Personalised PayBack Booster, enabled by Personal Health Pathways!

Discovery Life clients can now get even greater value at all Vitality Statuses! Close your health ring on the Discovery Health app and you can earn up to 100% of your monthly Life Plan Premium back.

Get rewarded with your maximum PayBack by engaging with Personal Health Pathways.

Complete your next best action, close your ring, and get rewarded!

Earn up to 100% of your monthly Life Plan premium back:

Activate Personal Health Pathways

Start your Personal Health Pathway on the Discovery Health app.

View your recommended next best action

Choose from the prompted personalised health actions, specifically recommended for you to improve your health and wellness.

Close your health ring

Each personalised health action contributes towards closing your health ring. Once you have completed enough actions, the ring will be closed.

Get rewarded with your maximum PayBack

Each time you close your health ring, your PayBack will be boosted to your maximum percentage for one month.

For more information please refer to the Personalised PayBack Booster Brochure

Experience the next generation of life insurance rewards now!

Personal Health Pathways has enhanced the shared-value model in life insurance. It leverages a sophisticated digital health platform to enable you to manage your health and wellness, ensuring that your experience is personalised to your physical activity and individualised health requirements.

By completing your journey that has been optimised to consider the most impactful set of actions for you, you unlock additional value that is returned to you through the Personalised PayBack Booster.

You can now earn greater rewards by engaging with the optimised recommended actions.

Maximise and track your financial rewards

To maximise your financial rewards, Integrate (link) your current Discovery products and manage your health and financial wellness.

Download the Discovery app to see how many more rewards you can earn and start watching your everyday healthy actions turn into financial rewards!

Find out more about Discovery Life products.

![]()

For more information, please speak to your financial adviser or contact us at 0860 00 54 33

- The Discovery Life Personalised PayBack Booster is a dynamic mechanism, underpinned by shared value, which incentivises policyholders to improve their health through personalised health actions. This generates value which can be used to provide a reward for completing those actions. By its nature wellness incentives are dynamic and expected to evolve over time.

- The reward is available to clients who are Health Integrated, are DHMS members and qualify to receive PayBacks from Discovery Life on a qualifying plan

- The Personalised PayBack Booster is linked to Personal Health Pathways (PHP) offered by Discovery Health. Any changes to the PHP by Discovery Health may result in automatic and immediate adjustments to the Discovery Life Personalised PayBack Booster without notice.

- The Personalised PayBack Booster rewards are based on your ring closures available on the Discovery Health app. Discovery Life reserves the right to cancel, terminate or suspend this Personalised PayBack Booster at any point.

- The Personalised PayBack Booster is an ancillary and complimentary feature provided to qualifying Discovery Life policyholders at no additional premium

- The Personalised PayBack Booster is available for a maximum of five years. Discovery Life reserves the right to change or redefine the events, actions or triggers that qualify a policyholder for a reward. This includes but is not limited to the next best actions and other qualifying activities. Discovery Life may also modify the frequency and value of rewards, and any such changes will apply at Discovery Life's discretion. Discovery Life reserves the right to cancel, terminate or suspend this Personalised PayBack Booster at any point.

- The Personalised PayBack Booster will reward qualifying policyholders with their maximum PayBack for one month's premium if they complete one or more next best actions. Discovery Life will decide the number of completed actions required to receive the reward and it is subject to change. The reward will be given when the client closes their health ring, which requires the individual to complete a varying number of actions. Rewards can be earned on up to three rings closed per policy year.

Frequently Asked Questions

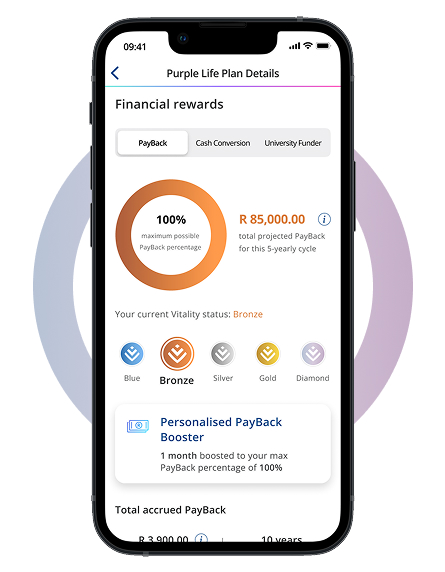

The Personalised PayBack Booster is currently available on qualifying Classic, Purple and Dollar plans. Your policy must also have Comprehensive Health Integration with a Discovery Health Medical Scheme-administered health plan and be eligible for PayBacks. You can identify if your policy qualifies for the Personalised PayBack Booster in the 'Financial rewards' section of your Life Plan, in the Discovery app.

Personalised Health Pathways is easily accessed in the Discovery Health app. The journey starts on the homepage of the app. It is simple to use and personalised to you.

Visit the Discovery Personal Health Pathways webpage for more information.

The Personalised Health Pathways and the Personalised PayBack Booster journeys are enabled through a seamless digital experience that manifests on your phone. Each time you close a health ring on the Discovery Health app, you will receive a notification. Furthermore, details on your reward from Discovery Life will be communicated to you on WhatsApp and can also be found on the Discovery app.

A month's PayBack will be boosted to your maximum applicable PayBack percentage each time you meet the reward condition. The maximum PayBack percentage is calculated based on your Vitality and Health plan and whether you have Double PayBacks.

This PayBack that boosts your PayBack Fund will be paid to you along with your normal PayBacks according to your PayBack cycle.

A maximum of three rewards can be achieved per policy year, starting at your policy anniversary. This means the first three times that you meet the reward condition during your policy year.

Only the main life on the policy is required to satisfy the reward condition. There are no requirements for the spouse to also meet the reward condition.

Additionally, if only your spouse meets the reward condition, you will not be eligible for the reward.

Other PayBacks follow the rules as specified in the Life Plan and do not change.

Your Vitality status does not impact the Personalised PayBack Booster, unlike the normal PayBack percentage.

How the PayBack values differ across the apps

The Discovery Corporate app also has a 'Financial rewards' page for each of your Life Plans. This page shows your accumulated PayBack value and when it will pay out. It also allows you to select different Vitality statuses to see how your projected PayBack changes as your engagement in Vitality changes. The Personalised PayBack Booster tile on this page allows you to identify if your policy qualifies for this reward.

The total accumulated PayBack updates at each anniversary once your PayBack for the year is calculated. The amount includes any boosts from the Personalised PayBack Booster until your most recent anniversary. However, any boosts from the current policy year are only added after the policy reaches its anniversary. The boosts for the cycle are indicated by a counter on the Personalised PayBack Booster tile.

If you have multiple policies, each policy's PayBack will be shown separately on the 'Financial rewards' page of each plan.

The Discovery Health app shows the total accumulated PayBack for your policy. Each time you close a health ring from completing your next best actions, your full PayBack for that month is added to the PayBack Fund shown in the Discovery Health app. Therefore, the value shown in the Discovery Health app will differ from that in the Discovery Corporate app when there are ring closures in a year, but these values will align on policy anniversary when the Discovery Corporate app is updated.

If you have multiple local policies, the Discovery Health app will show the total of your PayBack Funds across your local policies. If you have local and dollar policies, the value shown will be the sum of your local PayBack Funds. If you only have Dollar Life Plans, the total will be the sum of your PayBack Funds across your Dollar Life Plans.

How changes to your policy affect the Personalised PayBack Booster

Any changes made on a policy will impact the PayBack Fund as normal, provided it continues to meet the eligibility criteria.

Increase in premiums qualifying for PayBack after a ring closure:

Let's say your monthly premium is R1000 and the full premium qualifies for the PayBack benefit. Let's also assume that your maximum PayBack percentage is 100%. If you were to close a ring, the amount communicated at the time of ring closure would be that you've boosted your monthly PayBack to R1000 for a month.

Later, you increase your cover and your premium changes to R2000 for the second half of the year.

The average premium for the year is R1500, calculated as [ (R1000 * 6 + R2000 * 6) / 12 ].

Although the communication at ring closure said that you have boosted your PayBack to R1000 for a month, the actual amount accrued is based on your average premium for the year. Therefore, due to your policy change, you actually boosted your PayBack to R1500 for one month instead of R1000.

The opposite would be true where there is an increase in premiums qualifying for PayBack prior to a ring closure. The communication at ring closure will be based on new premium amount however the actual amount accrued is based on your average premium for the year.

Decrease in premiums qualifying for PayBack after a ring closure:

Let's say your monthly premium is R1000 and the full premium qualifies for the PayBack benefit. Let's also assume that your maximum PayBack percentage is 100%. If you were to close a ring, the amount communicated at the time of ring closure would be that you've boosted your monthly PayBack to R1000 for a month.

Later, you decrease your cover and your premium reduces to R500 for the second half of the year.

The average premium for the year is R750, calculated as [ (R1000 * 6 + R500 * 6) / 12 ].

Although the communication at ring closure said that you had boosted your PayBack to R1000 for a month, the actual amount is based on your average premium for the year. Therefore, due to your policy change, you actually boosted your PayBack to R750 for one month instead of R1000.

The opposite would be true where there is a decrease in premiums qualifying for PayBack prior to a ring closure. The communication at ring closure will be based on new premium amount however the actual amount accrued is based on your average premium for the year.

If you have any further queries, please see the Personalised PayBack Booster brochure, contact your financial advisors or contact Discovery contact centre: 0860 00 54 33