Why our nation needs citizens to save for retirement

When people don’t build retirement savings, it affects not just them personally, but their legacy and the wider economy.

We need retirement savings to grow the economy

According to South Africa's National Development Plan, our economy needs to grow at a rate of 5.4% to provide growth in employment and real incomes. Needless to say, we're not there yet - but research shows smarter savings behaviour could have this very effect on the economy.

If everyone in South Africa saved an appropriate percentage of income towards important savings goals, including retirement, children's education, and housing, the country would have a pool of relatively long-term savings that could be productively invested, and the rate of investment that could be achieved from that pool would be in the region of that required to sustain GDP growth of the targeted 5.4%.

Why South Africans have such a poor savings culture

To even begin understanding how retirement savings can affect economic growth, we need to address the unhealthy financial behaviours many South Africans are prone to.

Retirement? Tomorrow's problem

The first is a lack of future orientation. We have complex and competing financial needs when it comes to living standards, education, providing for unforeseen life-changing events, medical expenses and so on - and retirement needs just don't seem tangible enough to prioritise.

The problem is that when they do become tangible, it's usually too late. The longer we take to start saving enough, the more money it takes to achieve the same retirement outcomes – money most people don't have.

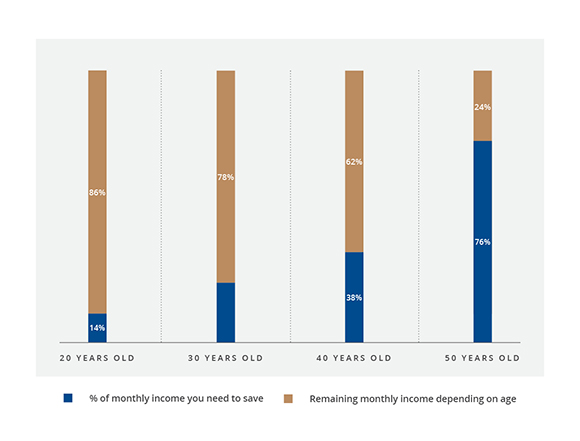

Starting to save only later in life dramatically limits one's retirement income. The graph below shows how much of their monthly income a person needs to save in order to replace 75% of it in retirement, depending on the age they start saving.

The plight of the sandwich generation

When people don't save enough for retirement, their families take the toll. Parents become dependent on their children. These children, called the ‘sandwich generation’, carry the double financial burden of providing for both their parents and their own children.

In South Africa, about 28% of working people carry this burden. When sharing a salary with your immediate and extended family is a reality for so many, the prospects of saving enough to create your own wealth are low - and when you don’t save enough for your own retirement, the cycle continues.

Like retirement, this often seems an abstract concept that is difficult to appreciate. Most people don’t equate it with real-world examples, like: If my child has to support me when I retire, they have less to spend on schooling for my grandson. My grandson may not get a good job later in life because I’m not saving enough for retirement now.

Improving the lot of individuals, families and society

Conversely, each person empowered to make better money decisions has an impact on their own and their family’s lives – potentially for generations to come. And when enough people save adequately, they have the collective potential to change the development course of the country by providing an investment pool that funds economic growth. Retirement savings are both a personal and national imperative.

This article is meant only as information and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06. An authorised financial service provider and registered credit provider, NCA Reg No. NCRCP3555. Product rules, terms and conditions apply. The views expressed in this article are those of the author and may not necessarily represent those of Discovery Invest.