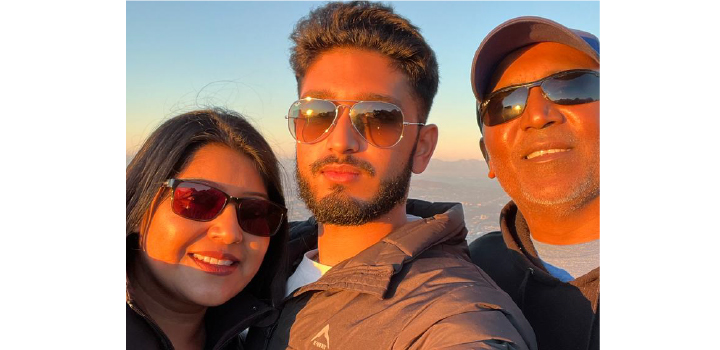

Life cover lifts burden for Nazmeera and her family

Financial adviser Nazmeera took her own advice: plan for the unexpected. As distressed as her family was when her husband, Santosh Sachidanand, had a quadruple bypass after a serious case of COVID-19, they were fully covered financially.

"It all started when my husband suffered a minor heart event in 2019, says Nazmeera. "His health scare led him to take every precaution possible to protect his health. He made lifestyle changes, from eating more healthily and doing more exercise. In fact, he even stopped eating his favourite fried chicken takeaway meal."

This is a story about how life cover, when properly structured, can help you handle the unexpected twists and turns that life may take.

"He was struggling to breathe"

"In mid-July 2021, my husband contracted COVID-19. This coincided with a week of serious political unrest in Durban. Initially, we thought it was a bout of sinus, so we contacted our GP who met us at his surgery. That was after three days of home treatment with little progress.

"When my husband tested positive for COVID-19, we started treatment for this specific condition at home. But after another three days, he was struggling to breathe. We managed to secure oxygen at home, but when he couldn't breathe at all, he was rushed to hospital. He had a severe case of COVID-19 and was in ICU for three weeks, which escalated the underlying heart disease he'd had in 2019."

"Only once the surgeon started operating did he discover that my husband needed a quadruple bypass"

"My husband lost a great deal of weight during this time. After he was discharged from hospital, he experienced ongoing health issues. His cardiologist performed an angiogram (a procedure that uses X-ray imaging to see your heart's blood vessels). This showed that his heart was not looking good. He started treatment and after a follow-up appointment in January 2022, things had deteriorated even further and he needed a bypass. Only once the surgeon started operating did he discover that my husband needed a quadruple bypass," says Nazmeera. A quadruple bypass is a procedure to restore blood flow to the four blocked arteries that feed the heart.

"His surgery was a success, but it was hard because we were in the tail end of the pandemic at the time. I wasn't allowed at the hospital and had to meet with the surgeon in the hospital parking lot to discuss the next steps. I also wasn't allowed to see my husband after his operation at all, which was nerve-racking and challenging, to say the least. My only point of contact after the operation was a phone call from the surgeon. And I only heard from my husband via a phone call the day after his surgery."

"Only once the surgeon started operating did he discover that Santosh needed a quadruple bypass"

"My husband lost a great deal of weight during this time. After he was discharged from hospital, he experienced ongoing health issues. His cardiologist performed an angiogram (a procedure that uses X-ray imaging to see your heart's blood vessels). This showed that his heart was not looking good. He started treatment and after a follow-up appointment in January 2022, things had deteriorated even further and he needed a bypass. Only once the surgeon started operating did he discover that my husband needed a quadruple bypass," says Nazmeera. A quadruple bypass is a procedure to restore blood flow to the four blocked arteries that feed the heart.

"His surgery was a success, but it was hard because we were in the tail end of the pandemic at the time. I wasn't allowed at the hospital and had to meet with the surgeon in the hospital parking lot to discuss the next steps. I also wasn't allowed to see my husband after his operation at all, which was nerve-racking and challenging, to say the least. My only point of contact after the operation was a phone call from the surgeon. And I only heard from my husband via a phone call the day after his surgery."

"Caring for my husband who wasn't well at home and my son who was in hospital at the time, I was not able to work fully"

"My husband's Severe Illness Benefit was a great help. Also, as my husband's Discovery Life policy is a joint policy, I have spouse benefits on it as well. So, when we logged his Severe Illness Benefit claim, my Income Continuation Benefit was triggered. This really helped because in between everything that my husband was going through, our son, Sashil Paruk, had also not been well and needed to undergo a minor procedure in hospital. Caring for and running between my husband who wasn't well at home and my son who was in hospital at the time, I was not able to work fully. Thankfully, I received an income through my Income Continuation Benefit for six months, and having my premiums waived took some of the financial strain off me.

"My husband's Severe Illness Benefit claim was paid out fairly quickly and we decided to invest this money, as it was money that we didn't expect and financially were still fine to manage everything. We also redirected the money we received from our Health Plan Protector into two investments with Discovery Invest - one local and one offshore - to build on my husband's retirement savings.

"Our son was in his final year of [studying] computer science at the time. His full university tuition, which was taking place online due to the pandemic, was completely covered by the Global Education Protector that we'd taken out. This was also triggered by my husband's health issue.

"What would have been a financial strain for us, had these benefits not kicked in, was fully covered"

"The money we would have paid towards my son's final year of university, which was covered, was kept aside for 'just in case'. And just as well, because when my son got a job in Cape Town a year later, we used this money to rent him a flat and furnish it for him. What would have been a financial strain for us, had these benefits not kicked in, was fully covered. We were very fortunate to be able to do this with ease, purely because we had the right benefits in place."

"My husband has completely changed his lifestyle, for the better. He must take things a lot easier than he did before. He has always been a very hands-on, active person and he can't do as much as he used to, because he tires out a lot faster. He is on ongoing medication for his heart health and has check-ins with his cardiologist twice a year.

"Since the major surgery my husband had to go through, I have increased my own Severe Illness Benefit as well as my income protection benefit. I have also made sure that my son has his own Discovery Life policy."

Why Discovery Life?

"As a financial adviser, my training involves deep-diving into various other products on the market so that I understand what makes Discovery Life products unique.

"I also sit with clients who have other products. I hear their stories and learn what they have been through, what their claims experiences with non-Discovery products have been like." Nazmeera says this has given her a good way to compare products and make informed decisions for her family.

"From smooth-running claims processes and payouts that arrive on time, our overall experience with Discovery Life has been comforting. It is great to know that your policy document actually does what it says it's going to do!"

Discovery Life Limited, registration number 1966/003901/06, is a licensed life insurer, and an authorised financial services and registered credit provider, NCR registration number NCRCP3555. Product rules, terms and conditions apply.

Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06. A licensed Insurer and an authorised financial service. Product Rules, Terms and Conditions Apply.

Get a life insurance quote today!

Discovery offers you and your family flexible personal financial protection at a cost-effective premium and we reward you for living a healthy life and managing your finances.