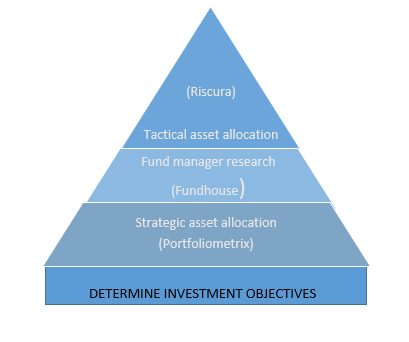

A roadmap to the advisory process

In the current low growth environment, financial advisers have a key role to play in terms of guiding their clients to make the right financial choices so that they can achieve their investment goals. From overcoming emotional bias to encouraging better savings behaviour, making sure the asset allocation within an investment portfolio is correct and choosing the right asset manager, the financial adviser’s role has shifted significantly from what it was ten years ago. These were just some of the issues discussed at the first Discovery Investment Forum last month, where financial advisers heard from both Discovery Invest as well as external Discovery partners.

According to the Fuhr Hughes team newsletter 2017, households who use a financial adviser have double the savings rate of those households who do not use a financial adviser, and their asset accumulation over 15 years is roughly four times more. “The newsletter as well as Vanguard says this translates to an extra return of 3% a year for households using an adviser, which is a strong endorsement of the importance of a financial adviser,” said Kenny Rabson, chief executive officer of Discovery Invest When navigating the roadmap of investment advice, the first step for the financial adviser is to help the client determine his investment objectives and to do this, the adviser must understand the client’s liabilities and financial goals.

The next steps are:

- Strategic asset allocation: In this step, the financial adviser helps the client design a goal-driven investment strategy. This is the long-term asset allocation the investor aims to track and is based on the investor’s objectives, risk tolerance and constraints.

- Fund manager research: In this step, the financial adviser deals with the implementation of the fund selection by allocating assets to appropriately screened and selected fund managers, and choosing the correct products with these managers to ensure that investment performance is properly monitored and assessed.

- Tactical asset allocation: In this step, the financial adviser adapts the current asset allocation to take advantage of the current market environment. The process of constantly adjusting asset allocations is referred to as dynamic asset allocation.

Strategic asset allocation

Brandon Zietsman, Chief Executive Officer at PortfolioMetrix, said the financial adviser fulfils the role of a field guide to the future, taking clients from the known present to the unknown future. This involves guiding them through the probability space. He says understanding your client is the critical first step and it’s not an accident that the top financial advisers in the country share the following qualities:

- High engagement

- The ability to gain trust

- High emotional intelligence.

“The financial adviser has to take the information available to them – the client’s income and expenses; their assets; the contributions to their asset base; their planned retirement date; their expected income in retirement – and use this information when determining a strategic asset allocation to help the client achieve the desired outcomes,” he said. This information then needs to be combined with what we know about capital markets – the riskiness of individual asset classes, their expected return and how they interact with each other. From this, one derives the client’s strategic asset allocation. He noted that this analytical process needs to take into account that not everyone is comfortable with a high-risk investment portfolio.

Fund manager research

Once a financial adviser has helped their client to define their investment objectives and determine the right strategic asset allocation to achieve those objectives, he has to help the client choose the right mix of funds within that asset allocation.

When it comes to choosing a fund manager, Ian Jones, director at Fundhouse, noted that there are a few factors that complicate the process. These factors include the possibility of a key portfolio manager leaving or the business changing and a lack of information provided by fund fact sheets and regular investment road shows.

There are 1 600 funds available to choose from in South Africa alone. Jones says the starting point is determining your investment process, which can help you choose funds by filtering out the funds you don’t want to invest in. For example, if your investment process says you don’t use passive funds, then you can filter out all the passive funds. If your investment process guidelines say you don’t use any fund of funds that would filter out half the funds.

Tactical asset allocation

Jarred Glansbeek, Chief Investment Officer at RisCura Solutions, explained that asset allocation ranges should be determined in such a way that if the financial adviser gets it wrong, it shouldn’t damage the client’s long-term financial prospects. Yet, evidence shows that increasing performance with sound tactical asset allocation views can be profitable, despite the fears of market timing. “When putting together tactical asset allocation limits, you need to have a view of the different asset classes and how they could potentially perform. Your starting point would be valuations of the asset classes,” he said. For example, when it comes to listed property, RisCura takes the property yield or the percentage of rental income and compares it with yields from government bonds. This means relating two asset classes that generate income and comparing the potential scenarios around performance. When valuations become extremely different, one has the opportunity to buy (increase exposure) the cheap asset class, and sell (decrease exposure) the expensive asset class within the tactical asset allocation limits.

Investment advice can be tricky, but using the right partners and innovative products can help a financial adviser significantly boost returns for their clients.

Keep an eye out for more in-depth coverage of topics from the Investment Forum 2017 in your next issues of The Investigator.

This article should not be taken as financial advice and is meant for information purposes only.

Discovery Life Investment Services Pty (Ltd), branded as Discovery Invest, is an authorised financial services provider. Registration number 2007/005969/07.

Click here to view the full footage of the Discovery Investment Forum 2017. http://www.corpcam.com/Discovery31072017