If healthy living increases life expectancy, why is it good for job security and retirement planning?

"Consider the simplest case of needing to work for a few years beyond retirement," says Discovery Invest's Head of R&D, Craig Sher, "healthier people are better able to summon the energy to satisfy their current employer, or find other work. And studies show that older adults who are physically active have a better working memory and visuospatial attention."

Good health enables you to pull the 'work for longer' lever

By the time a person reaches 65, longevity expectations could have changed so dramatically that many more years of work are required, but the healthier you are, the more able you are to compete and succeed in what will undoubtedly be a highly competitive and challenging job market. "So if by the time you reach retirement, your job is made obsolete by technology - you can adapt much better with good health. The point is this: healthy people have options," says Sher.

Rewarding healthy living can help clients finance a much longer retirement term

By encouraging people to be healthy and rewarding them for it through our retirement products, we provide the extra funding that increased health implies, but even more strategically, we encourage clients to develop the added advantage of health they will need to succeed in the rapidly changing world we're living in.

We should all be aiming for both a funded and an enjoyable retirement. The healthier we are, the more likely we are to achieve both. Our retirement products encourage the most impactful behaviours towards a successful retirement, such as healthy living, safe driving and better money management.

Rewarding healthy living before retirement...

In the Discovery Retirement Fund, employees' contributions receive boosts of up to 15%, based on their engagement in Vitality, Vitality Drive and Vitality Money. These programmes reward lifestyle choices that have proved to materially affect health, driving risks and debt.

By adding boosts to retirement funds, people are incentivised to change their behaviour for the better. This then funds the retirement savings gap created by improving their health. "By moving from average to excellent health behaviours, you could increase your expected retirement term by about three years," says Craig Sher Discovery Invest's Head of R&D.

To fund this, you need an extra 11% saved at retirement - and this can be more than covered by the up to 15% monthly boost to contributions.

...as well as after retirement

Our Living Annuity adds a boost to clients' income in retirement of up to 50%, based on their Vitality status and withdrawal level, allowing them to receive the same level of desired income and have their retirement savings last longer in retirement. This could result in an extra 29 years of retirement funded by the same lump sum.

A rapidly changing world is creating new risks to retirement planning

Retirement planning has always faced uncertainty. Whatever your plan is, it can be affected by unpredictable factors, like your investment returns, inflation and longevity. "In addition," says Discovery Invest's Head of R&D, Craig Sher, "we are now vulnerable to new risks that affect our retirement journeys."

The chances of outliving your retirement savings are rising

In 1900, people lived for about 31 years. By 2016, that figure rose to 72 years. The United Nations predicts that global life expectancy will reach 77 in the next 25 years, and may reach 83 years within the next 50 years. That means we should expect to live about 5 to 10 years longer than our parents did.

But the average is not what kills a retirement plan - it's the extremes. Of today's South African workforce, around

800 000 are expected to live beyond age 100. Beyond these predictions, advances in medicine and technology will keep improving the length of the average life.

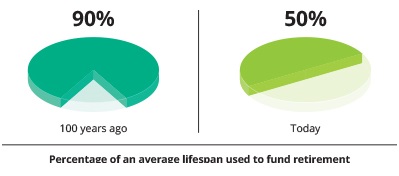

Sher highlights the fact that the portion of our lives in which we work and fund our retirement isn't increasing along with longevity.

With this trend on the rise, all bets for a regular retirement plan are off. The obvious solution is to work longer. "Deferring retirement for a year can take you one year into retirement without drawing an income, plus one and a half years' extra income from investment growth with a shorter post-retirement term - which means you could live for an extra two and a half years without your savings running out," explains Sher. "But a second risk brings significant extra uncertainty to the hopes of working for longer."

Unhealthy people experience the worst of both worlds

As medicine and access to medical care improves, people are able to live far longer in a poor state of health than in years gone by. 'Healthy Life Expectancy' is a measure of the number of years lived in a 'healthy' state, and is calculated by combining traditional mortality data with information on ill health and disability.

Studies show that Healthy Life Expectancy is increasing at a far slower rate than the traditional measure of life expectancy. According to Sher, this is doubly problematic for the unhealthy because:

- You still need to be able to provide an income for roughly as many years as the healthy.

- Your living costs will be higher due to higher healthcare costs. Before retirement, this makes it harder to save. After retirement, this increasingly eats into your income because healthcare inflation is higher than average price inflation. Sher explains, "For an average 25-year-old, the portion of their income being spent on health-related expenses increases nearly fourfold by age 65. Then to fund a mid-range health plan for 20 years in retirement, they'll need just over R3 million. But these costs depend to a large degree on their health. In Discovery's insured population, hospital costs for engaged Vitality members are up to 40% less than non-engaged members.

This article is meant only as information and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06. An authorised financial service provider and registered credit provider, NCA Reg No. NCRCP3555. Product rules, terms and conditions apply. The views expressed in this article are those of the author and may not necessarily represent those of Discovery Invest.