full period of retirement. This is because inflation will affect the buying power of your capital amount and the interest earned on your capital amount.

Effects of inflation

Warren Ingram, Executive Director at Galileo Capital, says he is frequently exposed to cases of retirees who live off their investments’ interest. “This is not viable,” he says, “because interest has no ability to track inflation.” Over long periods of time, using the local Short-term Fixed Interest Composite Index (STeFI) as a benchmark, he says you’ll see a real return of 1%, before tax. (“Real return” is the annual return of an investment, adjusted for changes in prices due to inflation or other external effects.) “Effectively, you’re standing still,” Ingram points out.

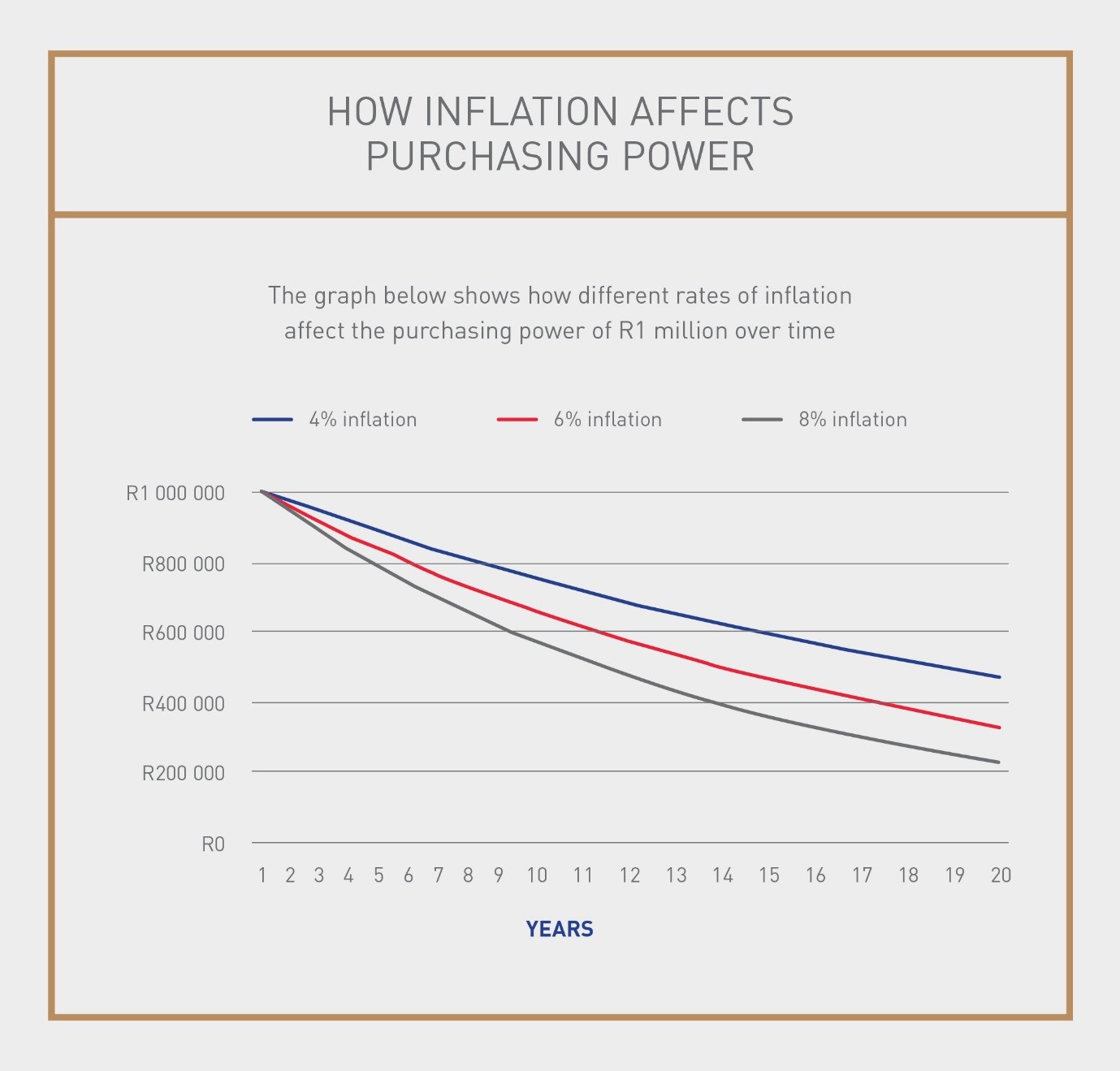

As an example, with an interest-focused investment of R1 million, generating a return of 6.7% over 12 months will mean a return of R67 000 for the year. But, consumer price inflation is at 6.3% during that same period. Living off the interest means your capital amount will remain relatively fixed. However, because inflation erodes the value of your R1 million, you will be going backwards because the capital amount (and the interest it produces) is worth less and less over time. At an average inflation rate of 5% a year, your R1 million will halve in purchasing power in less than 15 years. And the interest earned on this money will also reduce in purchasing power.

Investing to draw an income

Considering the above, a fundamental aim of investing for an income in retirement should be to provide an income that keeps pace with (or outperforms) inflation. There are various ways to do this.

Linked annuities

“I would caution against having 100% of your capital in interest-bearing (cash only) investments because it will decline in real terms over time,” says Ingram. By comparison, he says that a classic balanced portfolio accessible through a linked annuity with a linked investment service provider, invested two-thirds in equities with the remainder in property, bonds and cash, will generate a real return of 4% to 5% a year over the long term, based on historic long-term averages. With a balanced portfolio, your income is much more likely to outperform inflation, which means you could comfortably draw down a portion of these returns while your capital continues to grow.

Life annuities

A life annuity, also known as a compulsory annuity, is one way of ensuring regular and predictable income during retirement. This annuity factors in your life expectancy when you purchase it, and as such has “obvious merit if you are retiring relatively young, and have a history of longevity in your family,” points out Ingram. This would be because life expectancies are actuarial averages, and you would be on the right side of that equation. The one downside of annuities is the “high correlation between the income rates you get and the interest rate environment when you buy them.”

Many people also look to property as an answer to the income problem because this investment provides an income in the form of rent, which tends to be adjusted for inflation. But Ingram argues that, unless you have a large, diversified portfolio of investment properties, he “would always look for this exposure via listed property” because it offers better diversification.

Determining your drawdown

Once you’ve retired, the amount of amount you withdraw from your savings on a monthly or annual basis – your “drawdown amount – is critical. If your drawdown is too large, you risk reducing your capital amount. Also, your drawdown needs to keep pace with inflation, so it will need to increase over time.

“You definitely require professional advice from a financial adviser, even if it’s just to do this calculation,” says Ingram.

With a drawdown of “3% or less per year, you can be reasonably sure you won’t draw down on your capital in nominal or in real terms,” says Ingram. “At a drawdown of 6% or 7%, it’s very possible that over time you will start to erode your capital.”

In some ways, this corroborates the so-called 4% rule, but the shortcomings with a one-size-fits-all number like this is that the answer will necessarily be different for each individual. The difference between 3% and 5% seems small, but has massive consequences over time.

For more information on investing for retirement, speak to your financial adviser.

This article is part of an investment series by Discovery Invest.

Discovery Life Investment Services Pty (Ltd) branded as Discovery Invest is an authorised financial services provider. Registration number 2007/005969/07. For more information on Discovery Invest, contact your financial adviser.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell investment funds.