Working together is key to investment success

At Discovery Invest, we believe strongly in our shared value model, which subscribes to the belief that people can be inspired to make better lifestyle and financial choices if they see both a long-term and an immediate benefit.

The shared value model simply means that clients reap the benefits of improved consumer behavior by making better financial choices which leads to financial rewards, while Discovery benefits from sustainable business practice. The Discovery core purpose, TO MAKE PEOPLE HEALTHIER AND ENHANCE AND PROTECT THEIR LIVES, serves as an aspirational beacon.

What is shared value?

Shared value is about creating an environment that benefits both the consumer, the community and the financial services provider in terms of improved choices working towards better outcomes for all stakeholders. It is a business strategy focused on companies creating measurable economic benefit by identifying and addressing social problems that intersect with their business.

The behavioural science behind shared value

Speaking at the 2015 Shared Value Leadership Summit, Chief Executive Officer and founder of Discovery, Adrian Gore, said he believes that people are motivated not by targets, which can be threatening, but by visions which inspire them. The power of an inspiring vision is that it puts an ideal at stake; and through powerful goal-setting, human behavior follows. This ties in with the following behavioural patterns:

- Loss aversion: People tend to prefer avoiding losses to acquiring equivalent gains.

- Prospect theory: The way that a choice is framed can dramatically affect the decisions that people are likely to make.

- Escalation of commitment: Once people have made an initial investment of time and/money into something, they are more likely to continue investing in it.

Gore explains that loss aversion is the theory put forward by Daniel Kahneman and Amos Tversky* that says the avoidance of loss is a stronger psychological motivator than acquiring gains. The implications of this are enormous. He used the example of a detailed study by Pope and Schweitzer (*2) of more than 2.5-million golf putts in professional tournament play, which found that failing to make a shot for par felt like a loss but failing to make a birdie putt was experienced as a foregone gain. The difference was obvious in the rates of success that golfers had for the two kinds of putts, with a 3.6 percent higher success rate when golfers were putting for par. This is not a trivial difference. According to the study, if Tiger Woods had managed to putt as well for birdies as he did for par in his best years, his average tournament score would have improved by one stroke and his earnings by almost $1 million per season.

Shared value at work in the Discovery Invest model

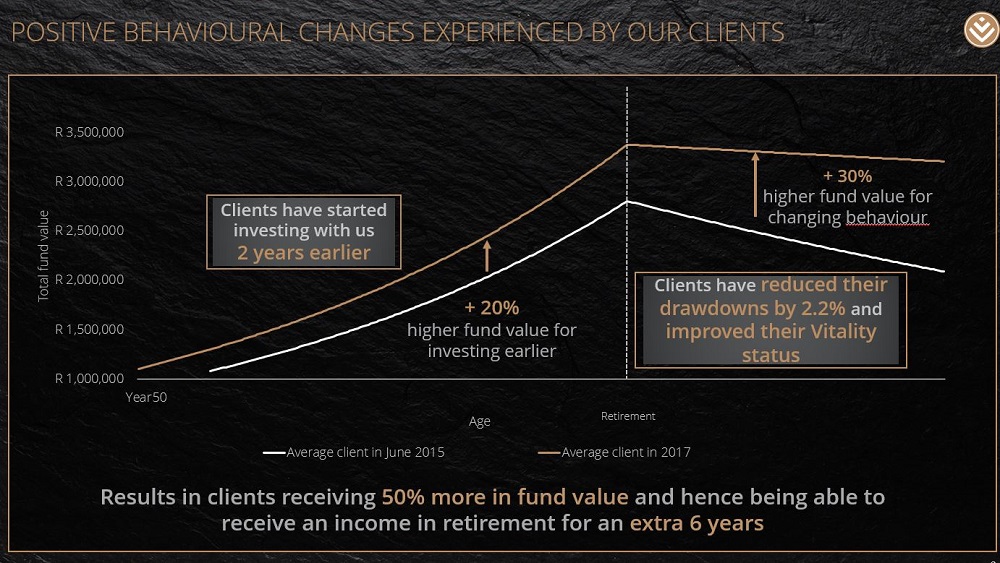

Discovery Invest is positioned to help address the retirement savings crisis in South Africa through the use of innovative products which incentivise clients to:

- invest earlier to harness the benefit of compound growth;

- stay invested so that their investment has the opportunity to grow and again, for the benefit of compound growth; and

- to select sustainable drawdown amounts in retirement so that their retirement savings will last longer.

For example, a client who chooses a retirement savings term of 40 years will receive an upfront “boost” to their savings, which will be a higher percentage than the upfront “boost” received by a client who takes out a product with a retirement savings term of 20 years.

Speaking in an interview, Discovery Invest’s Head of Research and Development, Craig Sher, refers to the Linked Income Retirement Plan which encourages sustainable income drawdowns in retirement, and coupled with Vitality status sees clients receiving an increase in their retirement income for the first 10 years of retirement, up to a maximum of 50%.

Discovery statistics dated October 2017 show that the average annual annuity income drawdown rate reduced from 8.21% in 2015 to 5.99% as at the end of 2016, which is a 27% reduction for clients with lump-sum amounts above R1.5 million. In just under two years between the launch of the Retirement Upfront Investment Integrator and the Linked Retirement Income Plan in September 2015 and September 2017, we have seen an average increase of more than two years in the investment period when clients are investing for retirement.

Source: Discovery Invest, October 2017

Sources:

Discovery statistics as per Discovery Invest technical marketing division – October 2017

2015 Shared Value Leadership Summit, www.sharedvalue.org

* http://people.hss.caltech.edu/~camerer/Ec101/ProspectTheory.pdf

* http://faculty.chicagobooth.edu/devin.pope/research/pdf/Website_Golf.pdf

Disclaimer

This article is meant only as information and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser.

Discovery Life Investment Services Pty (Ltd), branded as Discovery Invest, is an authorised financial services provider. Registration number 2007/005969/07. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06. An authorised financial service provider and registered credit provider, NCA Reg No. NCRCP3555.